Interloan, a P2P lending platform for salaried professionals in Vietnam, has secured US$500,000 in investment from Phoenix Holdings.

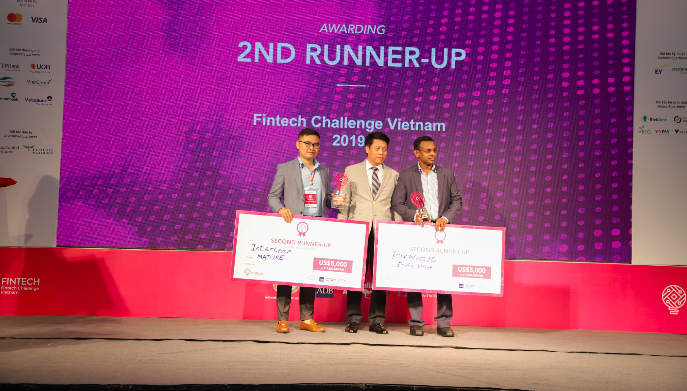

Interloan is one of the winners of Fintech Challenge Vietnam 2019, which was organised recently by the State Bank of Vietnam.

Phoenix Holdings is one of the investors and partners of the contest.

Also Read: How Vietnam is accelerating fintech growth

The fintech player will use the money raised to improve the technology infrastructure, partner with new banks, and ramp up its business development activities.

Interloan connects investors and borrowers (salaried professionals), who can avail an unsecured loan of up to VND 70 million (US$3,000) for a 6-month period for interest rates between 16.5 per cent and 19 per cent. The lender receives a return-on-investment rate up to 15 per cent per annum with a minimum investment of VND 1 million (US$43).

All transactions are done through its partner bank’s system. Interloan only connects users and doesn’t keep the money of investors and borrowers.

The startup claims that the user information is verified by a system to reduce risks.

“Interloan will solve the widespread problems of financial services that the Vietnamese regulatory agencies are aiming for,” said CEO Tran Dai Duong.

So far, Interloan has partnered with three commercial banks and 10 businesses with more than 7,000 employees in Vietnam.

A survey, conducted with more than 2,000 employees in Ho Chi Minh City, shows that 90 per cent of employees have salary advance in the last six months and this demand is almost unmet by their employers.

The post Interloan receives US$500K investment to provide unsecured loans to working professionals in Vietnam appeared first on e27.