Go-Jek has begun testing the feature for Go-Food customers, with fintech startup Findaya as its partner in managing the service

Indonesian ride-hailing giant Go-Jek launches PayLater, a new payment feature that enables customers to pay in installment for up to a certain limit. PayLater is a lending product of fintech service Findaya (PT Mapan Global Reksa), which was developed by Mapan, one of the three fintech startups that Go-Jek acquired last year.

Findaya has been registered as a lending service provider in the Indonesian Financial Services Authority (OJK). In running its business, Findaya is working with Go-Jek, Go-Food, Go-Clean, Go-Massage, and Mapan partners to help them purchase laptops, smartphones, and other goods through installment.

In a press statement, Go-Jek Chief Commercial Expansion Catherine Hindra explained that for the time being, PayLater is only available for selected Go-Food customers. Customers are being selected based on several criteria defined by Go-Jek and Findaya, though Hindra declined to explain in further details.

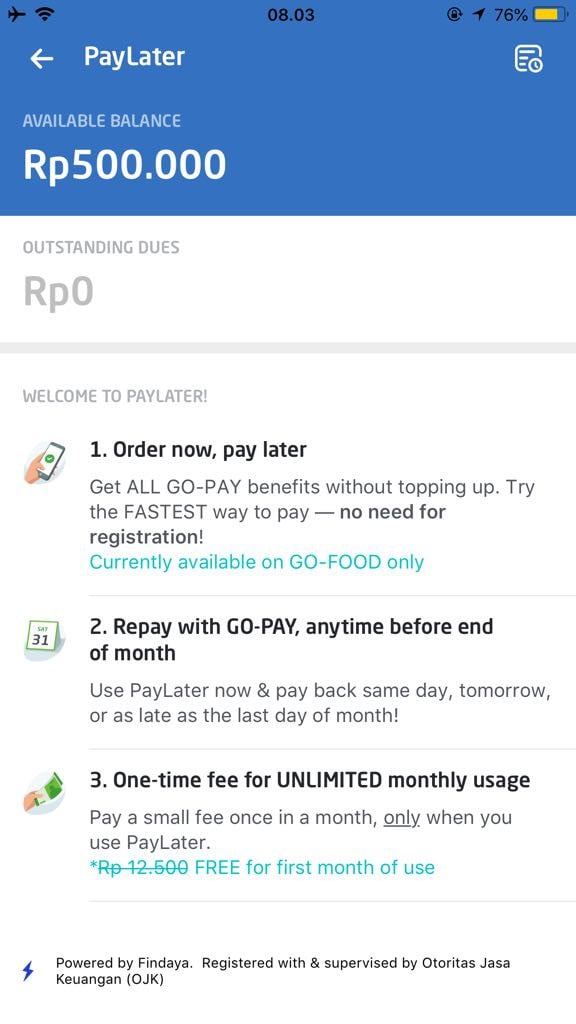

She likened the PayLater mechanism with a post-paid mobile service subscription. Customers are allowed to use up to IDR500,000 (US$33.5) with IDR2,500 (US$0.16) monthly subscription fee.

“Together with Findaya, our focus is to provide the best experience for selected Go-Food customers. The lessons that we learned from this process will be used to develop subscription feature in the future,” she told DailySocial.

Hindra continued to explain that the monthly subscription fee will only be charged when customers use the PayLater service. The admin fee will not be activated if the customer has not been using the service. For the first month, customers will receive free subscription as part of a promotion.

She also did not give further details on when the feature will be available for all Go-Jek customers.

Also Read: Go-Jek acquires Indonesian adtech startup Promogo, introduces Go-Vend and Go-Ice

Testing out PayLater

Upon deeper digging, we discovered that PayLater enables users to borrow money to pay for their food for up to IDR500,000. The bill should be paid by the end of the month using Go-Pay.

There is no explanation from Go-Jek whether interests will be applied to every late payments. The company will notify customers starting from the 25th every month until the bill is fully paid.

DailySocial had the opportunity to try out the service for the first time. It works just like a typical Go-Food booking; the PayLater payment option will show up upon checkout.

When choosing for PayLater, the page will automatically showcased the amount to be paid, just like when customers are opting for Go-Pay or cash. Once the order is received, there will be a notification about deducted PayLater balance. Customers can choose to pay for the bill anytime, all the way until the end of the month.

—

The article Mengenal PayLater, “Kartu Kredit Virtual” Tanpa Bunga dari Go-Jek was written in Bahasa Indonesia by Marsya Nabila for DailySocial. English translation and editing by e27.

The post Meet PayLater, an interest-free ‘virtual credit card’ service by Go-Jek appeared first on e27.