KredX helps businesses meet short-term working capital needs by discounting their unpaid invoices to a network of buyers/financiers including banks, NBFCs, wealth managers and retail investors

KredX, an invoice discounting marketplace for micro, small, and medium enterprises (MSMEs), has secured US$6.25 million in Series A funding led by Sequoia India. Existing investor Prime Venture Partners also participated in this round.

The investment will be used to strengthen the technology, data and sales functions within the company.

The funding comes six months after the startup secured US$750,000 from Prime Venture Partners.

KredX was founded in 2015 by IIT and Stanford alumni Manish Kumar, Anurag Jain and Puneet Agarwal. Previously known as Mandii, KredX helps businesses meet their short-term working capital needs by discounting their unpaid invoices (raised against blue-chip companies) to a network of buyers and financiers including banks, NBFCs, wealth managers and retail investors.

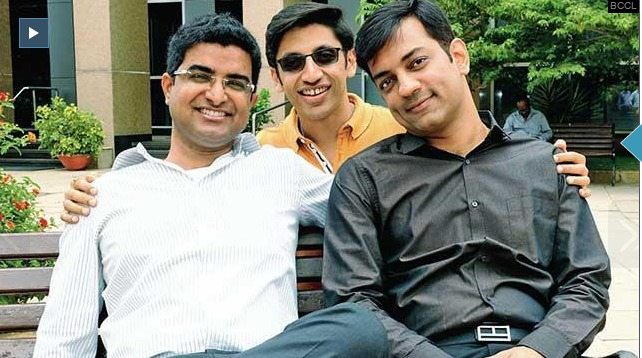

The Kredx founding team

“Access to working capital for sustained growth and production is critical to businesses, and late payments are often a huge bottleneck. Last year, almost 97 per cent of the Indian SMEs reported having experienced late payment of their invoices while 56 per cent dealt with working capital issues due to late payment or unavailability of credit. Additionally, most of the existing working capital arrangements today require collaterals and long-term commitments and businesses have no control on rates,” said CEO Kumar.

This is where KredX comes in. The platform helps MSMEs maintain their cash flow by unlocking the cash tied up in invoices that otherwise takes an average of 30 to 90 days to be cleared. On the other hand, it offers financiers access to risk-mitigated, high-yield and short-term investment opportunities that are not tied to the uncertainties of the stock market.

“We aim to connect financiers and businesses in a mutually beneficial manner by helping MSMEs unlock the value of their invoices and boost cash flow, while providing an investment opportunity for financiers to channelize their funds optimally,” said Co-founder Jain.

The team has developed a proprietary credit risk assessment model for its borrowers along with back-end technology that ensures secure, hassle-free and fast platform for transactions. For financiers, KredX provides complete trade services starting from sourcing curated invoices to conducting due diligence using its proprietary credit underwriting algorithms.

Shailendra Singh, Managing Director, Sequoia India, said: “KredX is disrupting a huge multi-billion dollar informal lending market for businesses all across India using technology, and thus allowing under-served SMEs access to credit from private and institutional lenders, typically 60 to 90 days in duration. The company neither assumes credit risk, nor has a balance sheet and that makes it akin to a pure marketplace.”

—-

The post KredX gets US$6.25M to help SMEs raise working capital against unpaid client invoices appeared first on e27.