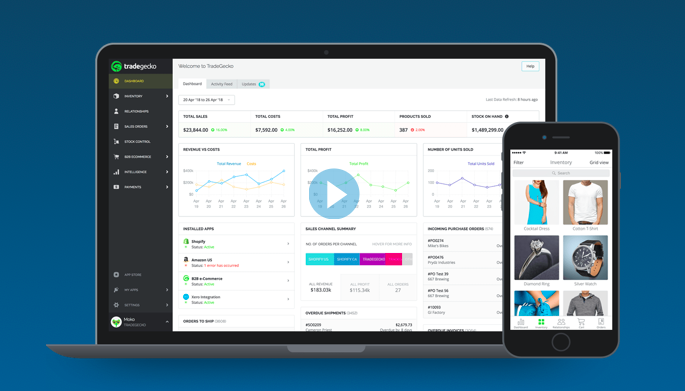

It offers a platform for SMBs to automate and reduce workflow inefficiencies, through integrating front-end e-commerce and POS software with back-end accounting and shipping software

TradeGecko, a global SaaS inventory and order management platform for small and medium businesses (SMBs), announced today it has closed a Series B investment of US$10 million, led by TNB Aura Fund 1 and Aura Venture Fund, with Perle Ventures, and 33 Capital participating in the round.

This takes the company’s total capital raised to date to over US$20 million.

The proceeds of the latest round will be used to grow TradeGecko’s product suite, scale the business, as well as for expansion.

“We see a massive opportunity to provide the back-end systems of SMB commerce on a global scale,” said Cameron Priest, CEO of TradeGecko. “With the rapid growth of SMBs around the world, partnering with Aura enables us to leverage their market knowledge and extensive network. With the latest funding, we will continue to invest in solving our customers most challenging operational challenges.”

Founded in 2012, TradeGecko offers a platform to automate and reduce workflow inefficiencies, through integrating front-end e-commerce and POS software with back-end accounting and shipping software. It allows SMBs to manage their inventory efficiently, process orders quickly and change the pricing of their products dynamically.

Headquartered in Singapore and Toronto, the company serves leading SMB commerce brands, including memobottle, Dead Studios, Brooklyn Bicycle Company, Maui and Sons, and Paula’s Choice Skincare.

In 2015, TradeGecko raised US$6.5 million in Series A financing led by NSI Ventures and Jungle Ventures.

“The investment into TradeGecko is a great deal for our fund,” commented Calvin Ng, Managing Director of Aura Group. “We are confident in the long-term prospects of the company and the team’s ability to continue executing strong and consistent growth of their revenues and unit economics.”

TNB Aura Fund 1 serves as TNB Ventures’s and the Aura Group’s inaugural Southeast Asia Venture Capital investment vehicle focused on data-driven B2B enterprises. The fund’s mandate will span investments into embedded devices, software & deep learning, and visualisation technologies. It invests between S$500,000 and S$3 million into early-stage seed-to-Series A/B startups in Southeast Asia.

Aura Venture Fund is an early-stage VC limited partnership (ESVCLP) dedicated to investing in growth and expansion stage (Series A/B) businesses. The fund’s broad mandate enables it to back a variety of technological innovations that help to reshape the way the world lives, learns and works.

Perle Ventures is a Sydney-based venture capital group that invests in growth-stage technology companies.

33 Capital is a principal investments firm with partner offices in Singapore, Hong Kong, Indonesia and Cambodia. Since 2015, it has invested in eight startups with three exits within the consumer-technology and financial-technology space.

The post SaaS inventory management platform TradeGecko raises US$10M from TNB Aura, others appeared first on e27.