The Malaysia-based online Direct Debit payments company has completed its seed funding round with the fresh funding

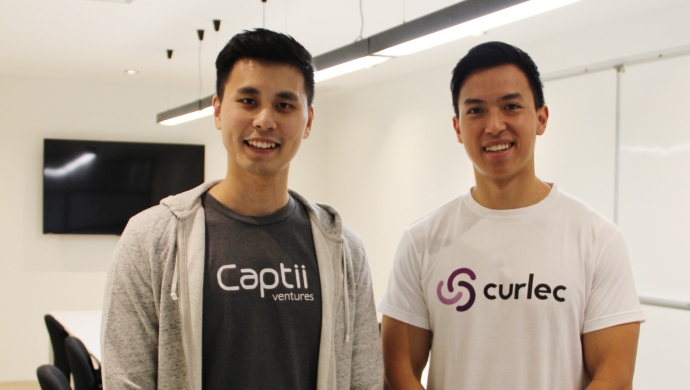

Online recurring payment startup Curlec has closed its seed funding round with investment from Captii Ventures, the investors known to back marketplaces, new media, fintech, agritech & enterprise applications.

Curlec plans to use this capital to further grow their Malaysian operations and take their online Direct Debit payments platform to the mass SME market.

Curlec facilitates transactions by intermediating between buyers, sellers, and their banks, making the process of administering bank-to-bank payments easy.

Also Read: AirAsia launches US-based VC fund, strategic partnership with 500 Startups

Curlec was founded in 2017 and it seeks to help businesses in collecting recurring payments and helping companies control cash flow. The API-automated system provided by the company enables SMEs to ditch manual methods like cash and cheque or credit card processing.

Curlec said since its launch, it has processed US$12.3 million (MYR50 million) worth of transactions for companies like CTOS, Funding Societies, HelloGold, and SMEs.

“Cash flow is the lifeblood of any business, particularly with SME companies, and up until now collecting payments has been incredibly admin-heavy and expensive. SMEs have traditionally been underserved by banks, so Curlec aims to provide a solution that takes the pain out of collecting payments to let businesses actually focus on growing their business,” said Zac Liew, co-founder , and CEO of Curlec.

“We believe there is a large opportunity in this space, as Direct Debit has traditionally been the hardest payment method for businesses and consumers to access prior to the introduction of Curlec,” said Ng Sai Kit, Chief Executive of Captii Ventures.

Direct Debit method is believed to have low penetration in Malaysia and the rest of Southeast Asia compared to Europe and other developed nations. The approach requires a larger workforce dedicated to just manage this admin task, something that Curlec believes not every SME can afford.

Also Read: Go-Jek nabs US$100M and joint venture with Indonesian conglomerate Astra

With its software, Curlec said it replaces the old error-prone method with a ccloud-basedsolution that improves the experience of consumers and removes the need for businesses’ to staff large finance divisions.

–

The post Online payment startup Curlec raises seed funding from Captii Ventures appeared first on e27.