In doubt whether your presentations will establish trust during your sales pitch or presentation, ask yourself if it fulfills these criteria

There’s no doubt that a riveting story structure and a visually arresting deck are both requisites of a great presentation or investor pitch.

However, all your work developing your presentation design and structure might be for naught if your audiences don’t trust you. If you can’t establish credibility early on in your presentation, it’s as good as not delivering the presentation in the first place as your messages will likely fall on deaf ears.

The adage: “Trust isn’t given, it’s earned.” usually rings true here. Problem is, trust is typically hard to earn, and sometimes, you simply don’t have the luxury of time to build trust quickly from scratch on the first contact with your investor panel. Even a prepared corporate video isn’t going to help you out here.

Unlike personal selling, you don’t always get to build rapport with your audience on a one-to-one basis. Instead, it’s likely you’ll only be able to speak to a group of people at a time when you’re delivering your pitch audience during an event like Demo Day.

Here are three ways to implicitly build and establish trust as you’re delivering your investor presentation:

1. Back up what you say with evidence

It’s easy to make sweeping claims like: “We’re building the next big thing,” but supporting these audacious statements with hard facts and data is where it gets challenging.

Naturally, you won’t always have research papers to back up every assertion or opinion you might have. Here are some ways to reference other people or hard evidence in varying degrees of credibility:

Reference actual research papers and aggregated statistics

You’d be surprised at the extent of research that has been published. Scientists have conducted experiments and research on anything from cognitive biases on how to be more persuasive to stats on mobile penetration in specific countries. You’ll very likely be able to find supporting stats to bolster your stance on areas like market potential and growth rate.

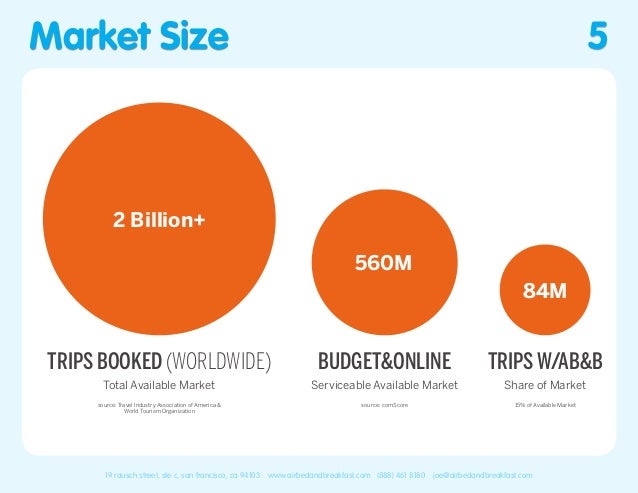

You can’t sell your startup based on a personal opinion but hard, indisputable factual evidence. Airbnb’s market size slide is a great pitch deck example.

Example:

Quote respected authorities or experts

In some cases where you’re trying to make a case to take action on something that you can’t find quantitative data on, citing a strong “endorsement” or quote from an authority figure is the next best thing.

As how we trust authority figures purely via conditioned behaviour in our lives (doctors, police, teachers) as theorized by Robert Cialdini in his book, Influence, we tend to lend trust to people who are considered authorities in their respective fields (aka the Principle of Authority).

Also discuss: What are the worst mistakes that you have made when pitching to potential investors?

For example, Jack Ma of Alibaba has risen to fame as an entrepreneur and business magnate to the extent that his foresight on market climates and the ‘future’ of industries is widely cited. Can we say that his statements are 100% accurate? No. Yet, we still afford his words credibility because of his stature, background and inherent expertise.

Example:

2. Develop your expert identity

A Nielsen research study found that consumers in a marketing setting unanimously seek out information and take action on content provided by companies or journalists they perceive to be experts.

It is integral that when you’re speaking on a topic, you have to be perceived as someone that has the relevant expertise and that you know what you’re talking about.

A way to do this implicitly is weaving a mix of client testimonials, credentials and relevant awards to signify your deep domain knowledge and expertise. This works especially well on your ‘team’ slide.

Show past client testimonials and credentials

A great way to immediately build credibility is having someone else talk about you in a positive light. Testimonials are a quick way to do this without seeming like you’re selling yourself – instead, it’s someone else doing the selling for you.

In Robert Cialdini’s epic, Influence: The Psychology Of Persuasion, this effect is known as “Social Proof” where we augment our behaviours to match what is perceived to be socially acceptable or correct behaviour as dictated by the masses. It’s almost like a herd mentality of sorts. He goes even further to talk about the more pronounced effects of it when the source of social proof is similar to the subject that needs to be persuaded.

What this means is that if you quote clients that are similar to your audience during your presentation, you’ll have a much easier time establishing trust from the get-go. At the same time, showing a list of past clientele or successful use cases can also help to assure listeners that others have put their trust in you prior and this can improve your image of trustworthiness.

That way, investors know they aren’t taking too much risk with their decision.

Have an unconventional opinion

True experts are expected to have original ideas that sometimes go against the grain of commonly touted advice or industry norms. It’s not to say that you should actively seek to be contrarian for the sake of it, but being able to hold your ground and have a clear stance is indicative of an expert that knows what he/she is talking about.

An easy way to do this is to identify a common, but misguided belief that the industry has and logically debunk it with your own theory. Having an original stance and supporting it with evidence can quickly help you become perceived as an expert.

We buy into the brand of industry moguls like Steve Jobs and Elon Musk precisely because they seem to offer ideas that are novel and unique. At the same time, because their ideas are at odds with the current status quo, we’re drawn to their narratives because of either the Underdog Effect (e.g., when Apple is up against conglomerates like IBM) or the protagonist-antagonist dynamic of their vision(e.g. Elon Musk fighting against pollution and innovating beyond the public’s current perception of what’s possible).

Share relevant credentials that matter to your audience

Different audiences have various ways that they use to evaluate speakers on trustworthiness. Being aware of these early on will give you an edge in establishing trust with your audience.

For example, if you’re aware that an investor that you’re speaking to has personal inclinations towards a specific topic (sometimes even cuisine), having a slide that validates your experience in a particular area or maybe including an analogy of relevance can help your case.

In certain industries, even factors like age can play a part in whether your audiences listen to your or discount your views on first-impression. For example, in tech companies, older workers are perceived to take longer to “get to grips with new skills”.

Hence if you’re speaking at a tech-related event, it might not be the best strategy to try to boost your credibility by boasting about your age. Being prepared for the right context can make or break your presentation.

3. Be Genuine

Nobody likes to deal with someone who appears to be inauthentic. After all, if you manage to garner successful investment, they’ll need to engage with you on a regular basis to maintain a relationship and ensure a return on investment.

Also read: How to effectively pitch your startup

Put in a couple of extra hours to deliver timely, relevant content that’s obviously tailored to your audience. A simple Linkedin search can reveal a copious amount of useful information about your prospective investor that you can utilize to boost your chances.

Use examples that your audiences resonate with

Think back to when you were back in school, listening to your lecturer offer examples that didn’t interest you in the least bit. Similarly, if you were speaking to a group of investors about a topic that they aren’t familiar with or have little interest in, you can expect it to fall flat.

Referencing recent trending news and drawing relationships between what you’re speaking about and what they might find relevant is an easy way to build rapport quickly. If you’re talking about a business-related topic, try referencing recent news that would directly impact them. For example, if you’re building a financial startup, referencing trends related to Bitcoin’s latest bull run or cryptocurrency may or may not be relevant. You can be sure they’ll sit up and listen if it hits close to home.

That way, you’ll have their attention and also a gentle appreciation for taking the time to put together relevant examples.

Whenever you’re in doubt as to whether your presentations will establish trust during your sales pitch or presentation, ask yourself if it fulfills these three criteria:

- Back Up What You Say With Evidence

- Develop Your Expert Identity

- Be or Appear Genuine

There you have it, three simple ways to almost immediately establish trust during your investor pitch.

—-

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Featured Image Copyright: 123RF

The post 3 ways to to instantly establish trust during your investor presentation appeared first on e27.