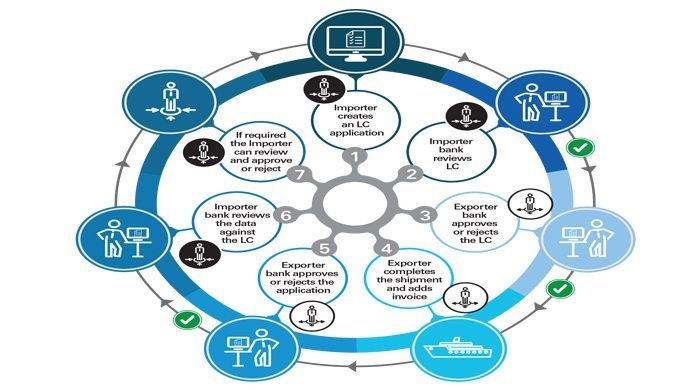

The application mirrors a paper-intensive Letter of Credit (LC) transaction

How Blockchain can be applied to a Letter of Credit

Bank of America Merrill Lynch, HSBC and the Infocomm Development Authority of Singapore (IDA) have jointly developed a prototype solution built on blockchain technology that could change the way businesses around the world trade with each other.

The application mirrors a paper-intensive Letter of Credit (LC) transaction by sharing information between exporters, importers and their respective banks on a private distributed ledger. This then enables them to execute a trade deal automatically through a series of digital smart contracts.

Also Read: OCBC Bank set to disrupt wealth management and customer service with these 3 startups

The proof of concept shows potential to streamline the manual processing of import/export documentation, improve security by reducing errors, increase convenience for all parties through mobile interaction and make companies’ working capital more predictable.

The consortium now plans to conduct further testing on the concept’s commercial application with selected partners such as corporates and shippers.

Trade finance processes are typically time- and labour-intensive, involving multiple documents and checks to reduce risk and provide assurance to sellers, buyers and their banks.

Also Read: Machine learning technology set to unlock US$17B fintech opportunity: white paper

A Letter of Credit (LC), or Documentary Credit, is essentially a guarantee provided by a bank that a seller will receive payment from a buyer once certain conditions are met; for example once the seller can provide proof that they have shipped the buyer’s goods.

With this concept, each of the four parties involved in an LC transaction — the exporter, importer and both of their banks — can visualise data in real time on a tablet and see the next actions to be performed.

Also Read: A couple’s journey to modernise microfinance institutes in Indonesia

Each action in the workflow is captured in a permissioned distributed ledger, giving transparency to authorised participants whilst encrypting confidential data.

“A letter of credit or LC conducted on Blockchain enables greater efficiencies and visibility in trade finance processes, benefitting multiple parties across its value chain. With participation of more members, greater impactful benefits will be realised by the trade ecosystem. As part of the Smart Nation journey, partnerships and the adoption of such innovations can help transform the banking and finance sector,” said Khoong Hock Yun, Assistant Chief Executive of IDA Singapore’s Development Group, in a press statement.

The post BofAML, HSBC and IDA Singapore join forces to build blockchain trade finance app appeared first on e27.