The new digital bank licences proposed by the Singapore government is the talk of the town in Singapore nowadays. Almost 21 companies/consortia from across the globe, including Ant Financial, Grab and Singtel, and Razer, have applied for a licence — but only up to five licences (two digital full-banks (DFBs) and three digital wholesale banks (DWBs) — will be issued in total.

For the uninitiated, a digital bank licence will allow entities, including non-bank players, to conduct digital banking businesses in the city-state.

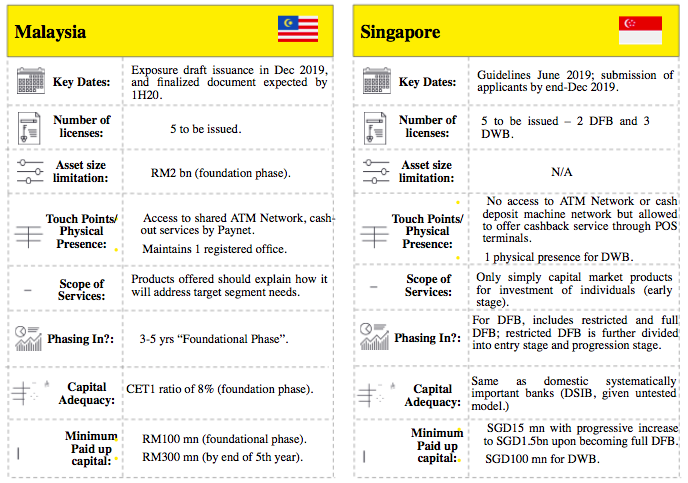

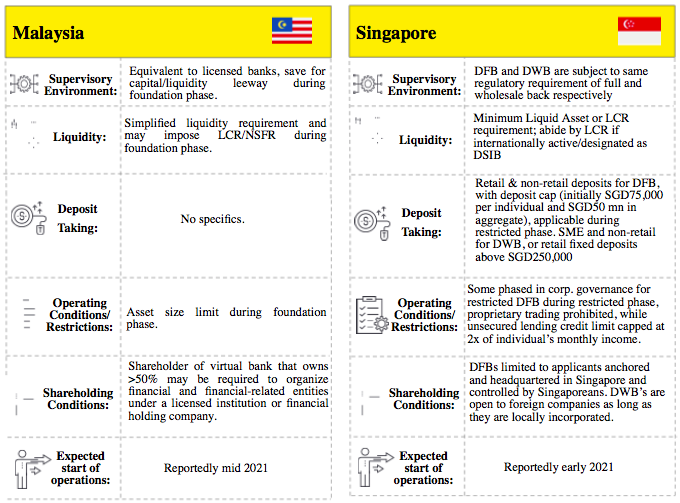

As the enthusiasm is getting high in the city-state, Malaysia is also playing catchup, with its government issuing guidelines for new digital bank licences. Although there are a few similarities between the guidelines issued by the two countries, some experts feel that Malaysia’s digital bank guidelines are unique from the perspective of achieving a balance between innovation and level playing field.

“Compared to Singapore, Malaysia has ensured that new digital banks can access ATM networks and cheque infrastructure, acknowledging that some parts of the economy with unmet and unserved needs will still need access to these while using digital banks. That the advent of digital banks won’t magically make cash vanish with their launch is an undeniable truth,” adds Varun Mittal, Global Fintech Leader at EY.

Also Read: Will the new digital banks sound the death knell for traditional banks?

Regarding foreign participation, Malaysia has clearly articulated the preference for local “equity” control, thereby ending debate about headquarter location and subjective definitions of management, operating and board control.

“Clarity on preference for year five as the breakeven mark is also a welcome step to ensure applicants can develop and evaluate their plans internally,” added Mittal, who has been tracking the Singapore and Malaysia digital bank landscape extensively.

Below is a document prepared by Mittal comparing the licence guidelines issued by the two countries:

—

Image Credit: 123RF Stock Photos

The post Digital bank licences in Malaysia and Singapore: A comparison appeared first on e27.