Revolut is introducing a new product specifically targeted toward kids aged 7-17 years old — Revolut Junior. Revolut Junior is a new app and service that integrates directly with the main Revolut app on the parent’s side.

Parents or legal gardians who are also Revolut users can create a Revolut Junior account for their kid. After that, your kid can download the Revolut Junior app and get a Revolut Junior card.

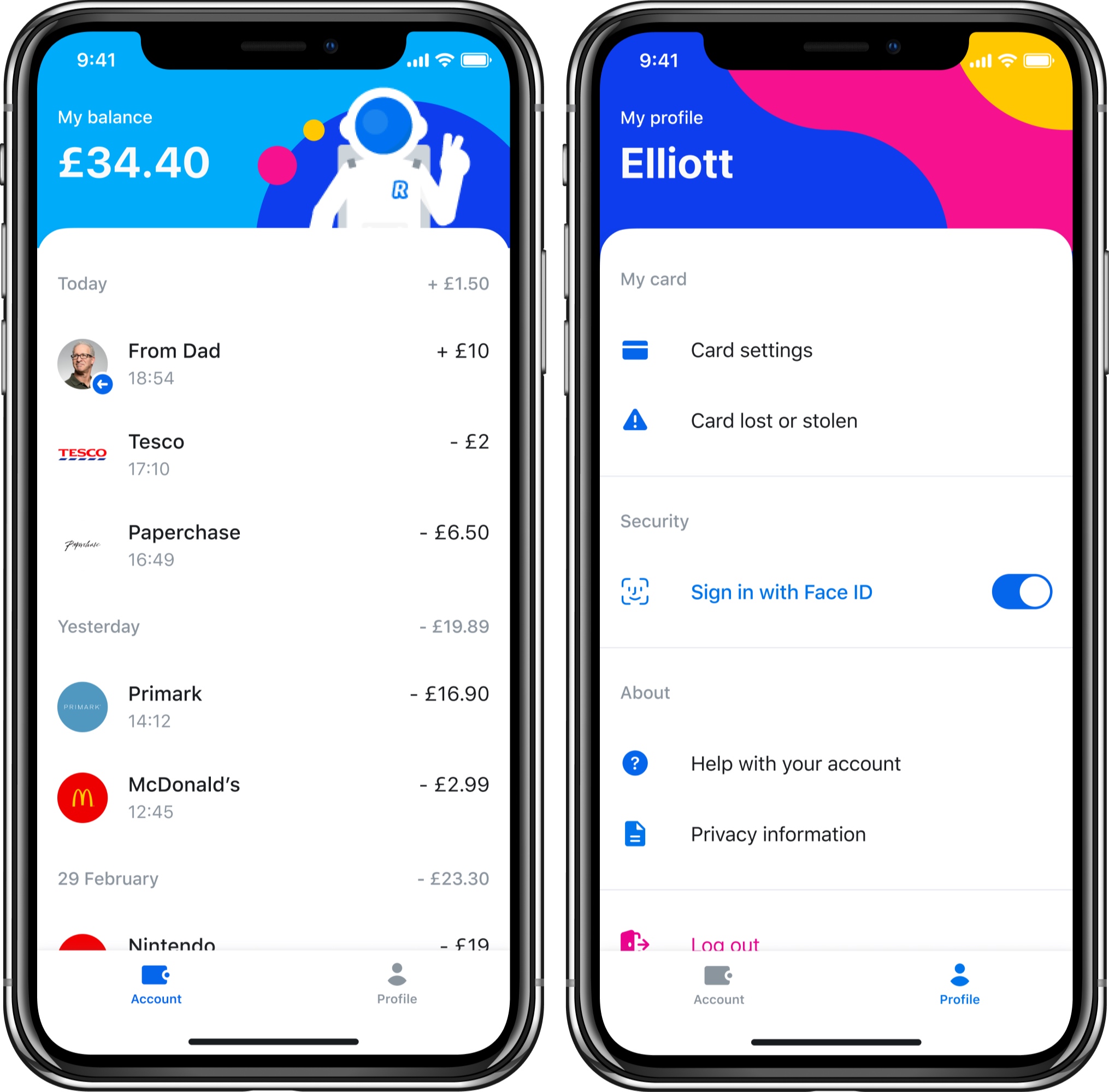

The new app offers a limited set of features with an interface divided in two tabs — Account and Profile. Kids can see a list of transactions in real time in the Account tab. They can configure card settings in the Profile tab. And that’s about it.

On the other end, parents can control their kids’ spending from Revolut. They can transfer money to a Revolut Junior account instantly. Parents can also access balances and transactions as well as disable some card features, such as online payments. They can also choose to receive notifications when a child is using their card.

The reason why Revolut Junior can attract a ton of users is that Revolut itself already has over 10 million users. It’s going to be easier to convince existing Revolut customers to use Revolut Junior over a custom-made challenger bank for teens, such as Kard or Step. Arguably, the biggest competitor of challenger banks for teens is still cash.

As kids grow up, chances are they’ll switch to a full-fledged Revolut account if they’ve been using Revolut Junior for years. Revolut Junior represents a great acquisition funnel as well.

Revolut Junior is only available to Premium and Metal customers in the U.K. for now. The company will eventually roll it out to more users and more countries.

Revolut plans to add more features to Revolut Junior in the future. For instance, parents will be able to set a regular allowance and financial goals. Kids will get savings options, spending reports, spending limits and more.