We sit down with BitX CEO Marcus Swanepoel to learn about the latest update on Bitcoin in Indonesia

Bitcoin. The digital currency had reached the peak of its fame in the past years, though it has also started to slow down recently. It once made us break out in cold sweat when Bank Indonesia –as the central bank– rejected its use as a legitimate means of payment; pushing Bitcoin activists to restrategise by promoting Bitcoin as an investment commodity in the midst of the continuously deteriorating global economic condition.

We had the opportunity to interview BitX CEO Marcus Swanepoel to learn more about the development of Bitcoin in Indonesia in the past few years, how the public responded to it, and how BitX is going to evangelise the use of Bitcoin as a commodity.

It’s mid-2016 and we still don’t hear much about Bitcoin in Indonesia. Can you explain how the situation is in the year 2016? Can you tell us more about the statistics of Bitcoin users in Indonesia?

On a global scale, Bitcoin is experiencing a surge of popularity, and countries such as the US, European Union, and Japan has pioneered Bitcoin adoption and regulation. We see the same thing in Indonesia. Generally speaking, Bitcoin transaction in our network has increased 140 per cent in the past one year.

This year, several factors play a role in the significant rise of Bitcoin price. Those factors are:

1. Stronger media coverage on the benefits and advantages of Bitcoin, rather than its risks.

2. Better consumer understanding and increased interest in Bitcoin.

3. Regulation certainty (such as in Japan, US, and Europe).

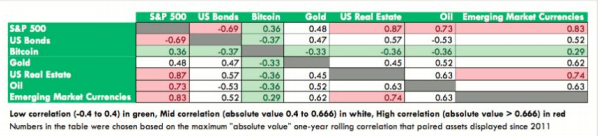

4. Interests from institutions (long term or uncorrelated).

5. Economic uncertainty around the world.

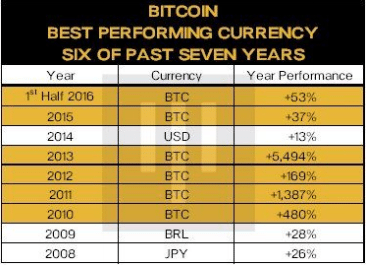

Many people are starting to explore Bitcoin as a safe alternative asset to own. It happens because the returns are not correlated, and Bitcoin’s performance is still relatively better compared to other currencies in the past years.

Bitcoin performance is excellent compared to other currencies in the past seven years. Image Credit: Pantera Capital

Also Read: Juniper Report: Bitcoin’s value soars following Brexit and weak Chinese economy

In Indonesia, the use case is really not that different. People who wish to own Bitcoin as an uncorrelated asset with great investment possibility. What we have observed in several global markets is that there is a strong interest for Bitcoin coming from institutions and we expect the same thing in Indonesia.

Some private wealth managers and hedge funds have contacted us to buy Bitcoin for their customers, and they aim to own Bitcoin in their assets. BitX has worked together with those clients to help them run this investment for their customers. They trust us for our outstanding security.

In BitX, we have been seeing healthy growth since our launch. Our customer base has increased 10 times in the past few months and we have been growing very rapidly. We are investing more here through market education, recruiting Indonesian-speaking customer support, localising our products, and also setting up a new office in Jakarta.

BitX positions itself as a “bank” to deposit Bitcoin as an “investment commodity.” Do you think this is the most appropriate way to promote Bitcoin to the general public, especially in Indonesia?

At BitX, our goal is to make it easier for the public to buy or sell Bitcoin and to deposit it safely. At this stage, buying Bitcoin as an investment is an example of one use case, and it will automatically encourage people to learn more about this new financial system.

Commerce will become easier once enough people are owning Bitcoin. We have observed that a number of people use Bitcoin for trade, sending out messages to their friends, and much more. Bitcoin is in the very early stage of its evolution, pretty much like the internet in 1992-1993. Therefore, investing in Bitcoin in its early stage like this is very much like investing in the internet in those early years.

Another important aspect when we are talking about Bitcoin is its security. This is what BitX is taking seriously. Most funds belonging to our customers are being kept with keys that are safely stored in a safety deposit box in banks. We call this storing system the “deep freeze” and we developed this as our first project when we were building the world ‘s first banking-class Bitcoin product.

We purposely made this deep freeze funds hard to access so that daily operational funds are kept in joined system using offline cold storage and online hot wallet. It enables us to ensure that we always have Bitcoin available for daily use.

In order to increase our knowledge about how Bitcoin operates, we always encourage all Bitcoin users to ask your provider how they are safekeeping your Bitcoin:

1. Do you trust the provider who keeps your Bitcoin?

2. Do they understand – and implement secure key storage?

3. Do they have a safe, two-factor authentication or integrated to security partner?

4. Do they perform financial or security audit regularly?

Also Read: The inevitable marriage of bitcoin and Silicon Bali

BitX recently partnered with Doku to ease Bitcoin purchase and sales. Do tell us about this partnership, existing payment method, and how is the response from users so far?

Our goal is to help people buy Bitcoin as easy as possible. This partnership with Doku is a step towards that direction. Through this partnership, our users can fund their accounts by depositing cash in Alfamarts across the nation, BCA Klikpay, ATM transfer, or Doku Wallet. We have received a good response so far, as it gives our users greater options to fund their accounts easier, anytime.

What else do you plan to do this year to promote Bitcoin? What are the upcoming partnerships?

Indonesia is our priority target and it has several strong areas to develop our business here. We strongly believe that we have the best product in the market and it is the result of the hard work from our world class team, best technology, and the fact that we are being supported by leading investors in Indonesia and the world.

Our main investor is Naspers. They have invested in Tencent, Flipkart, OLX and many more. Our main investor in Indonesia is Venturra Capital, a Jakarta-based venture capital firm with a focus on Southeast Asia with its US$150 million fund, and our other investor is the Digital Currency Group (DCG), which is run by Barry Silbert. He is possibly the most productive Bitcoin/Blockchain investor, and he is based in New York. DCG also took part in Coinbase, Circle, Kraken, Ripple, and many more.

Having the support from leading investors means that we are in the position to run this business in the long run. having the resources to recruit world-class talents and build the best product, and ensuring regular security audit. This also means we are able to bring the best of local and international investors, and expand a strong team that consists of people from Google, Amazon and Standard Chartered, as well as other leading local talents in Indonesia.

We have the resources to recruit world-class talents and build the best product, and ensure regular security audit. This also means we are able to bring the best of local and international investors, and expand a strong team that consists of people from Google, Amazon and Standard Chartered, as well as other leading local talents in Indonesia.

Also Read: Once every four years: the summer olympics and bitcoin halving

Generally, we focus on educating the market about Bitcoin. We have several events in May this year and plan to arrange another shortly. There is a great opportunity to educate a wider market (non-tech and early adopters) through the mainstream press in Indonesia, the way we have done in other markets.

One of the major areas that we want to focus on is communications and education on Bitcoin safety. Most Bitcoin users do not fully realise the importance of keeping Bitcoin safely and the various method that they can use.

We plan to highlight security aspect through a number of initiatives this year. We want Indonesian users to be more informed about Bitcoin safety and to recheck their service provider on the security method that it is using.

Another great differentiator is our focus on the mobile app. Our engineering team consists of several leading Android and iOS developers and it reflects the quality of our app. Our focus on this mobile app makes it more relevant for our users, which is why we call it the ‘Smart Wallet.’

We can do a lot of smart and interesting things as a result of our design. For example, we work together with several merchants for co-marketing campaigns by promoting “deal of the day” card, and feature promoted products and encourage users to purchase it using Bitcoin. The card shows up in users’ feed inside the app and can be clicked or swiped if they are not interested. This mobile app enables traders to sell/purchase Bitcoin directly in the BitX app.

You can observe that we are working with businesses in other sectors including payment platform and merchants, to enable people to pay using Bitcoin, you can expect the same happening in Indonesia in the next few months.

—

The article Kabar Bitcoin di Indonesia dan Peluangnya Sebagai Komoditas Investasi was written by Amir Karimuddin and was first published on DailySocial. English translation by e27.

The views expressed here are of the author’s, and e27 may not necessarily subscribe to them. e27 invites members from Asia’s tech industry and startup community to share their honest opinions and expert knowledge with our readers. If you are interested in sharing your point of view, submit your article here.

Image Credit: Francis Storr on Flickr

The post How Bitcoin is doing in Indonesia, and its opportunities as an investment commodity appeared first on e27.