Startups and corporates may have differing perceptions on valuation, due diligence, and timelines

This post is the second half of my previous post, Overcoming internal barriers.

When we start corporate venture capital we face many challenges. I believe these challenges sometimes are the same with independent venture capital, but there are specific challenges that corporate venture capitals encounter.

So in my next posts, I’d like to write about the specific internal and external barriers that our funds have been seeing for the last five years of operation.

What are the common external barriers?

1.Unsuccessful financial returns. I guess this can be said of independent venture capital. But one of the reasons why many corporates shut down their venture investing in their relatively early stage is that the performance of the CVC doesn’t turn out to be as they first expected. Some happen to mix venture deals with M&A deals, evaluating a startup in a very different context. By analysing some CVCs that have ceased venture investing in Japan, the two causes which I think lead to their unsuccessful financial returns are the following.

- Partial due diligence

Corporates have certain areas of expertise. When I say partial due diligence, I mean that they tend to execute thorough due diligence only on those areas and not evaluate a company as a whole. In the beginning, most CVCs are unfamiliar with venture investing. Therefore, they can’t judge things that they don’t know about and try to make some kind of decisions from the areas that they actually understand. - High valuation

Since corporates aren’t much familiar with the venture investing economy, they tend to pick up deals that other VCs passed on, usually deals that won’t bring attractive returns due to the high valuation. Especially in a place like Japan where the exit valuation is somewhat predictable, it is very important to control the entry price.

2.Struggle with corporate collaboration. For both synergy-focussed CVCs and return-focussed CVCs, giving back the venture investing experience in some kind of context to the corporate side, ranging from soft collaboration like sharing information to heavy collaboration like business alliance, is important. But CVCs can struggle working with the corporate side for the following reasons.

Also read: Corporate venture capital is more than just funding, a discussion at Echelon Asia Summit 2017

- Difference in perception

It is obvious that each company has its own strategies and that strategies change year by year or even quarter by quarter. It is easy for VCs to know startup’s strategies since VCs talk directly with the CEOs, but it is usually difficult for startups to know the corporate’s updated strategies and understand the corporate’s true aim of the business. Although corporates do share their high level objective when the discussion of the collaboration takes place, there is a slight difference in perception depending on their size of the business, making the collaboration have a bumpy ride. - Separate timelines

This was also one of the reasons for the internal barriers but it also causes external barriers. Startups don’t have time to wait so long so timing issue again brings some conflicts.

So how can we try to avoid or lessen these barriers?

1. Conduct due diligence outside of your expertise

The below grid shows some of the areas that our fund looks when we consider investments.

It is important to have the whole overview but in the past there were CVCs that analysed just the core technology or just the financial statements and ended up ceasing the venture investing. Out of the above, the area that our fund mostly focus on is the Business DD. In order to know a market that is not yet actualized or to see whether there are any true competitors, we rely on our network and ask professionals or other venture capitalists for their thoughts and insights. Through these processes, it is often the case that we notice whether the valuation is at the lower or higher end of the range.

If a corporate doesn’t have any talents who can execute the business DD, I highly recommend that the corporate either hire venture capitalists or pay advisors to help fill this sector. Btw, when hiring venture capitalists, it is crucial to understand the general compensation structure and set the bar at the market level or slightly higher.

2. Appoint decision makers from corporate side to be part of the CVC

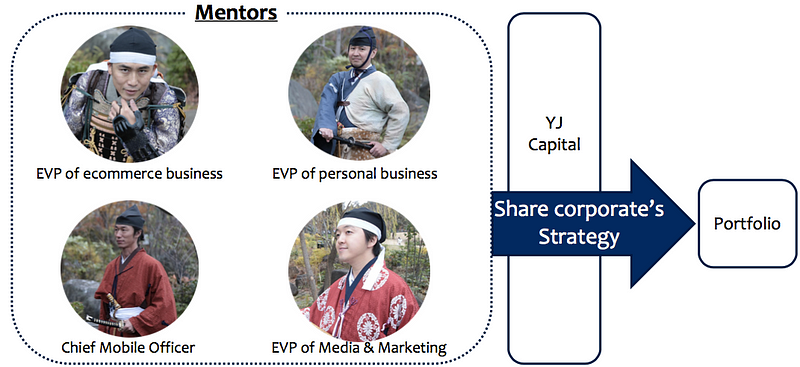

As difference in perception makes collaboration difficult, having top members from the corporate side close to the CVC will help the process move faster and more efficient because they can share the corporate’s overview with background information better than the business development members.

In YJ Capital’s case, we have 4 executive vice presidents of Yahoo Japan as mentors. Although they don’t actually participate in the daily operations, they share the current corporate strategies with startups, mostly our portfolios, on request basis so that both parties won’t waste time working on something that won’t work well. This structure is very useful to help both parties make quick decisions.

3. Expectation control

Not all collaboration works. From a CVC standpoint, you need to keep supporting your portfolios even if the collaboration with your corporate breaks up. You never know what happens so it is better not to make promises that you can’t keep but rather support portfolios be prepared for any unexpected turn overs.

In conclusion

So the key take aways for external barriers are:

—-

The views expressed here are of the author’s, and e27 may not necessarily subscribe to them. e27 invites members from Asia’s tech industry and startup community to share their honest opinions and expert knowledge with our readers. If you are interested in sharing your point of view, submit your post here.

Featured Image Copyright: kitten200 / 123RF Stock Photo

The post Overcoming external barriers in Corporate Venture Capital requires due diligence and expert mentorship appeared first on e27.