Angel-eQ co-founder Sandiaga Uno predicts energy as one of the sectors that will receive much attention from investors starting this year

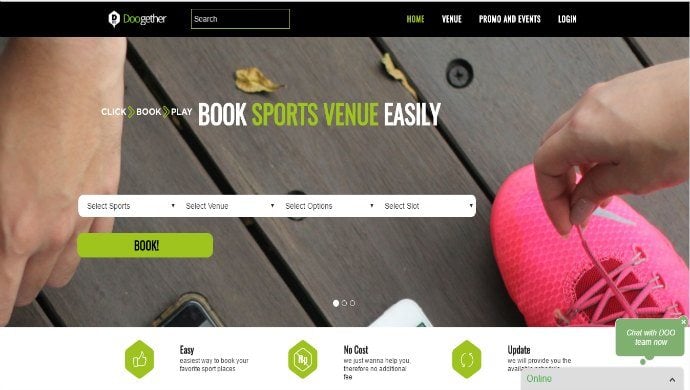

Angel investment network Angel-eQ announced an undisclosed seed funding investment to Indonesian sports booking platform Doogether, DailySocial reported.

Founded in 2016 by Fauzan Gani the platform enables users to book venues for 20 different kinds of sports, from badminton, basketball, to billiards and zumba in one platform. It also provides sports venue a cloud-based service to help “increase efficiency and revenue.”

The funding is the first that Angel-eQ announced since its one-year break in 2016. According to co-founder Shinta Dhanuwardoyo, the angel investor network will start investing again this year as they had to focus more legal administration matters last year.

Since its founding in 2015, Angel-eQ has invested in seven to eight startups, with 70 per cent of being claimed to start having good business traction.

Angel-eQ is also looking forward to add more startups in its portfolio, though they did not set up any particular target.

“We don’t know yet how many to target this year, because it depends on whether it clicks or not. We [the investors] have different ‘tastes’ in investment … If we find five startups, then we will do five this year. Starting March we will start meeting more startups,” Dhanuwardoyo said at the recent Local Startup Fest 2016 event.

Also Read: This Indian live sports app raises funding round from a Bollywood star

The angel investment network is also expanding the investors listed in their network, which was co-founded by the likes of Dhanuwardoyo, Sandiaga Uno (Saratoga Capital Co-Founder and politician, currently running for DKI Jakarta deputy governor position), Erick Thohir (Mahaka Group Founder and Chairman, Chairman of Inter Milan), Emil Abeng (Tason Holdings President Commissioner), Michael Steven (Kresna Graha Investama President Director), Adi Sariaatmadja (Kreatif Media Karya Founder), and Tony Fernandes (AirAsia Group CEO).

“Most of the young founders I’ve met can only bootstrap for three to six months at most. After that there needs to be a handover to the angel community, not only for money but also for mentorship and guidance,” Uno told Dealstreet Asia.

Uno also stated that there are seven sectors that will receive “much attention” from investors starting this year, and they are: health, consumer, food, daily necessities, fintech, education, and energy.

Energy is particularly “alluring” particularly for the opportunity for startups to disrupt how the industry collects, gathers, and distributes energy in the future.

The post Angel-eQ invests in Indonesian sport booking platform Doogether, looking to expand angel investor network appeared first on e27.