With the development of open banking and new digital bank licenses, Singapore is on its way to become one of the world leaders in the field of Fintech and AI innovation

Singapore has become the regional Fintech hub in SEA. In recent years, AI has become one of the dominant technologies that have gained significant traction in the financial sector given its treasure trove of data and its pervasive impact on the industry.

We believe the confluence of Fintech and AI presents a major opportunity for financial sector transformation – impacting every part of the user’s journey and further enhancing Singapore’s lead as the regional Fintech hub.

Defining Fintech + AI

It won’t be easy to define the boundaries for Fintech + AI startups.

If viewed as a spectrum, there are two generic types of startups at the extremes. At one end, there are AI-intensive startups that focus on providing technology or service to help Financial Institutions (FIs) transform into AI enterprises.

At the other end, there are the AI-light ones that combine the power of AI with business model innovation to compete head-on with traditional FIs.

I always look at the full spectrum to understand how AI can help FI’s or aid startups competing with Fi’s.

In general, startups can be classified into a few categories – those who focused on [1] achieving alpha (seeking above-market returns), [2] assisting with lending activities (kind of looking for alpha but in the lending space), [3] achieving beta (generally help personalization while at least achieving market returns), [4] managing risk (regulation and compliance-related), or [5] position as a general tech provider that can help to achieve any of the above.

There is also a segment that enables front-end customer relationship development and management. Since it can be quite general, I have placed them in the last bucket.

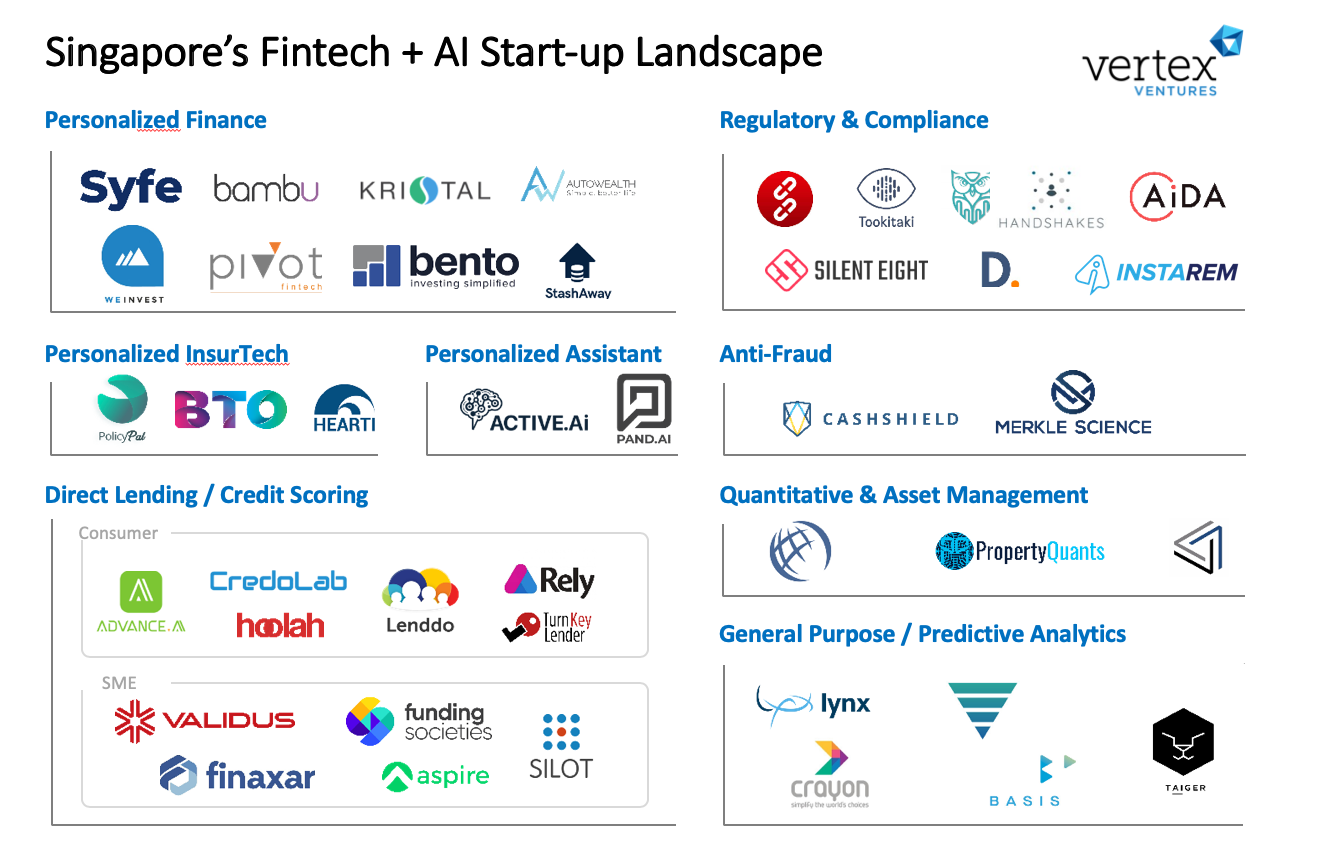

At Vertex, we invest using a thesis-led approach – seeking markets undergoing disruption while keeping a lookout for opportunities that offer high growth potential which is why I have decided to map out the Fintech + AI startups landscape in Singapore.

To date, we have invested in a few promising startups along these lines including Validus in Singapore (credit scoring for SMEs), Active.AI in Singapore (conversational banking), Turnkey Lender in Singapore (SaaS-based lending platform), Sunday in Thailand (AI powered Insurtech), Cicil in Indonesia (student financing), Kissht in India (check-out financing). We also have our Singapore based Instarem heavily leveraging AI on AML and other regulatory compliance. We are interested to explore more opportunities in this space.

An overview of fintech + AI startups in Singapore

Based on my research to date, there are about 40 Fintech + AI startups from the AI-light to AI-intensive. They can be categorized into these segments for ease of understanding. Here are a few general observations:

1. Personal finance, especially the robo-advisory category comes on top as the most active. This is related to Singapore’s position as the region’s wealth management hub and one of the leading hubs in the world.

Also Read: 6 Singapore-bred e-commerces that tread ahead among fierce competitions

It is indeed a real opportunity for the developed Singapore market but regional adoption remains nascent as most emerging markets require time for its people to understand the concept of wealth management. Cracking the code for educating and onboarding the populace in emerging markets will offer significant opportunities.

2. Regulatory, compliance, and fraud detection comes in as the second most active category. This is because regulatory compliance, especially AML, has always been the top concern of Singapore. Leveraging AI to improve accuracy while lowering compliance costs naturally becomes a priority. Going forward, the key challenge lies in addressing the different customization needs of different FIs.

3. General purpose / predictive analytics: As a general category this comes third – a reflection of the strong technology talent pool in Singapore and the potential, sizeable opportunities to serve FIs or other industrial sectors.

4. Credit scoring / direct lending: While SME lending has attracted much attention in Singapore since 2016, consumer lending remains relatively muted. Consumer lending has gone through a mania phase in other ASEAN countries, especially Indonesia with over a few hundred players in 2018.

It is no surprise that this remains a small category in Singapore given the country’s well-established banking/lending system and robust regulatory oversight.

Many people may also not be aware that consumer lending is regulated by the Ministry of Law (MOL) rather than the Ministry of Finance in Singapore (MAS). It is also more recently that the regulation has only been slowly relaxed.

5. Quantitative and asset management: This is perhaps the most interesting sector for many (to generate a direct return) but amongst the most difficult sectors to crack (given the billions invested by Wall Street firms). I believe the private asset sector thesis remains an interesting one, as regional startups do have their advantage when it comes to local data access.

The above is intended to serve as an overview for the Fintech + AI sector in Singapore. It is not a complete landscape mapping and any suggestions/comments on missing notable startups.

Singapore as the regional leader in fintech + AI

Singapore has many attributes that avail it an advantage in developing its Fintech + AI sector – [1] the heft of its financial sector, [2] deep Fintech talent pool, and [3] significant initiatives to build its AI capabilities and cluster.

In addition, Singapore’s regulator – MAS has adopted a very open mindset and takes an active approach in driving industry development. They are willing to embrace innovation to the extent that funds are established to help FIs pilot test different technologies, encouraging a risk-taking mindset.

Also Read: Tech trends of 2019 to watch out for in Singapore

They only intervene when risks are deemed excessive. MAS also has initiatives to drive certain key AI research direction such as explainable AI or federated AI and to encourage the financial industry to open up their infrastructure, although this remains a key challenge.

–

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Join our e27 Telegram group here, or our e27 contributor Facebook page here.

Image Credit: Julien de Salaberry

The post Mapping out Singapore’s broad “Fintech + AI” landscape appeared first on e27.