French startup Lydia is raising a $45 million Series B round (€40 million). Tencent is leading the round with existing investors CNP Assurances, XAnge and New Alpha also participating.

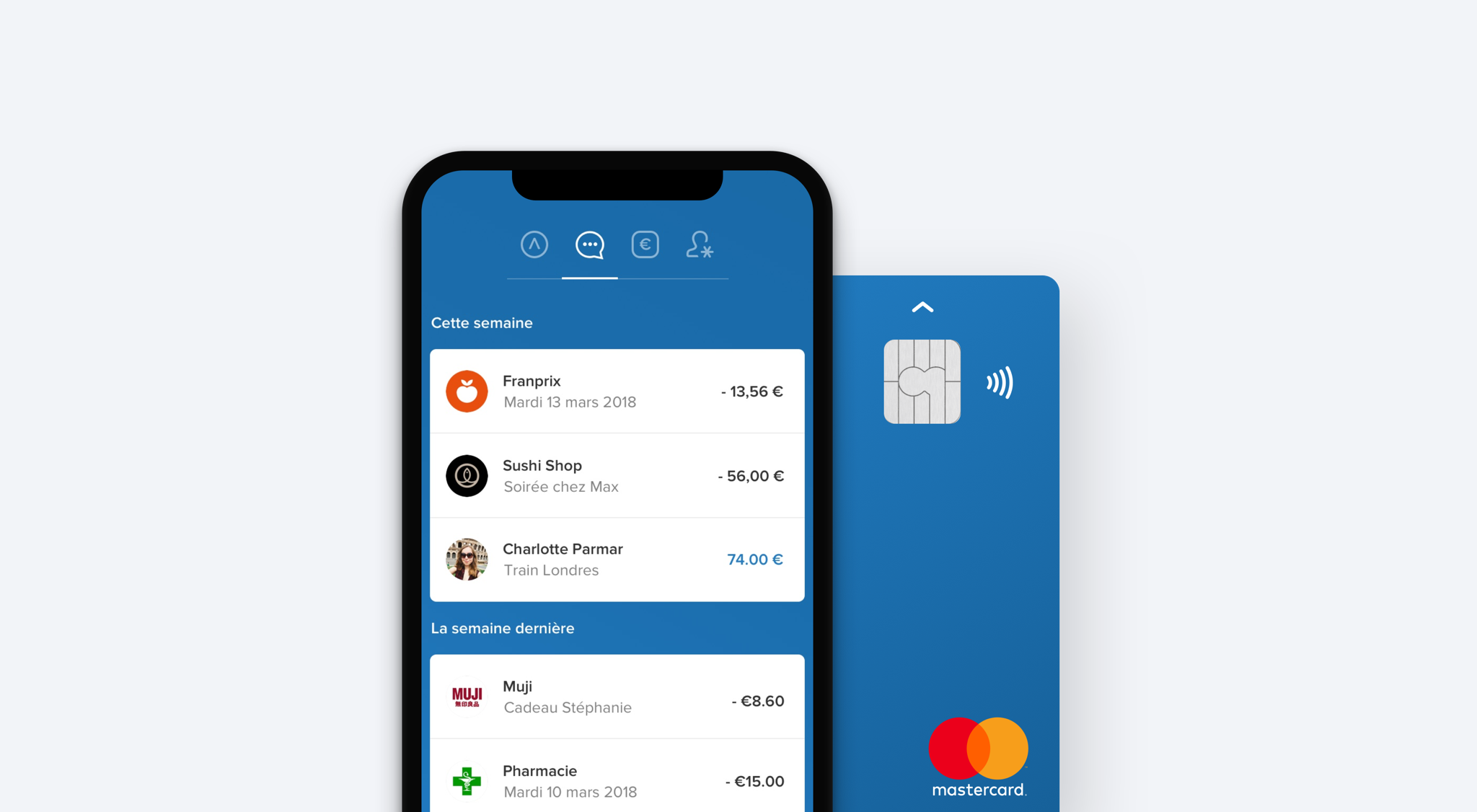

If you live in France, chances are you already know Lydia quite well. The company has become a ubiquitous mobile payment app, especially for people under 30 years old. Think about it as a sort of Square Cash or Venmo, but for France.

“At first, we wanted to raise less but we ended up raising more,” Lydia co-founder and CEO Cyril Chiche told me in a phone interview.

The company has managed to attract 3 million users in France. More impressive, 25% of French people between 18 and 30 years old have a Lydia account — and 5,000 people sign up every day. Lydia currently has 90 employees.

More recently, the company has expanded beyond peer-to-peer payment. First, the company wants to help you manage your money in many different ways with an important value — everything should happen in real time.

You can create multiple Lydia accounts to put some money aside or use money in that sub-account for a specific purpose. That feature alone turns the app into a versatile money management app.

For instance, you can associate a Lydia payment card with a Lydia account and a virtual card with another Lydia account — that virtual card works with Apple Pay, Google Pay, Samsung Pay and more. You can change those settings in real time.

You can share accounts with other Lydia users. And shared accounts are truly shared — everyone can top up and withdraw money from that account. You can spend directly from that account or withdraw money to another account.

You can also turn any Lydia account into a money pot account. In just a few taps, you can generate a link and share it with your friends so that they can add money using their regular payment card or a Lydia account.

More recently, the company has introduced “the market”, a marketplace of other financial products. From the Lydia app, you can borrow up to €1,000 in just a few seconds. You can also insure your phone and other mobile devices. You can get some free credit when you open a bank account, insure your home with Luko, switch to another electricity and gas provider, compare mobile phone and internet providers and more.

And that strategy is going to be key in the future. “We have an ambitious goal, which is turning Lydia into a mobile financial service app,” Chiche said.

He also pointed out that the company that has been the most successful when it comes to creating a mobile marketplace of financial products is Tencent with WeChat.

“Tencent is also the number one player in the video game industry, and there’s no industry with as much user engagement,” Chiche said. Tencent acquired Supercell, bought 40% of Epic Games, acquired Riot Games (League of Legends), invested in Ubisoft, Activision Blizzard, Discord, etc. Lydia hopes that it can learn from Tencent on the user engagement front.

Compared to many fintech startups, Lydia doesn’t want to replace banks altogether — the company says it wants to build a meta-banking app. Peer-to-peer payments represent the top of the funnel and a great user acquisition strategy thanks to networking effects.

You can then connect your Lydia account with your bank account and your debit card. This way, you can send money back and forth between your Lydia accounts and your bank account. As a user, that strategy slowly pays off over time. After a while, you end up spending money directly from your Lydia account and relying more heavily on Lydia’s native payment features, with your bank account acting as a money back end.

At the bottom of the funnel, Lydia hopes that it can turn active Lydia users into paid customers with a handful of in-house and third-party financial products. In other words, Lydia doesn’t want to become a credit institution like a traditional bank, it wants to become a financial hub. Expanding the marketplace will be a big focus for the company going forward.

While Lydia is available in other European countries, Lydia is still massively used in its home market with other markets lagging behind. With today’s funding round, growth in foreign countries is going to be the second key topic.