Plus, learn how an early risk set Goxip on a path towards growth and expansion

They say you never forget your first.

For myself, and a growing Hong Kong e-commerce platform named Goxip, this could not be more true. My first article for e27 was a feature about the photo-recognition fashion app. For Goxip, my article was the first time they had been featured in the media.

In the startup world, the only constant is change, but going through the day-to-day it can be hard to notice the differences. It’s like raising a child, the parents typically don’t see how much a kid has grown over 6 months, but their friends do.

After three years, and US$8 million of funding, Goxip is a vastly different company than it was in 2015 — albeit with its core still intact.

It still is attached to its fashion-first consumers, but the snap-and-match product is now secondary. It is now a search engine.

Goxip has around 500 merchants and over 6 millions items on its list. Juliette Gimenez, the Co-founder and CEO of Goxip, said this decision came down to data, and moving the focus away from vanity metrics.

“We got a lot of users downloading our app and views were actually really nice. However, what we didn’t achieve was the monetisation part,” she said.

In the early days of Goxip, it was built like Instagram, where people would see an outfit and decide it looked nice. But the problem was, if someone wanted to make a purchase, they still needed to move onto a search engine. Goxip decided to become that search engine.

“We started picking up a lot of orders with this change. We facilitated even more [revenue] because we figured out there was an advertising strategy as well,” she said.

To be clear, the photo-matching product still exists, but it is now a secondary feature, a decision Gimenez said was difficult to make.

“We had a strong debate within the development team. Because that put our core product into a secondary feature. But the team also decided to move forward with this,” she said.

“ We were finger crossing and holding hands, hoping that it worked, and thank god it did.”

The next adaptations

In late October, Goxip raised US$1.4 million from Convoy, a Hong Kong-based financial services conglomerate. The money is meant to build out a Goxip payment system, which Gimenez called a “gamechanger”.

The logic goes as such: Most offline stores offer installment payments for items like televisions, refrigerators or other appliances. However, these days, big-ticket items for households are often Chanel bags or dresses from Gucci.

Yet, for online shops, they rarely offer an installment plan, so people have to take a large chunk out of their monthly budget to buy the goods. This makes it less likely for them to actually complete the transaction.

Over the next six to twelve months, Goxip will be developing an in-house payment solution that will allow people to choose installment options.

Importantly, it is not relegated to Goxip. If I sign up for the Goxip online credit card, I can use it on Lazada, Amazon or any e-commerce website. I will still get offered installment options and the merchants will still see the full sale in their accounts.

Also Read: Taiwan’s KKday raises Series B+ from LINE Ventures, Alibaba to expand globally

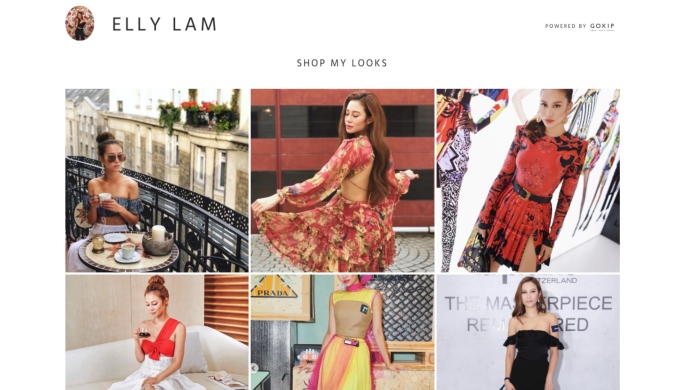

The other major product update from Goxip is an initiative called RewardSnap, which helps influencers more conveniently monetise their profiles.

Essentially, if a person is wearing an article of clothing that is sold on Goxip, they can post it on their profile and get a commission of the sales. The goal is to help influencers make money on their daily instagram posts and not just the branded campaigns.

“Conversions is about ROI, nobody cares about likes as long as it drives sales. The tools we have not only allow influencers make money, the brands can track which influencers can sell goods,” said Gimenez.

Raising from High Net Worth Individuals

The interesting quirk about Goxip is that the company has not raised much money from VCs. They grabbed some seed funding from Ardent Capital, but their major funding was co-led by a Chinese startup named Meitu and Chryseis Tan, the daughter of the Malaysian businessman Vincent Tan (who’s estimated net worth is US$820 million).

That investment also saw participation from a Macau-based HNWI named Sabrina Ho and Iman Allana, who is in a similar position in India.

It can be difficult to “break in” but if an entrepreneur can raise from HNWIs, there are some unique benefits.

The network is obvious, and most of these people have either gotten rich in the world of business, or their parents have. This means they have a personal playbook they can tap into, and, according to Gimenez, are understanding of the difficulties of being and entrepreneur.

“On a personal note, I get a lot of support of them because I am very comfortable sharing the hardships that I have. They really get it. They offer me a lot of help instead of just pushing me on one KPI that I didn’t meet on time,” she said.

In the Asian startup scene, its rare to meet a company that has raised from mostly corporates and individuals, and seeing how the relationship is different from that of a VC is a unique perspective on alternative funding routes.

Moving into Thailand

Goxip moved into Thailand about three months ago, it’s first foray outside of Hong Kong and Macau. For myself, I wondered why Goxip chose this route instead of China, which is right across the border and is a gigantic market.

“I think first of all, an entrepreneur needs to go into a market that you know well. So in the past I have worked in the e-commerce scene in Thailand,” said Gimenez.

Also Read: Grab raises US$50M from KASIKORNBANK to bring GrabPay to Thailand

She saw a mature e-commerce industry, but one that is largely dominated by one-stop-shop platforms. In the fashion world, this created an issue where people were seeing their expensive dresses being advertised next to diapers and skincare products.

According to Gimenez, this is why Instagram took off as a commerce platform. It allowed people to show off their outfits and how it can be mixed-and-matched. Instagram, however, does not have a very effective payments tool or backend management software.

“I think this is a market we can expand into, and then fine-tune to fit local needs,” said Gimenez.

Moving forward, Goxip is soft-looking at expanding into South Korea or the Middle East.

Three years is eons in the startup world and for most entrepreneurs it is like riding a roller coaster and for a startup reporter, it is fun to see how tall the kid has become in the last few years.

—

The post With fresh funding, Hong Kong’s Goxip readies itself for major fintech play appeared first on e27.