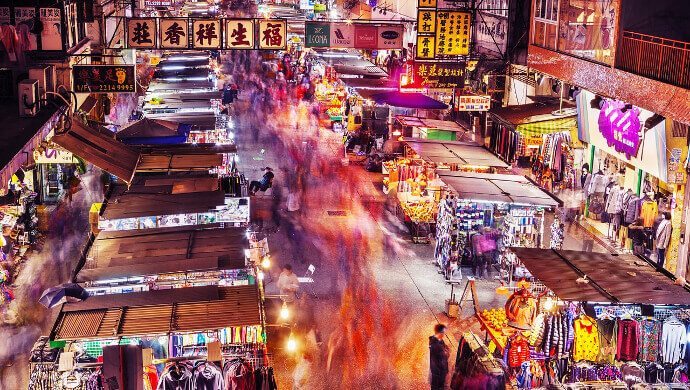

Poor market conditions and increasing innovations in the digital space provide the conditions for e-commerce to thrive

Consumers are tightening their purse strings amidst slow economic growth. A report by Deloitte in 2015 cited that in APAC, retail revenue growth slowed dramatically in 2014. 55.3 per cent of the APAC companies surveyed in that period reported a lower net profit margin and 4.3 per cent reported a negative net profit margin.

But, there is a silver lining in this; while sales have contracted, the impact would have been worse if it were not for the availability of e-commerce options. Of the top 140 most profitable retail companies worldwide, 7.6 per cent of their sales came through online channels, and 33 of the companies do not even possess a physical store.

These include Amazon (ranked at 14), which raked in more than US$70 billion in revenue in 2014, and JD.com (ranked at 58), which saw its sales jump to 62 percent at US$17.7 billion in the same year. The top 50 e-retailers in total, saw a boost of 19.7 per cent in profits in 2014.

Also Read: Shopee wants to create a more holistic and safer e-commerce experience

The shopping behaviour of consumers is inevitably shifting online. A total retail survey published by PWC in 2016. There are many factors contributing to this growing trend: a sharp increase in smartphone adoption, the rise of cross channel social media engagement and competitive pricing.

54 per cent of the respondents surveyed for the report shopped online at least once that year, up from 30 per cent in 2012. In 2014, 69 per cent of Alibaba’s Singles Day US$14.3 billion sale revenue came via mobile channels.

In general, APAC consumers are more social-orientated in the sense that their spending habits are susceptible to what their peers think In Malaysia, 69 per cent of the respondents surveyed said user-generated comments, feedback and reviews influenced their buying behaviour. In India, the figure stood at 66 per cent; China, at 63 per cent; and Singapore, at 57 percent.

Adding to that, many of them also purchase directly through social media channels such as Line and WeChat, etcetera. 51 per cent of consumers in Thailand have purchased through social media channels; India, at 32 percent; Malaysia, at 31 per cent; and China, at 27 per cent.

The stats have decreed for innovation

It is premature to say that the sun is setting on traditional brick and mortar retail, but radical innovations are clearly needed to retain and attract more customers — and the figures show that the e-commerce sector provides the said engine of seismic change that the industry so urgently needs in this slowing economy.

One example of such a disruptive technology is Singapore-based C2C e-commerce platform, Shopee developed under Internet and Mobile platform service unicorn Garena.

Built as a mobile-optimised platform, buyers can snap and upload screenshots of their items directly onto Shopee and start selling instantly. And, to prevent fraudulent deals from occurring, it has a system called Shopee Guarantee designed to safeguard transaction risks through a secure payment method. For high profile sellers or SMEs with more wares to hawk, it has Seller Assistant which helps to organise inventory and track store performance. Users can also interact with others through live chats and follow trending items and deals.

Also Read: Ten years later, Southeast Asia could see Shopee’s domination in C2C marketplace

In essence, Shopee ticks off the boxes that would indicate future healthy commerce growth if the trends reported by the aforementioned retail reports continue on its trajectory.

And it is not only harnessing innovations mobile technology and security to strengthen its value proposition, it is also leveraging third-party collaborations to deliver services it lacks the expertise or resources to do so. Shopee partnered with Singapore-based logistics startup NinjaVan. Buyers with bigger orders and located far from the sellers can opt to have their goods delivered via NinjaVan. The seller then tracks the delivery process through the app.

But, its list of innovations does not stop there. To encourage more sellers to come on board, it recently launched Shopee Free Shipping. This allows sellers to sell their and ship their items and have their shipping costs reimbursed by Shopee. It also recently launched Shopee University, a programme to empower sellers by imparting skills such as online marketing and photography, and more.

“Selling on a mobile app like Shopee has brought about greater convenience to my store as it is extremely hassle-free to manage my inventory and to track my sales on a daily basis. Not only am I able to save on rental costs, I am also able to reach out to a wider target audience, thus increasing my shop’s exposure easily,” says Ruiling, owner of beauty product store Crystalbeauty.

Also Read: Singapore’s Garena raises US$170 million Series D, led by Malaysian Government fund

Currently, Shopee is generating over US$1 billion in GMV since its soft launch in June 2015 and this represents a 45 per cent compounded monthly growth rate.

The future belongs to e-commerce

The strong success of e-commerce platforms such as Shopee shows that the future of retail belongs in the online space — and more notably, on the smartphone.

E-commerce does not just enable traditional businesses and SMEs to seek another channel for revenue, it is democratising commerce. By putting ditching the physical modus operandi, anyone with a smartphone or a computer can put an item for sale to potentially millions of customers in a matter of seconds.

—

Disclosure: This article was produced by the e27 content marketing team, sponsored by Garena.

The post Figures don’t lie: Here’s why e-commerce is key to retail innovation appeared first on e27.