Neat customers can make payments to more than 60 countries, and can also link to third-party services such as Stripe or PayPal, and deposit cash and cheques

Neat, a Hong Kong-based digital alternative to a traditional bank, has bagged US$2 million from Singapore-based VC firm Dymon Asia Ventures (DAV) and Montreal-based early-stage fund Portag3 Ventures.

The company will use the new financing to focus on enhanced customer on-boarding, new product features, and hiring.

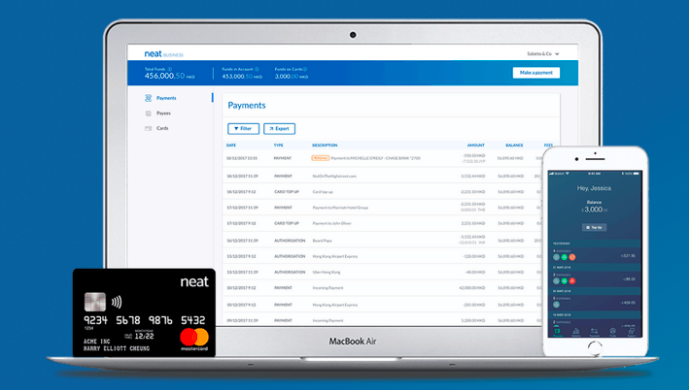

Along with the funding, Neat has also announced the full launch of its new product ‘Neat Business’, an alternative to a traditional corporate bank account for entrepreneurs, startups and corporates. The product offers a multi-user business account, accompanied by Mastercard debit cards that provides businesses anywhere in the world with a dedicated Hong Kong bank account number. Neat claims it takes just 10 minutes for a company to complete the sign-up.

The Neat Business dashboard gives users an overview of the state of all finances, and features mechanisms for receiving payments, payroll and expense management. In addition, Neat customers can make payments to more than 60 countries at the click of a button. Customers can also link to third-party services such as Stripe or PayPal, and deposit cash and cheques.

Neat’s mission is to take away the obstacles entrepreneurs face in dealing with traditional financial institutions: the paperwork, bureaucracy and long waiting times.

Also Read: Fintech could help banks save costs but also erode their income, says Singapore’s central bank

The firm has customers in IT, e-commerce and consulting industries across more than 100 countries.

“Neat Business has evolved thanks to feedback from our personal product customers and our increased understanding of the challenges faced by organisations when they are establishing business operations. Neat will continue to provide financial ease, flexibility and security so that individuals and corporates can spend more time growing their businesses,” said David Rosa, CEO and Co-founder of Neat.

“Technology has changed how we do business, which means the way business owners want to manage their company finances has changed as well,” said Chris Kaptein, Partner at Dymon Asia Ventures. “We believe that Neat understands better than any team we have seen that everything in banking revolves around the customer. As a result, Neat offers a customer experience that is frictionless, digital, and delightful.”

Established in 2015, DAV partners with exceptional entrepreneurs that drive transformation in financial services. DAV is the venture capital arm of Dymon Asia Capital, an alternative investment manager headquartered in Singapore with approximately US$4.9 billion (including committed capital and notional assets) in assets under management.

The post Digital bank for startups and entrepreneurs Neat nets US$2M from Dymon Asia, Portag3 appeared first on e27.