Direct-to-Consumers (D2C) startups globally strive to achieve the type of recognition achieved by Dollar Shave Club and Warby Parker in the US by selling premium branding with relatively affordable pricing.

Most D2C startups only arise when the e-commerce marketplace has reached the mainstream market, where a small number of consumers strive for niche brands. Southeast Asia would eventually follow a similar suit as the US and we could be in the early stages of the next possible boom.

From a price standpoint, D2C allows businesses to have higher margins, as they are cutting out the wholesalers’ and the distributors’ portion of the profit.

This allows brands to sell products at lower prices while gaining significant market share against the expensive incumbent. Just look at Oxwhite breaking the ECF records in Malaysia raising over US$1.2million by selling the tagline of luxury products at affordable prices.

In addition, the removal of a middle man helps businesses better understand their customers’ needs and complaints, which also allows them to construct more effective segmentation for marketing campaigns.

Stages of D2C brands

Before a market breeds D2C brands, it usually starts with e-commerce marketplaces together with the growth of the sectors supporting e-commerce: logistics, payments, digital marketing, and data analysis.

Once the marketplace reaches its mass adoption scale, there would be a demand for more personalised products and niche brands, which would give rise to the early adopters of the D2C market.

A majority of the large D2C players in the US and China are within the Consumer Packaged Goods (CPG) spaces, where incumbents are not born in the internet era. Think Unilever, P&G, Walmart, etcetera.

Is Southeast Asia ready for D2C to disrupt or become an alternative in the market?

Unlike the relatively singular market with Amazon in the US and Alibaba and JD in China, Southeast Asia remains a very fragmented market, where users are still price-conscious and not brand loyal, which relates to some of my observations and forecasts:

- I anticipate the rise of D2C to rise in conjunction with social commerce. More influencers would launch their own product line, as a way to scale and build their brand. Think Kylie Jenner with Kylie Cosmetics or Michelle Phan with Ipsy.

- The vast majority of startups would be in the CPG category targeting higher margins to sustain the marketing dollars needed to build their brand from scratch.

- Eventually, a D2C brand would reach a saturation point of early adopters. The eventual market expansion would require the opening of brick and mortar stores to capture a new customer pool, which is the late majority of offline customers. For example, Thailand’s Pomelo Fashion started as an online fast-fashion womenswear store that has since launched stores in Singapore and Thailand. However, at the same time, these offlines stores allow online customers to test the product before making purchases, effectively acting as a showroom of products to capture all kinds of customers.

Also Read: Thailand’s Pomelo gets US$52M Series C funding to expand omnichannel experience

Strategies for D2C

The biggest barrier in scaling a D2C company in Southeast Asia (and in general) is to create brand awareness itself. Most D2C companies around the world would need to sustain high customer acquisition costs (CAC) to attract customers to an unknown brand. This coincides with the difficulty in pricing a product, particularly at the early stages.

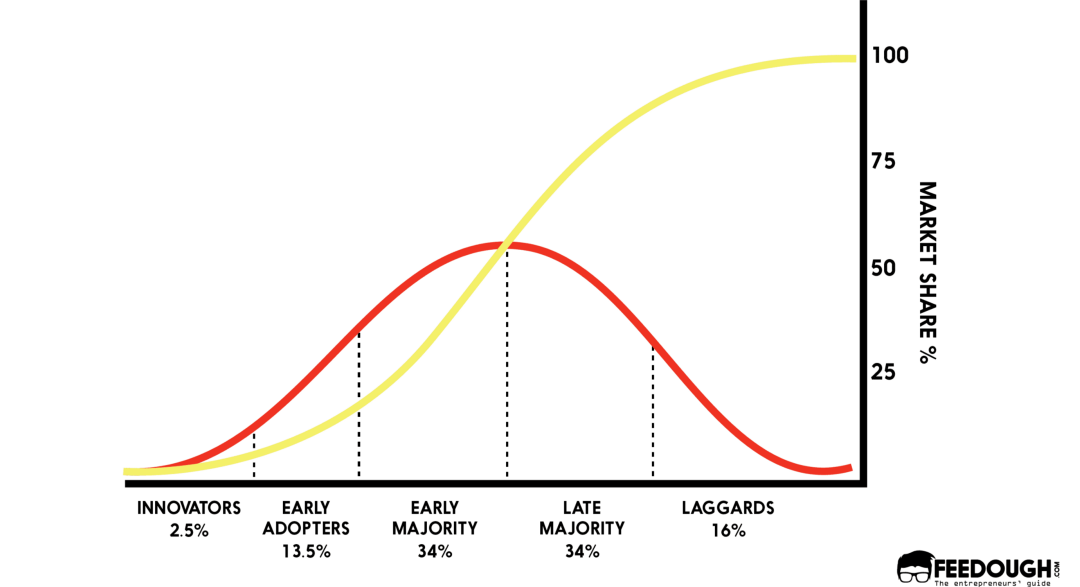

Source: Feedough

Most companies would generally target customers in the first two stages, which at the core are the early adopters. However, do bear in mind, the first 2.5 per cent is where most businesses fail, where they struggle to find product-market fit.

Thus, when you are getting your first thousands of customers, bear in mind the psychology of them purchasing the product. They are willing to take the risk and try something new that would give them utility. Thus, price is secondary and benefits are primary among the early adopters.

After a company reaches its early adopters, the next step would be to figure out the price optimisation. A simple table showing price against conversion rate to calculate the most optimal price for the highest revenue is the best way at different stages of the company.

The general rule of thumb is that you could test increasing your price by five per cent until you start losing 20 per cent of the customers.

Also Read: Indonesian e-commerce site Blibli embraces New Retail with BlibliMart launch

One thing similar between present Southeast Asia and China five to 10 years ago is that the rise of the middle class has allowed more consumers to demand premium brands and experiences.

This brings me to the overall strategies that D2C brands will have to take to succeed in SEA:

Branding

The general strategy of most D2C companies is that the whole product line revolves around a central brand. One of the biggest D2C brands in SEA is Singapore’s Secret Lab, which sells chairs for gamers, and was invested by Temasek at a valuation between US$200–300million. The branding of Secret Lab has focused on its quality and affordable pricing.

Its products are positively reviewed in most tech review sites and the prices remain competitive at (US$350 to over US$600) compared to other gaming chairs at the time. The very fact that they have removed distributors from the supply chain allows it to keep its prices while maintaining their margins.

The same strategy follows Malaysia’s Oxwhite, which again sells on the quality of their products while remaining affordable. Being in the clothing industry with many big players is difficult because incumbents are able to cut their prices due to the economies of scale.

Thus, it is foreseeable that traditional incumbents would eventually meet the same price point. Thus, D2C companies in the competitive clothing industry have to build a brand that is able to create a constant flow of loyal customers to sustain the competition.

Overall, creating a brand requires a lot of marketing dollars. The startup will require a marketing expert to segment the customer base and achieve optimisation in marketing efficiency.

At the same time, there is definitely a need for trial and error in pricing to find the optimal pricing that balances the number of quantities sold with the price of products to maximise revenue.

Community Building

The lack of marketplace loyalty in SEA is ripe for D2C brands because customers are eager to try new products that are unique or add utility. Besides the overall emphasis on branding, there is a rise in the social commerce element, which means using social networking sites such as Facebook, Line, Instagram, etcetera to promote and sell products and services.

This is especially relevant in Thailand where sales via social media are at US$10.9 billion in 2017, according to Thailand’s Electronic Transaction Development Agency.

In a survey by PWC in Thailand, 61 per cent of consumers are influenced by social media for their purchases through positive reviews or inspiration.

Also read: All in the family: How to build a community that accelerates business

However, less than 20 per cent of consumers stated that they are likely to buy a product because of a celebrity or an influencer. Thus, influencer networks might not be as effective when targeting the early adopters compared to community building.

One successful case of community building is Sociolla, an Indonesian beauty, and personal care e-commerce site. It has built a large community platform called Soco, which connects the e-commerce site with social media sites. Anyone can become a content creator on Soco by writing reviews or articles and also engage with new brands through events.

Through the app, users can scan a product’s barcode to see reviews by the community to reinforce the purchasing mindset. Although it distributes products from other brands currently, it could easily start releasing its own line of products.

How big can it get?

While consumers in SEA have frequent changes in their consumer preferences, the question remains on how big a D2C startup can grow in SEA.

Just looking at the US counterparts, there seems to be a price ceiling in the most successful D2C companies, which is less than US$2 billion.

Warby Parker is valued at US$1.75 billion; Dollar Shave Club was acquired for US$1 billion by Unilever; Casper was last valued at US$1.1 billion and planning on going public; Bonobos was acquired for US$310 million by Walmart.

These valuations are definitely impressive, but it shows that these D2C giants have relatively small valuations compared to the other tech startups. This could highlight that D2C investment is an early-stage game where there is a cap in their scalability.

There are similar parallels between the US and China in terms of businesses’ eventual expansion into offline stores and community building.

Again, there was a bunch of losers in the D2C space in China, but companies such as Three Squirrels, which started by selling nuts were able to break the bottleneck by diversifying their product range and also the strategy to sell on e-commerce marketplace, TMall unlike the American D2C companies, which were reluctant to go on Amazon to avoid brand dilution.

After reaching a growth saturation, Three Squirrels started selling cakes, which now accounts for 20 per cent of all sales, while nuts account for 50 per cent of sales. Three Squirrels is currently listed in the Shenzhen stock exchange at a market cap of RMB28.9 B (US$4.18 billion).

Overall, the success of a D2C company depends on the founders’ ability to constantly reevaluate the business and churning out new products to convert a product into a company. There is much room for D2C brands to grow, but the high marketing dollars could kill off most of them before reaching scale. Let’s see whether a unicorn could come out of this industry in the next five years.

–

Editor’s note: e27 aims to foster thought leadership by publishing contributions from the community. Become a thought leader in the community and share your opinions or ideas and earn a byline by submitting a post.

Join our e27 Telegram group, or like the e27 Facebook page.

Image credit: Photo by rupixen.com on Unsplash

The post D2C: Is it time for the next phase of ecommerce in SEA? appeared first on e27.