With Circle Invest, Circle has been trying to make it as easy as possible to get started with cryptocurrency trading. And the company wants to go one step further with collections of multiple tokens.

When it first launched, Circle Invest was pretty straightforward. You could download an app, sign up and buy Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic and Litecoin in just a few taps.

But the company then started adding more coins. And if you’re new to the cryptocurrency industry, it’s hard to understand the difference between Ethereum and Ethereum Classic if you weren’t looking at the market when the fork happened.

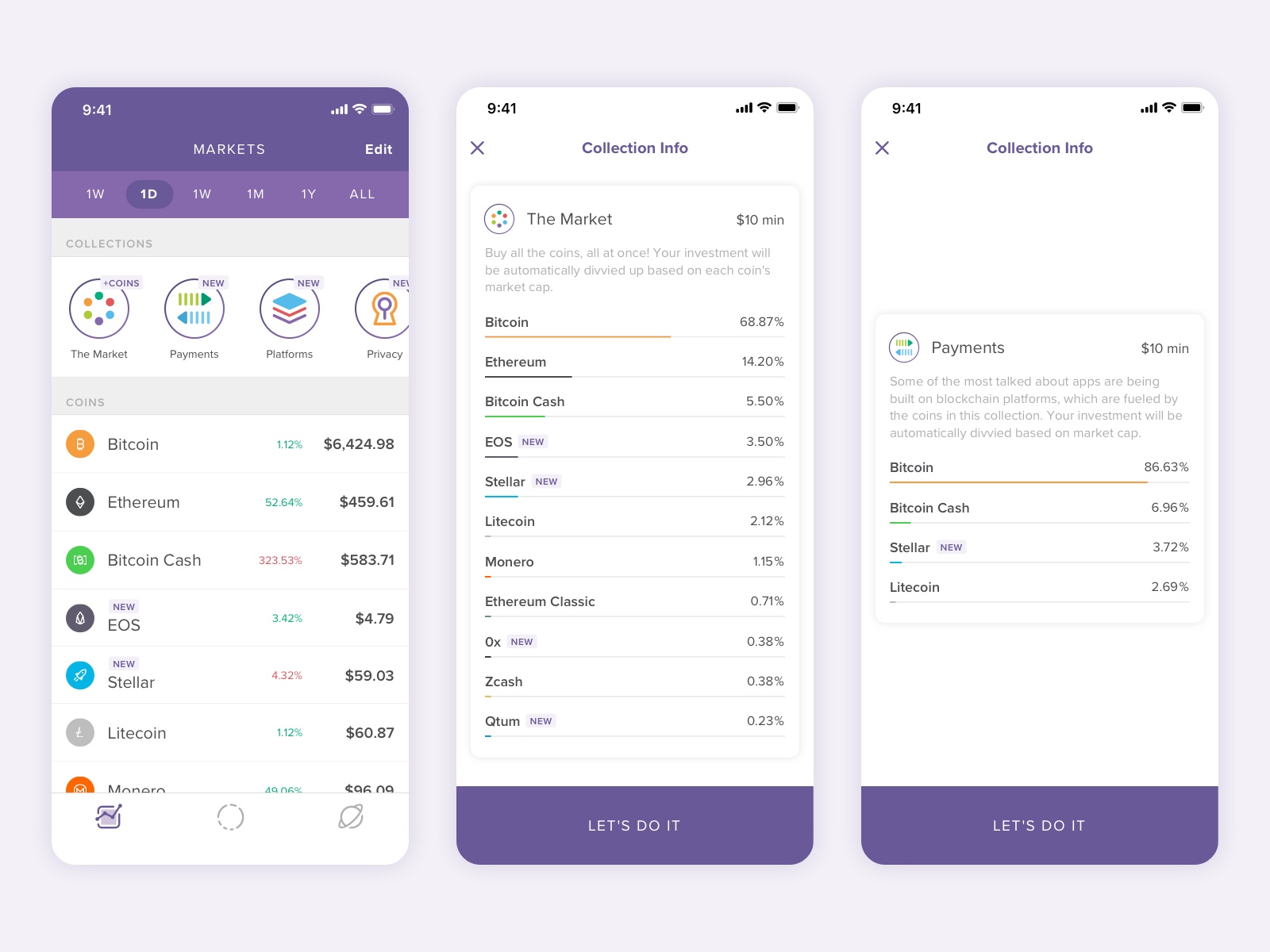

That’s why Circle introduced a feature called “buy the market”. In one tap, you can buy all the coins on Circle Invest, weighted depending on their respective market capitalization. For instance, the total market capitalization of Bitcoin is much higher than the market cap of Monero. So you’ll end up with a lot of bitcoins.

30 percent of Circle Invest users are using this feature. People who buy this package probably don’t invest as much as users who build their own portfolio, so it might not be 30 percent of Circle Invest’s transaction volume.

Coinbase recently introduced a similar feature called bundles. In just a few taps, you can purchase all the coins on Coinbase. Of course, both Coinbase and Circle Invest provide a limited selection of coins. But it’s clear that they both want to list more assets in the future.

With collections, you can buy a subset of the tokens available on Circle Invest. There are three packages for now — Platforms, Payments and Privacy. For instance, you’ll find Bitcoin, Bitcoin Cash, Stellar and Litecoin in the Payments collection. Once again, collections are weighted by market cap.