MoolahSense will be able to leverage MatchMove’s integrated regional partner network to tap new segments and extend its capability to fund creditworthy SMEs across Asia

Singapore-headquartered banking-as-a-service platformMatchMove e27 has acquired a strategic equity stake in local P2P lender MoolahSense for an undisclosed amount.

This deal will enable MatchMove to strengthen its ‘Spend.Send.Lend’ capability and provide access to financing to SMEs within its ecosystem.

Consequently, MoolahSense will be able to leverage MatchMove’s integrated regional partner network to tap new segments and extend its capability to fund creditworthy SMEs across Asia.

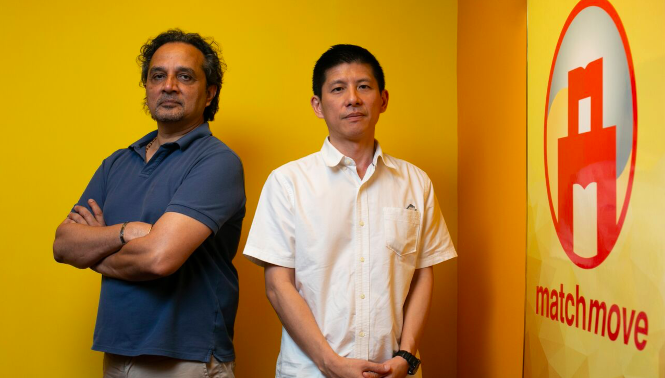

“With this partnership, we will be able to leverage MoolahSense’s capability in credit origination and scoring to serve our clients better. Furthermore, there is a natural strategic convergence between our two digital platforms to go-to-market together as a combined offering,” said MatchMove Group CEO and Founder Shailesh Naik, who joins MoolahSense’s Board of Directors.

Moving forward, MatchMove will be able to originate potential issuers and lenders from its client ecosystem. MoolahSense will, in turn, grow its loan portfolio on the back of accessing new segments and structuring new product capabilities.

“We are excited to partner with MatchMove to launch a risk-mitigated “on-tap” credit solution for curated digital ecosystems that fulfils the working capital needs of SMEs. We shall be tuning our “lending-in-a-box” into MatchMove’s vision of “banking-in-any-app” to realise the dreams of many SMEs and reward the decisions of lenders,” said Lawrence Yong, CEO of MoolahSense.

Also Read: MatchMove appoints Krishnan Sarangapani as CTO

This investment is aligned to MatchMove’s direction to make strategic acquisitions in adjacent and complementary businesses.

MatchMove digital payments company, whose proprietary banking wallet OSTM enables ‘banking-as-a-service’ and the capabilities of Spend.Send.Lend within any app.

The ‘Spend’ platform empowers businesses and their customers to spend both online and offline safely, via instantly issued prepaid cards on major card networks.

Its ‘Send’ capabilities include P2P domestic transfers, cross-border remittances, P2M and mass disbursements to global recipients.

MatchMove’s platform further extends to ‘Lend’, where credit scores are assigned based on customers’ spending and sending patterns to offer customised lending solutions.

The startup — with offices in India, Indonesia, Vietnam and the Philippines — is backed by investors including Japanese financial services giant Credit Saison.

Founded in 2013, MoolahSense is a digital lending platform, which aims to simplify and speed up access to working capital for SMEs. It implements the lending-business-in-box solution in collaboration with ecosystem partners by incorporating the latest technologies such as microservices architecture, blockchain, machine learning and artificial intelligence.

MoolahSense is backed by East Ventures and Pix Vine Capital, among others.

The post MatchMove acquires stake in P2P lender MoolahSense to strengthen its SME financing capabilities appeared first on e27.