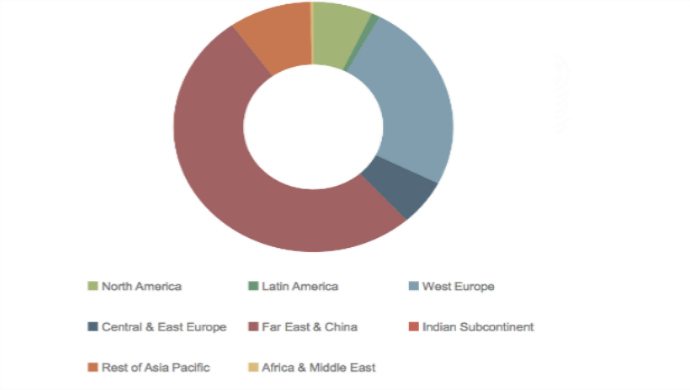

While it may not catch on globally, Asia is projected to dominate the global market for popularity of contactless payments

Global transactions made via contactless point-of-sale (POS) machines (i.e. Apple Pay, Samsung Pay and card technology) will increase from a projected US$321 million in 2016 to a just under US$500 million by 2017 — a figure that will only represent 5 per cent of total POS transactions.

According to a Juniper Research white paper, if the technology is going to become popular on the world stage, it will do so via the Asian market, with usage locally far outstripping that of the rest of the world.

Currently, contactless POS systems make up a significant minority of payments systems — accounting for 20 per cent terminals across the globe — the percentage translates to about 15.3 million terminals globally.

Looking ahead, the technology surge of the last two years, plus obligations by retailers to placate the demands of credit card partners, means, according to Juniper, the number of contactless terminals is expected to rise dramatically over the next five years.

Juniper projects two out of every three POS systems in 2021 will be contactless terminals.

More POS systems should mean users are more willing to test out the technology and, should they like the service, adapt it into their daily shopping habits.

Also Read: Biggest threat to OTT industry is not Netflix, but another video giant

Additionally, the report predicted that contactless credit/debit cards will make up one in every two plastics issued by the year 2020. So, even if products like Apple Pay and Samsung Pay never catch on, credit cards might still help bolster the sales statistics for contactless POS technology.

Let’s put a wet blanket on this optimism

While contactless payments appear to on track to become an inevitable part of POS technology; it does not necessarily translate to becoming the ‘future of retail’.

After all, as the saying goes, cash is king.

Even with significant minority of POS machines being contactless, its added value like pouring a bucket of water in the cash-first ocean.

While countries like the United States and Singapore have largely moved to a card-based economy, it is not a trend that traverses across all developed countries. Much less something that is even relevant across much of the developing world.

Also Read: Forget Apple Pay or Samsung Pay, Hong Kong just implemented a revolutionary payment system

“[The limits of contactless payments] is mainly due to the lack of widespread availability of supporting POS contactless reader terminals and also that some potential users are likely to remain cash-centric. For example, Germany remains a highly cash-centric economy, with cash still accounting for around 57 per cent of in-store retail transactions by value,” said research author Nitin Bhas in a statement.

To compare, the United State’s retail transaction by value number is 10 per cent for cash.

Contactless payment technology is limited by its low average-per-transaction numbers, its high financial barrier to entry for users and the popularity of a millenia-old payment method.

While Apple Pay, Samsung Pay and credit card companies can grab headlines; the products which do so have so far failed to change the way people shop.

—

The post Not catching on: Contactless payments to grow next year, but value remains minimal appeared first on e27.