E-commerce industry hasn’t had a smooth sailing last year and the challenges are only going to get tougher in the years to come

The shadow of the dotcom bubble of the late 90’s is looming large over the Indian e-commerce industry. Will the history repeat itself? Will the Internet bubble 2.0 crash e-commerce companies, sweeping away millions from the pockets of investors and hurting the sentiments of customers?

E-commerce industry hasn’t had a smooth sailing last year and the challenges are only going to get tougher in the years to come. There are data-backed reasons why some experts are spelling doomsday for the e-commerce industry.

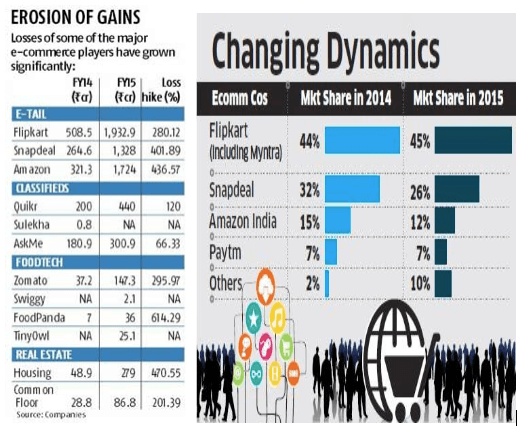

Heavy Losses: The e-commerce players reported combined losses of INR 7,884 crore (USD$1.17 billion) in FY15. The top three e-commerce unicorns like Flipkart, Amazon and Snapdeal cumulatively accounted for losses of around INR 5,000 crore (US$744 million)! While Flipkart managed to increase its share from 44 per cent to 45 per cent, thereby capturing the maximum market share of the e-commerce segment, the total market share of India’s top three e-commerce companies fell from 91 per cent to 83 per cent.

(Image Source: Business Standard.com and The Economic Times)

A marketplace which banked on the same product offering, customers, suppliers and investors, pricing was the biggest differentiator to beat the competition. The losses can be mainly attributed to the business model that is based on offering massive discounts, free shipping and spending on advertising to lure customers.

Another factor that e-commerce companies have been ignoring for long is unit economics, which is the calculation of revenues (for example, LTV or Lifetime Value from a single customer account) and costs (for example, CAC or Customer Acquisition Cost) associated with the basic unit. So, if the ratio is 2:1, then the customers are contributing twice the value than the cost of acquiring them.

Instead, e-tailers focus on either the increase in the number of customers (how many smartphone users download Swiggy app or register on Quikr website) or growth in Gross Merchandise Value (GMV), which measures the value of products sold on the site excluding sales returns and discounts. The absence of right metrics has also contributed to the huge losses of e-commerce market.

Devaluation: Earlier this year in February, Morgan Stanley devalued Flipkart by 27 per cent, following which T Rowe Price marked it down by 15 per cent. The online restaurant research platform Zomato, witnessed a similar fate in May 2016, when HSBC slashed its valuation by 50 per cent. Devaluation of startups may be first in India, but global companies like Twitter, Dropbox and Snapchat have also borne the brunt.

While the reasons for devaluation were not explicitly disclosed, it is speculated that the absence of a rational profit-revenue-growth model, missed targets/milestones, top management exodus and lack of innovation could be the probable reasons. The devaluation is a lesson that other companies in e-commerce space would be required to learn soon. Unless they define the new metrics of growth, it would be challenging to raise funds at the preferred valuation, retain employees and maintain customer loyalty.

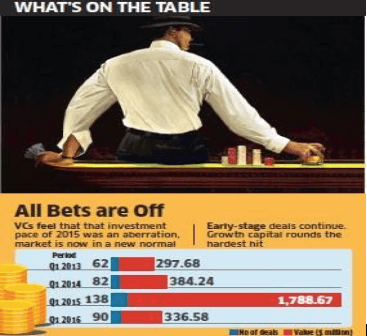

Slowdown in the pace of funding: If 2014 and 2015 were the years of funding boom, 2016 is touted as the year of fund crunch. A joint report by KPMG and CB Insights indicates that startup funding in the first quarter of 2016 has fallen by 24 per cent from the last quarter of 2015.

(Image Source: The Economic Times)

The investors haven’t stopped funding, they have just turned watchful and realistic. They are deferring from investing in e-commerce companies which offer skyrocketed valuation. They are now looking at long-term value creation, sustainability, disruptive ideas, product differentiation and how companies burn their cash to achieve its milestones.

The capital cycles are expected to shrink, where the venture capitalists will be interested in a lesser number of deals and smaller rounds. Series A funding, which earlier used to be in the range of US$5-10 million could now be in the range of US$2 million. Whereas, Series B will see investment in the bracket of US$5-10 million and Series C funding will come with stringent conditions and expectations.

There is also a bloodbath among other sectors for grabbing their share of funding from e-commerce. In fact, travel startups at US$366 million were among the highest-funded sector in 2015-2016, followed by e-commerce marketplace at US$358 million. Ibibo group raised US$250 million, while Oyo rooms raised US$100 million, among a few others.

BUT…Bubble May Just Not Burst Yet…

In spite of all the skepticism that the e-commerce industry in India is facing, it appears to be taking giant leaps towards growth. At least, if we go by these promising statistics.

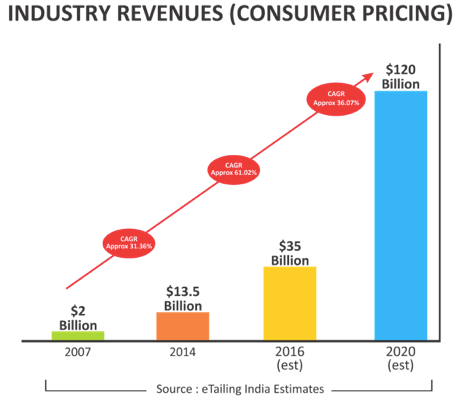

eTailing India estimates that the e-commerce market would grow to US$120 billion by 2020.

A Morgan Stanley Research report estimates that India’s e-tail business will touch US$159 billion by 2020.

According to an SBI Research report, the e-commerce market in India has grown at a CAGR of around 56 per cent during 2009-14. It is forecast to grow at CAGR of 36 per cent till 2020, as per a TechSci Research report.

Indian e-commerce startups received a funding of US$11.3 billion in 2015, according to a research by Tracxn.

Google and AT Kearney predict that the number of online shoppers in India will touch 175 million by 2020.

India is emerging as one of the fastest growing economies with a projected GDP growth at 7.5 per cent in 2016-17, overtaking China’s 6.3 per cent growth, thereby boosting investment and demand.

Big Indian brands like TATA, Reliance and Aditya Birla and China’s Alibaba and Japan’s Rakuten are all set to foray into the Indian e-commerce market. This should result in new product offerings, better customer service standards and a healthy competition.

The Turning Point

The Indian e-commerce market is currently standing at the point of inflection. The hype that gripped the unprecedented growth of e-commerce industry is subsiding. 2016 is predicted as the year which will witness a dramatic change in the business models of e-commerce companies.

A few e-commerce businesses have started realising the importance of profitability, sustainable growth and consolidation instead of relying on overvaluation, vague metrics or me-too strategy. And, they seem to be taking significant steps in this direction.

Also Read: An open letter to Indian startups, entrepreneurs, VCs and startup employees: Let’s celebrate failure

Flipkart and Snapdeal are replacing their inventory model with a marketplace. They have started talking the language of Net Promoter Scores (NPS), which is the measure of customer loyalty.

Jabong has reduced its discount offering from 50 per cent to 20 per cent and started focusing on selling premium lifestyle products instead of low-margin brands.

Housing.com is restructuring its business to streamline its operations and focus on its core technology and product while curbing cash burn.

Ola will soon start leasing self-owned cars to drivers instead of hiring drivers who owned cars.

The budget hotel aggregator OYO Rooms has acquired its rival Zo Rooms.

Foodtech startups such as Tiny Owl and Zomato are laying off staff or shutting down in some cities to reduce operational costs.

Additionally, government incentives and regulations will also push the e-commerce sector towards equilibrium. In March 2016, Department of Industrial Policy and Promotion (DIPP) announced that, “E-commerce entities providing a marketplace will not directly or indirectly influence the sale price of goods or services and shall maintain a level playing field”. The sector also received a boost when RBI last year passed a regulation to lift all FDI restrictions.

It is time for the e-commerce companies to flush out its inefficiencies, strive for profitability and do justice to every penny of the investor. This is a phase which will mark the survival of the fittest. The bubble will burst, but only for the weaker players.

—

The views expressed here are of the author’s, and e27 may not necessarily subscribe to them. e27 invites members from Asia’s tech industry and startup community to share their honest opinions and expert knowledge with our readers. If you are interested in sharing your point of view, submit your article here.

Image Credit: Shutterstock

The post E-commerce bubble in India: Has it burst yet? appeared first on e27.