Corporate venture capital comes with challenges — some similar with independent VCs, but also some specific corporate VC

Last week I spoke at a CVC conference in Bangkok that was aimed to share YJ Capital’s experience as a CVC of Yahoo Japan to corporates who are intending to set up their own venture capital fund. My part was to talk about how CVCs can overcome internal and external barriers.

When we start corporate venture capitals we face many challenges. I believe these challenges sometimes are the same with independent venture capitals but there are specific challenges that corporate venture capitals encounter.

So in my next two posts, I’d like to write about the specific internal and external barriers that our funds have been seeing for last five years of operation.

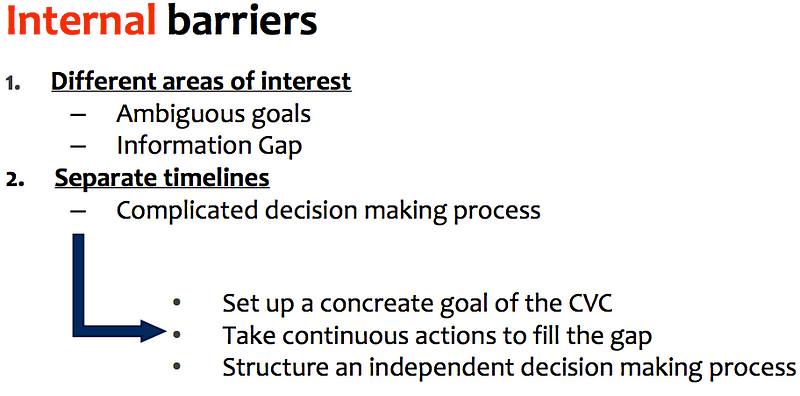

What are the common internal barriers?

1. Different areas of interest

There are many cases where the CVC side and the corporate side are looking at a very different direction and have different areas of interest. Why do corporate and CVC end up with different area of interest?

Ambiguous goals. When setting up the CVC, objective of the CVC is important. Is the CVC aiming to help the corporate build a new business or is it aimed to grow the current business? If it is the latter, to grow the current business, but the corporate side is not sharing the same objective, it is most likely that the corporate side will try to do things on themselves and not rely on outside resources which CVC are desperately looking for. So if the objective is not clear and not shared between the two parties, no matter how many times the CVC introduces startups to the corporate side, the deal will never reach a conclusion.

Information gap. CVC is surrounded by new and trendy information but corporate side is very much focused on their operational information. This environmental difference makes the two parties think differently and have different priorities. Furthermore, CVC usually lack the information of what the corporate side is doing so that also causes them to have different areas of interest that can eventually cause opinions to conflict greatly.

2. Separate timelines

I guess a lot of people can imagine but corporate usually have a long and complicated decision making process. On the other hand, CVC doesn’t have that many people to make decisions so the speed of working things out is way faster. This time lag usually becomes a problem when a CVC is considering venture investing with the corporate side. CVC’s timeline is aligned with startups’s timeline but since the corporate has many decision making processes, finding synergies and considering whether it will be reasonable to invest outside take so much time. Startups can’t afford to wait for corporates to finish making decisions especially when the round is over subscribed. Since this separate timelines can end up missing some investment opportunities, it is one of the common internal challenges.

So how can we try to avoid or lessen these barriers?

1. Set up a concrete goal of the CVC; Make the goal as simple as possible

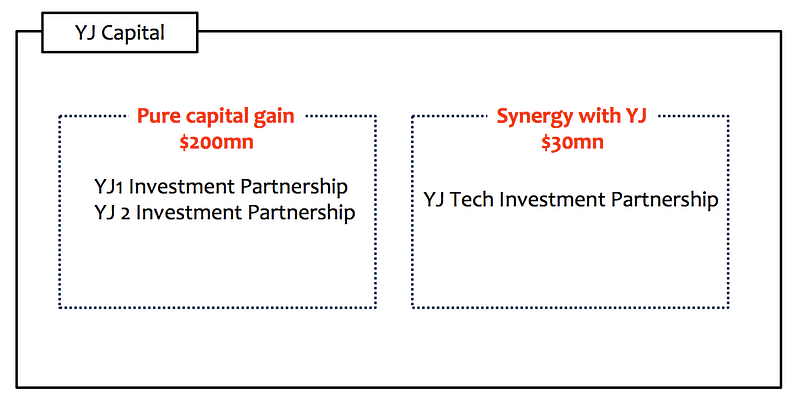

For our case, we are currently running 3 different funds within YJ Capital.

Structure of YJ Capital

Two funds aiming for pure capital gain and 1 fund aiming for synergies with Yahoo Japan. We don’t mix the 2 different goals in one fund because that makes the goal change depending on each deals, resulting in a confusing and time taking process.

Also read: Corporate venture capital is more than just funding, a discussion at Echelon Asia Summit 2017

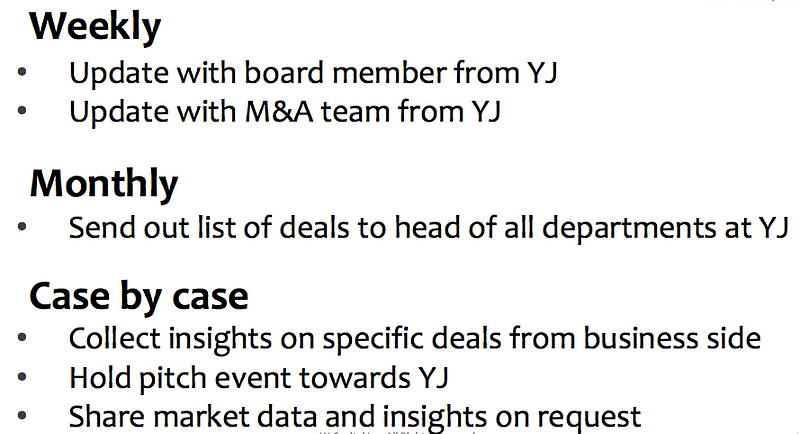

2. Take continuous actions to fill the gap between the CVC and the corporate side; Make efforts to communicate

It sounds simple and people think it is obvious but the hard part is that you have to continue doing this for years. There is no standard way but here’s how we are making efforts to fill the gap between Yahoo Japan.

We don’t want to have too many meetings with the corporate side so we try to have the overall updates from the board and M&A team on a weekly basis who know where the corporate itself is heading for. On a monthly basis we send our full list of deals to all departments so that teams who are considering collaborations with external companies like business development team can search whether there is any company that they may be interested in talking with. On a request basis, we have multiple ways of communicating. I believe this became possible since we were able to build personal relationships with each development through the regular routines mentioned above.

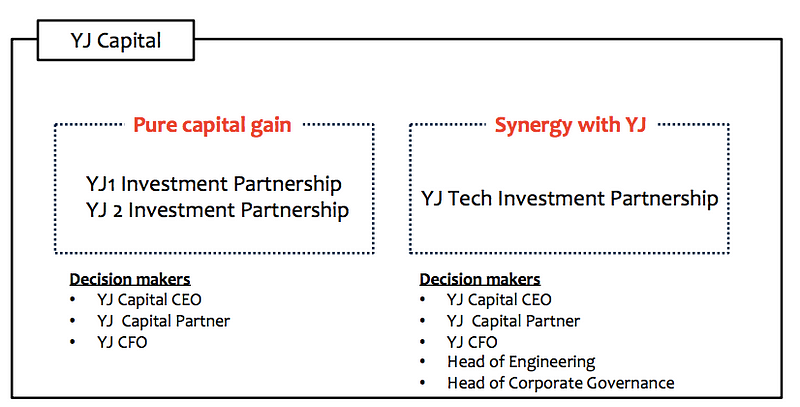

3. Structure an independent decision making process

This is somewhat related to the first one (setting up concrete goals). After you set a clear objective of the fund, you will also need to think about the process. For our case, we have different processes for each type of fund.

Decision makers of YJ Capital

For the funds aiming for pure capital gain, there aren’t any Yahoo Japan members except for the CFO as a decision maker. For most cases, we don’t request companies to seek collaborations with Yahoo Japan so we make decision just within YJ Capital. This makes our decisions faster (4–6 weeks) and allows us to control our own schedule. On the other hand, YJ Tech fund is looking for synergies so heads from several departments of Yahoo Japan participate in the investment committee. Furthermore, YJ Capital members are also working for either one of the two so we don’t need to think about how we should allocate our time to each fund. (Btw, I am dedicated to the pure capital aiming funds.)

In conclusion

So the key take aways for internal barriers are:

Overcoming external barriers will be coming up next week so stay tuned!

—-

This article was originally published on Medium.

The views expressed here are of the author’s, and e27 may not necessarily subscribe to them. e27 invites members from Asia’s tech industry and startup community to share their honest opinions and expert knowledge with our readers. If you are interested in sharing your point of view, submit your post here.

Featured Image Credits: Copyright: lightwise / 123RF Stock Photo

The post Overcoming internal barriers in Corporate Venture Capital involves gaps in information and decision-making appeared first on e27.