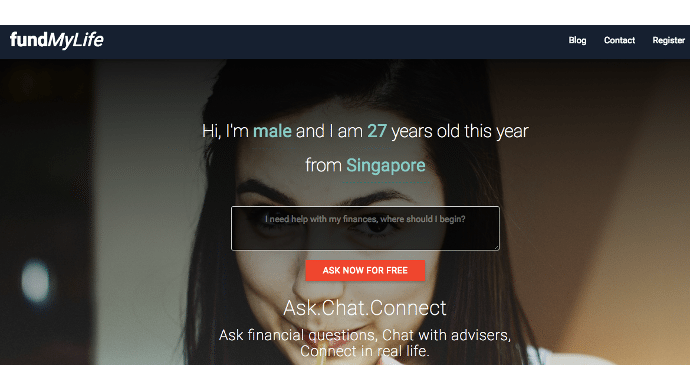

fundMyLife gives users the freedom to ask financial questions without the need to entertain sales pitches

If last year’s trends are any indicator, fintech will continue to be one of the dominant tech innovations that will drive Singapore’s Smart Nation ambitions this year. And its subsection of insurtech looks set to grow more exponentially

This reason is simple: Buying insurance has traditionally – and still is – quite complex. There is a myriad of policies and premiums to consider. One has to consult with a financial advisor/insurance agent for at least a good hour in order to craft the best-suited plan.

But insurance agents, who live off commissions, can be overzealous in their sales pitch, and this puts potential clients off. And in their hurry to close a deal, might overlook a crucial fine print that is not beneficial, or worse, detrimental to the client.

Also Read: InsurTech in Asia: 10 things to know

These are just some of the pain points that newly-launched Singapore-based insurtech startup fundMyLife hopes to address. e27 spoke with the three co-founders, Jackie Tan, Matt Lim and Wesley Goi to find out more:

What is/are the fundamental problem(s) with the traditional model of the insurance industry today?

Lim: The way insurance is being bought and sold today is still very primitive: The buyers are being harassed, and the sellers have difficulty engaging clients in quality conversation. Quality conversation on financial planning do not take place enough.

Tan: There’s trust, credibility, and complexity of finance terms. Firstly, we’re still in an environment where financial advisors are viewed with wary distrust. Secondly, there’s no way of establishing credibility, i.e., social proofing is limited to word-of-mouth. And thirdly, the complexity of finance terms is off-putting, leading to delay in making decisions until it’s too late.

Did you have a personal bad experience that spurred you to build fundMyLife?

Tan: When I was much, much younger, my father contracted cancer, and it turned out that the policy he bought was not suitable and the person who sold it to my father was unreachable. He stubbornly opted to forgo any treatment due to the costs, and he never recovered.

Also Read: Fintech, insurtech and the millenially-minded

Goi: Someone very close to me was struck with a chronic illness before he started working and wasn’t insured, this led to him being barred from future medical insurance. This set me thinking about whether there is some way I can reach out and engage those who are underinsured in a friendlier way in line with the current times.

What is your background? Tan, I think you mentioned before you are pursuing a PhD … So why the switch to the startup life?

Tan: That cancer episode was a pivotal point in my life, and I embarked on cancer research work because I (naively) wanted to make a difference. As I went on, I realised my work was not as impactful as I hoped, and was increasingly disillusioned. Start-ups, on the other hand, offer strong solutions with world-changing impact, and I think my energy and time were more suited for such pursuits. The skills and mindset from PhD life are transferable, and I see lots of parallels between the two.

Also Read: Insurtech investment: What is the potential of each Insurtech initiative?

Goi: I’m a computational biologist (also pursuing a PhD) – we use machine learning techniques and statistics to uncover the secrets behind numerous biological and ecological processes. For myself, I see this as an opportunity to hone my skills in a more industrial setting outside of academia.

Lim: I am a Financial Adviser with Prudential for three years, saw the pain on both sides of the coin, and want to create something that brings value to both sides.

How are you building your startup? Did you guys join any accelerator?

Tan, Goi, Lim: We have been bootstrapping all the way, keeping everything lean. We applied to quite a few accelerators, from DBS to OCBC to even TAG.PASS by NTUC Income but I guess we haven’t been quite a good fit for any of them.

What are some of the hurdles that you faced — and continue to face — while building fundMyLife?

Tan: A big hurdle we faced as first-time startup founders was getting guidance. For a while, it felt a lot like groping in the dark, and we were immensely fortunate to have found the community of startup founders and mentors who gave invaluable advice for us to move forward.

Goi: As a data scientist, I had to pick up web development which was at the beginning very foreign to me. Now that I have had a better handle on web development, the challenge I now face is finding talent and engaging them to work with fundMyLife.

Any plans to raise funding?

Tan, Goi, Lim: There was a time when, out of naiveté, we thought we can go out and get funding just because we have an MVP. We spent too much time fund-raising unsuccessfully, so we are going back to basics and won’t raise any more.

What new features are on the horizon?

Tan, Goi, Lim: For new features, we’ll have to obtain more feedback from our users before we build any more. Our immediate next feature is improving our financial adviser recommendation algorithm to better serve users’ financial planning questions.

—-

The post Got a burning financial question? This Singapore-based portal aims to address them appeared first on e27.