The fintech startup also provides credit scoring and loan origination services to financial institutions

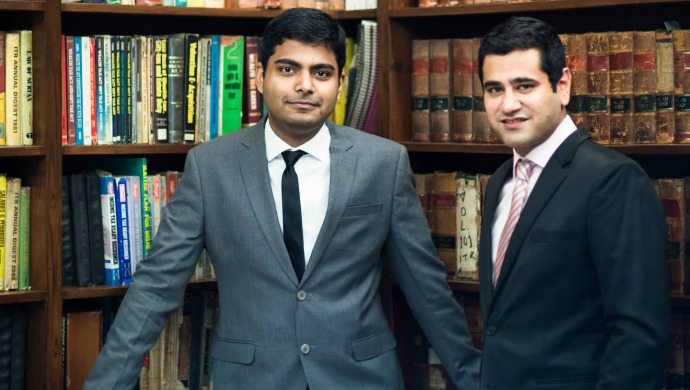

IndaLends Co-founders Mayank Kachhwaha (L) and Gaurav Chopra

Delhi-based IndiaLends, a credit scoring and analytics platform, has raised US$10 million in a Series B round of funding led by London-based ACP Partners with participation from existing investors American Express Ventures, DSG Consumer Partners and AdvantEdge Partners. India-focused Chinese fund, Ganesh Ventures, also co-invested.

The capital will be used to expand IndiaLends’s technology platform, enhance credit underwriting and analytics capabilities, increase market footprint to offer products pan-India, and to hire talent.

Started in March 2015 by Gaurav Chopra and Mayank Kachhwaha, IndiaLends operates an online marketplace that allows consumers to access the most relevant unsecured credit products offered by various financial institutions based on the consumers’ credit profile. The startup claims to have disbursed over INR 500 crore (US$73 million) in personal loans since launch and helped nearly 200,000 consumers in securing approvals for credit cards.

In addition, IndiaLends also provides credit scoring and loan origination services to financial institutions.

“We have partnered with close to 50 banks and Non-Banking Financial Companies (NBFCs) and offer personal loans in multiple consumer segments with loan ticket sizes ranging from INR 15,000 (US$218) to INR 50 lakhs (US$72,800) and loan repayment tenures from three months to six years,” said Chopra. “Our focus remains on unsecured consumer credit and we will shortly be launching new products such as an app-based line of credit and point-of-sale loans to meet the needs of our customers.”

Must Read: The oBike exit is not just unethical, it should be illegal

“Price comparison platforms have enjoyed success as a consumer driven product offering with a number of strong players in the US, Europe and Southeast Asia. India is set to enter a phase of rapid retail credit expansion; IndiaLends is perfectly positioned to capitalise on this growth and we are very excited to begin our partnership. Our involvement in a number of businesses across India, including NBFCs, gives us comfort in the space and the value of IndiaLends’s unique product offering,” said Alok Oberoi, Founder of ACP Partners.

Prior to this round, IndiaLends has raised US$4 million in December 2016 from American Express Ventures, DSG Consumer Partners, Cyber Carrier VC and AdvantEgde Partners.

The post Online marketplace for unsecured loans IndiaLends raises US$10M Series B funding appeared first on e27.