The company is based in Singapore and has championed the ‘Buy Now Pay Later’ concept

Singapore-grown fintech Rely announced that it has raised a seven-figure pre-Series A funding led by Goldbell Financial Services. Joining the round is family office Octava and strategic investors from the financial and technology sector.

Rely said it will use the funding for regional expansion, scale up their team, as well as to support more partnerships across the region with leading retailers.

Also Read: Cradle Fund’s DEQ800 invests in US$190K in proptech NEXPlatform

“Rely wants to continue to stay at the forefront where the ‘Buy Now Pay Later’ concept is being touted as the perfect fit for the way consumers shop online. Rely plans to be at par with the rapid expansion of the e-commerce industry in Southeast Asia and Singapore,” said CEO and Founder, Hizam Ismail.

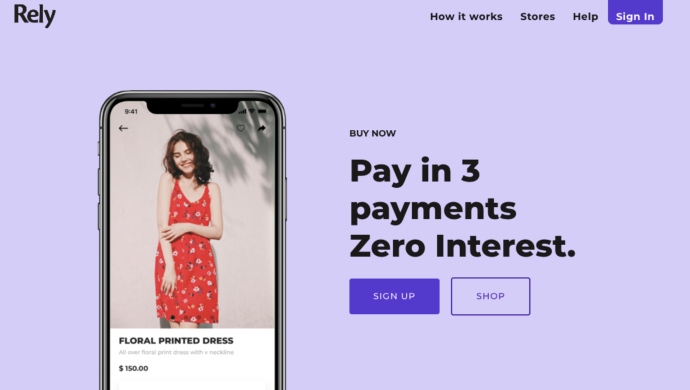

Rely seeks to redefine e-commerce customer shopping experience by providing shoppers with an interest-free ‘Buy Now Pay Later’ service. By linking a debit card to their Rely account, shoppers can split their purchases into three equal, interest-free monthly payments with the initial payment is collected at checkout, and the remaining sum is collected over the next two months.

The company uses its proprietary decision engine powered by artificial intelligence and machine learning, to help determine shoppers’ repayment capabilities for each transaction. Furthermore, the technology is able to determine the spending limits for each consumer to encourage responsible spending.

To ensure shoppers will pay on time, there are safeguards put in place and further purchases cannot be made if payments are not made on time.

On the merchants side, Rely presents itself as a partner in which offering Rely can increase conversion rate and order values 20 to 40 per cent for retailers.

With the prediction that Singapore as one of the fastest growing players in the e-commerce industry will grow to US$5 billion by 2025, Rely is on track with the budget approach solution without falling prey to credit card debt.

“We recognise the ‘Buy Now, Pay Later’ industry in the region to be ripe with potential and complimentary to the e-commerce industry at this stage. Rely’s use of alternative data and machine learning have the potential to propel both industries,” said Alex Chua, CEO of Goldbell Financial Services.

Also Read: Meituan-Dianping lays groundwork for Southeast Asia entrance via Chope

Rely has partnered with e-commerce retailers such as Zalora, Zilingo, and Fitlion. The company said that there is a particularly strong uptake from millennials, which makes up 75 per cent of these ‘Buy Now Later’ transactions.

“Rely caters to these millennials and the relationship between what they want and what they think they ought to do, allowing them to be in control of the way they chose to handle their finances,” said Ismail.

–

The post AI-based payment installment fintech Rely secures pre-Series A funding from Goldbell Financial Service appeared first on e27.