DailySocial is working together with Indonesian Fintech Association to release a report on the state of fintech in the country in 2016

“My wallet is empty because I no longer use cash to pay …”

When it comes to its potential as a market for internet-based services, the numbers seem to bear great promises for Indonesian market. Internet users in the country had exceeded 100 million users, with over 326 million mobile subscription —or roughly 126 per cent of its population.

But Indonesia remains a challenging market for fintech industry to grow with only 36 per cent of adults in the country have an account at formal financial institutions. The consumer behaviour also reflected this challenge as 44 per cent of people would rather borrow money from friends and families (instead of financial institutions) and only nine per cent use credit cards for payments.

In November 2016, the Indonesian government through the Central Bank had launched Regulation on Payments Transaction Processing to provide legal assurance for new and existing payments business activities. It has also created a Fintech Office which work also includes capacity building and regulatory sandbox implementation.

So how did the fintech sector fare in Indonesia in 2016?

DailySocial is working together with Indonesian Fintech Association (IFA) to publish a report on the state of fintech in the country throughout the year. The report focusses on non-bank and non-telco fintech companies, and it also includes a survey and analysis on consumer awareness.

The following are key learnings from the report for you.

Also Read: Check out the new fintech industry partnerships announced during the IFFC 2016

A glimpse on the market

Indonesia has entered the Fintech 3.0 stage, where innovation is championed by startups instead of financial institutions as in Fintech 2.0 stage, or a joint venture of financial institutions and tech companies in Fintech 2.5.

The number of fintech startups in the country experienced drastic increase between 2014-2015, when it grew for 78 per cent from the 2013-2014 rate of just nine per cent.

IFA noted that by November 2016, there are around 135-140 players with 55 registered as fulltime members of the association.

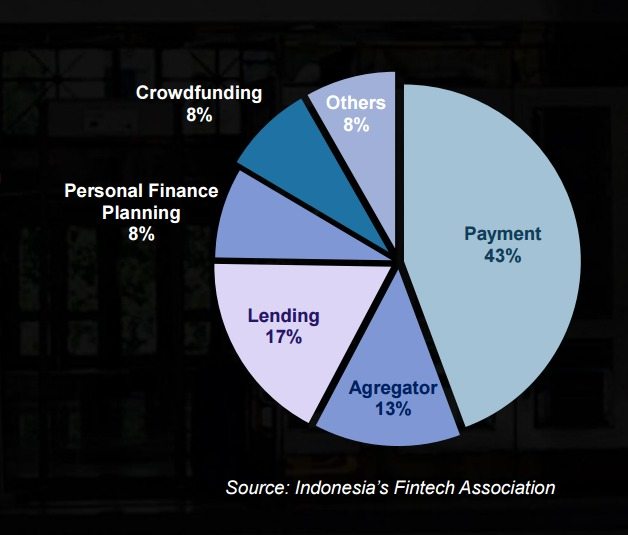

Fintech player profile by sector.

As shown in the graphic, payments was the most popular sector, following the growth of e-commerce sector in the country.

In 2016 alone, the total disclosed funding reached IDR486 billion (US$36 million), which includes IPO and investment from parent company outside of the country.

The survey

The consumer awareness survey involved 1,000 respondents, with a 43.34 per cent of them are between 20-25 years old. More than 80 per cent of respondents reside in Java, Indonesia’s most populated island, which affects the number of respondents who have access to bank accounts (86.93 per cent).

Among these respondents, fintech remains a foreign concept with only 28.34 per cent of them claiming to have heard the term before. Even among those who are familiar with it, only 18.46 per cent are using a form of fintech service.

For those using fintech services, the majority (81.08 per cent) are using services provided by a bank.

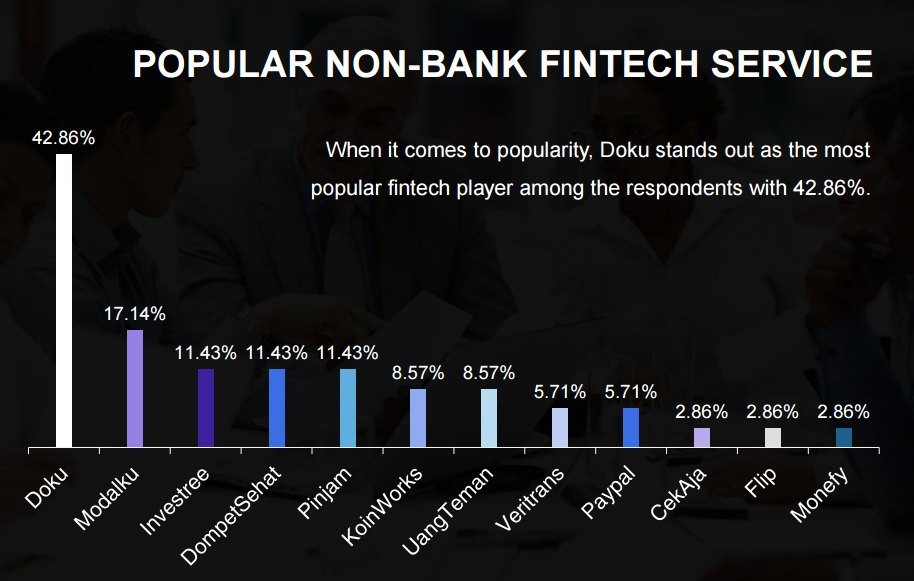

Popular non-bank fintech services in Indonesia

As shown in the graphic above, among existing non-bank fintech services, Doku maintained its staying power as the most popular service at a whooping percentage of 42.86 per cent.

Also Read: Indonesia to set up minimum capital requirement for fintech startups

Despite the disheartening numbers, 74.47 per cent of respondents believe that fintech can help push for better financial literacy and financial inclusion in the country.

In order for the sector to grow, there are several challenges that players need to solve, which are being divided into four categories based on a recent Deloitte report: Clearer regulation, more collaboration, lack of talents, and financial literacy.

Regarding talent, the report highlighted that companies at different stages have different needs for talents. Younger companies (less than two-year-old) have greater needs for Data and Analytics talents (83 per cent) while older companies (more than four-year-old) need more Risk Management talents (90 per cent).

—

Image Credit: BDS / 123RF Stock Photo

The post In 2016, fintech remained a foreign concept in Indonesia. But there is still hope appeared first on e27.