It is easier to acquire a digital banking license with a trusted partner

Akim Arhipov, CEO of BASIS ID

The announcement from MAS that non-banking fintechs will be eligible to create banks in the digital format, and provide services without any physical branches whatsoever can be considered as the biggest headliner in the financial news of Singapore in July. Altogether, MAS is planning on issuing 5 digital banking licenses in the nearest future.

Applications admission shall begin in August and financial enterprises are, one after another, already announcing their interest in getting the license. As early as today, top managers form Validus, Grab, Razer, Singtel, and InstaReM have already expressed such intentions.

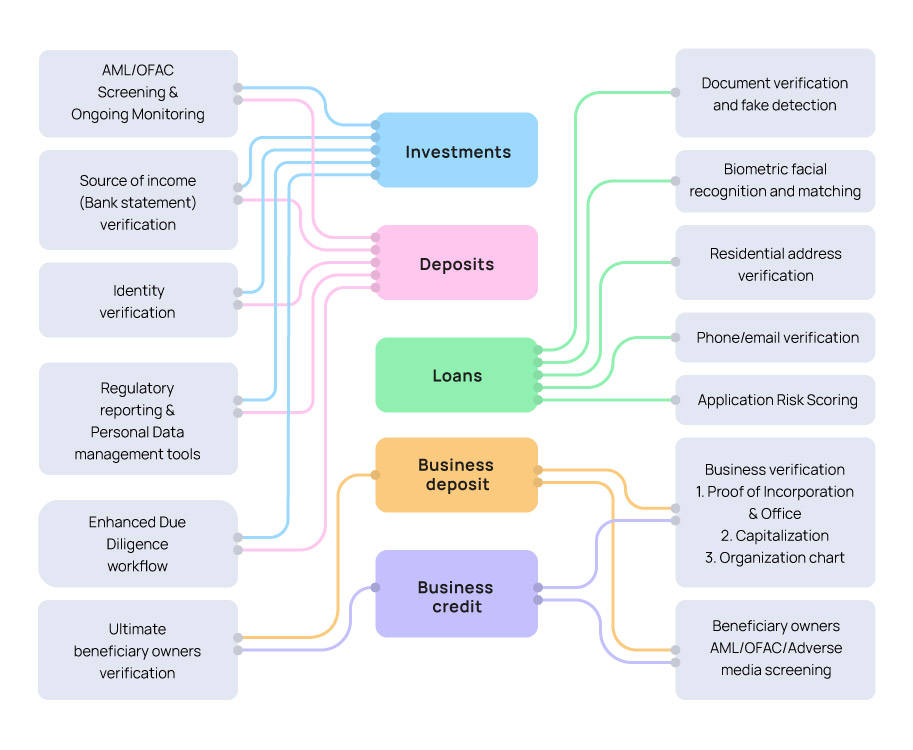

The new licenses issued for digital banking allow the performing of the following services: depositing, lending, and investing for both businesses and natural persons. Customer onboarding therefore, will become essential as the very first step towards utilizing the product. This step has to take into consideration the requirements of the regulations as well as internal risk assessment. This motivates companies to engage in specific partnerships in order to perform the onboarding and KYC.

Mr. Reuben Lai, senior managing director of Grab Financial Group, said: “we will study the digibank licensing requirements closely, and we are keeping an open mind as we assess how to best pursue this, including whether to work with suitable partners.”

Different services require various elements of KYC:

Various elements of KYC

Definitely, the optimal partner for a Singaporean company would be another Singaporean company, one with expertise in the domestic market of customer on-boarding and KYC services. BASIS ID is exactly that.

“BASIS ID – is the leading KYC&AML workflow management platform provider in Asia. Among our clients, we already have banks that hold full banking licenses and perform digital services. BASIS ID operations have been approved by the auditors from Big4. At the very moment, we are one of the few companies, that has access to the MyInfo system as well as having taken part in the MAS Expert working groups that have created financial regulations,” comments Akim Arhipov, CEO of BASIS ID.

Also read: Don’t be anchored by the anchor

Arhipov added, “with Singapore’s economy being the most competitive in the world, there are a lot of financial services on the market. However, there is still plenty of room and we are thrilled that companies now gain the opportunity of obtaining a banking licence.”

BASIS ID is notorious for the flexibility of its platform and shaping optimal on-boarding process for any financial product. At the same time, it is capable of providing stand-alone tools to be integrated into existing workflows, all ensuring full compliance with the regulations.

Acquiring the digital banking license is the confirmation of full compliance with the requirements of MAS, which is easier to achieve by performing the customer on-boarding in collaboration with a trusted partner.

The post Customer onboarding and the brand new digital banking licences by MAS appeared first on e27.