It received an in-principle approval for its Capital Market Services License for Retail Fund Management from the Monetary Authority of Singapore

Singapore-based fintech startup StashAway has received in-principle approval for its Capital Market Services License for Retail Fund Management from the Monetary Authority of Singapore (MAS).

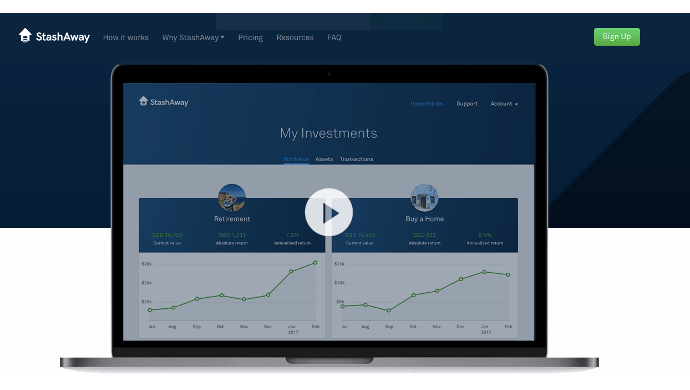

With the approval, StashAway will be able to launch its digital wealth management platform in the coming months. Investors will be able to build personalised, highly advanced portfolios online, with the help of robo-advisors.

In a nutshell, robo-advisors automate financial planning through algorithms. Clients give them personal information such as salary and risk appetite in order to receive highly tailored investment strategies.

StashAway’s platform is available to all investors regardless of net worth (as long as they are at least 18 years old). There is no minimum balance required and they are allowed to withdraw at any time. StashAway says its management fees range from 0.2 per cent to 0.8 per cent.

“Since moving to Singapore a few years ago, I found that the financial industry has been focused on selling over-priced investment products that could not meet my personal financial needs. Being disappointed in these services that could not grow my personal wealth the way I knew was possible, I decided to found StashAway,” said Michele Ferrario, Co-Founder and CEO, in an official press release.

Also Read: 6 ways for Robo-advisors to gain people’s trust and convince them to invest

To create a personalised portfolio, StashAway’s clients can specify their salary, monthly savings capacity, risk preferences, and time horizon to financial goal. The system will then design an intelligent portfolio of exchange-traded funds (ETFs) and a monthly investment strategy.

The technology also automatically manages the portfolio by rebalancing and re-optimising as market and economic conditions demand.

StashAway says a stress-tested “highly-advanced economic regime-based investment strategy” drives the design of its robo-advisors. This is critical as they would need to navigate the ups and downs of economic cycles.

StashAway operates under the legal entity, Asia Wealth Platform. The development team is in its final stages of preparing both the user-interface and trading platform, and expects to be able to launch in the coming months.

—

Want to be part of the ecosystem?

Register for your Echelon Asia Summit access pass now! Enjoy +10% off Echelon Asia Summit Startup, Investor and Corporate passes just for being our favourite e27 reader:

The post Robo-advisor startup StashAway gets in-principle approval from MAS to manage investment portfolios appeared first on e27.