Only blockchain-focused funds and some individual investors are betting on the sector now, whereas the majority of mainstream funds are still adopting a wait-and-see attitude

Blockchain investment 2018: A who’s who of blockchain investors and startups in China was written by Emma Lee for TechNode.

Editor’s note: A version of this article by Zhang Lincheng originally appeared on our sister site, TechNode Chinese.

Blockchain technology has developed by leaps and bounds. But there’s something weird: primary market investors, those who have the keenest business sense, don’t seem very interested.

An executive at China Renaissance Group, a financial advisory firm, told TechNode that only blockchain-focused funds and some individual investors are betting on the sector now, whereas the majority of mainstream funds are still adopting a wait-and-see attitude.

So who is bucking the trend to become the first advocates of blockchain technology? TechNode tries to shed some light on the issue and here’s what we found.

Mainstream funds

ZhenFund

ZhenFund is among the first mainstream funds to embrace blockchain technology. The direct pronouncement for the blockchain revolution made by ZhenFund founder and angel fund guru Bob Xu went viral and instilled great confidence in blockchain entrepreneurs.

Rather than only making predictions, ZhenFund joined the seven-digit RMB angel round of China’s digital currency trading platform and exchange Huobi as early as November 2013. The fund gradually established a footing in the sector over the past few years: investing in Bitcoin trading platform Maicoin in 2014, Bitcoin miner 21Inc in 2015 (the company rebranded as Earn.com, a social media company), and data trading platform GXS in 2017. The fund has backed three ICO projects: IOST, DATA (DAT), and Hydro so far this year.

Also Read: Singapore Airlines to launch blockchain-based loyalty digital wallet

It’s interesting to note that ZhenFund seems to underplay the blockchain concept and tries to avoid talking about the blockchain issue. In their year-end media gathering, a ZhenFund representative stated clearly “Don’t mention that word,” referring to blockchain.

China Growth Capital

China Growth Capital participated in the US$28 million Series A round of Ripple in May 2015 and then invested in Bitcoin bank Circle, which shifted focus to a social payment business after giving up on Bitcoin business in 2016. The fund moved further into the industry by joining an RMB28 million (US$4.4 million) Pre-A round of Beijing-based Hoopox in September 2017. It reportedly invested in DATA as well.

Wu Haiyan, a managing partner at the fund, believes blockchain technology will lay the foundation for financial infrastructure in the long-run, but the current technology is far from maturity.

Probably due to the governmental ban on ICOs, China Growth Capital says they have ceased looking at tokens; blockchain technology is their future priority. Technological solutions and application scenarios are two foremost criteria for project selection.

IDG Capital

Along with China Growth Capital, Baidu, Everbright, and CICC, IDG Capital is one of the backers of blockchain financial startup Circle. Its other blockchain portfolios include Ripple, Koinify, and Coinbase.

Bringing blockchain technology to China is one of the initiatives for IDG Capital’s investment in Circle. The company is becoming less active in the sector, but a rumour has circulated that IDG Capital and Sequoia Capital are going to invest in miner maker Bitmain.

Sequoia Capital

In addition to the rumoured investment in Bitmain, Sequoia Capital is also behind Huobi, plus US-based data storage solution provider Protocol and Filecoin.

Non-mainstream and individual investors

Compared with mainstream investment institutions, a group of new funds and individual investors are playing an increasingly active role in China’s blockchain funding.

Fenbushi Capital

It may sound new to outsiders, but Fenbushi Capital is already a big name in the blockchain investment sector as a top-10 most active investor in the vertical globally. The fund started to invest in cryptocurrencies in 2014 and then move to the fundamental technologies of blockchain. As of 2017, it invested in a combined 40 blockchain projects, such as ABRA, Circle, Symbiont, Juzhen Financials, and Bubi Chain.

It is the blockchain investment unit of Wanxiang Group, a Chinese multinational automotive components manufacturer, and is fully owned by Wanxiang’s vice board chairman Xiao Feng.

Li Xiaolai

Similar to Bob Xu, Li Xiaolai was first known to the public as an English prep teacher at China’s largest private educational service, New Oriental. He moved into Bitcoin mining and investment as early as 2011. By the end of 2013, Li held a six-figure sum of Bitcoins and was one of the largest Bitcoin holders in China.

After that, Li launched an ICO project named EOS and raised US$185 million in five days (although this has been questioned by the public). PressOne, another ICO project Li initiated last July, sparked wider argument because there is only a-few-hundred-word introduction on the official website, not even a white paper.

Li reportedly raised over US$82 million through the ICO as of last July, making a new record for China’s ICO industry.

Like many people who have obtained financial freedom, Li started to make inroads into the capital investment sector. He founded Bitcoin-focused fund BitFund and angel fund INBlockchain, both of which are quite active.

Li’s investment returns are very impressive. “We invested in over 30 blockchain projects over the past two years, including Qtum, VeChain, RadarWin, BigONE, BeX, PressONE, and EOS. Three of them achieved hundred times return, 18 recorded over 10 times return, only one booked a loss. The overall return is more than 10 times,” disclosed founding partner at INBlockchain Yi Lihua last July.

Charles Xue

The legendary angel investor entered the blockchain sector in 2014 with a Ripple purchase. He invested in several blockchain startups after attending a summit in August 2017, where he met tens of blockchain tech teams.

In total, Xue has invested more than 20 blockchain companies and his portfolio includes Bytom, Qtum, InkChain, Ripple, BeX, Dochain, Delphy, Primas, MLGB, Ownership, and 168coin

But Xue still warns about the risks of entering the industry because he thinks the current hype surrounding the blockchain industry is more severe than the dotcom bubble of the late-1990s. He’s giving tips on cryptocurrency and blockchain investment: This is not for the risk-averse investor. Don’t go with easy projects that are out of the world’s top-30 list. Don’t invest in teams without successful experience and/or endorsements.

Also Read: Board files to dissolve Singapore blockchain startup Otonomos amid lawsuits, public spat

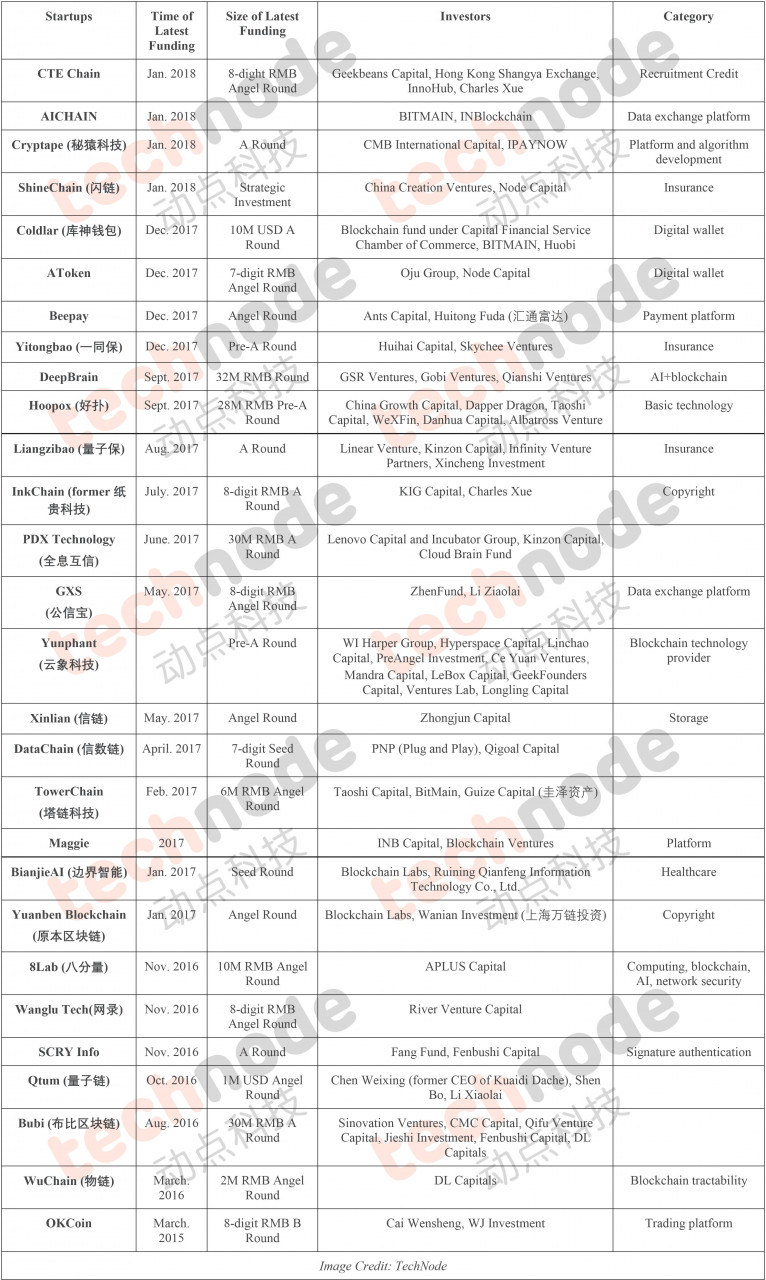

Investors behind recent blockchain technology funding

Blockchain technology startups are becoming the new darling of investors, but it’s easy to find out that mainstream investors have yet to enter the arena. Here’s a list of blockchain startups’ funding status.

—

The article Blockchain investment 2018: A who’s who of blockchain investors and startups in China first appeared in TechNode.

Image Credit: traviswolfe / 123RF Stock Photo

The post Blockchain investment 2018: A who’s who of blockchain investors and startups in China appeared first on e27.