A successful acquisition can be a once-in-a-lifetime opportunity, so it pays to be prepared

2016 was a great year for tech M&A (mergers & acquisitions) – the global deal volume has reached new peaks. The European and US tech ecosystem were marked by transformational mergers and acquisitions, reflecting the maturity of these markets in global technology terms. Tech is eating the world. In 2016, technology companies held each of the top five spots of the world’s most valuable companies. In addition to organic growth, these companies also grew via strategic investments and acquisitions of startups.

Tech is not only eating but also radically changing the traditional business world. Non-tech companies made more than US$125 billion worth of acquisitions in 2016, compared to US$20 million in 2011. Startups are benefitting from this global trend. The acquisition appetite from tech and non-tech buyers is growing constantly as the advantage of spending money for disruptive technologies outweighs the risk of being disrupted by this technology.

As the Southeast Asian tech ecosystem is maturing continuously and the Series A/B/C rounds grew to multi-million dollar amounts, we will also see more mergers & acquisitions in 2017 and the upcoming years. Buyers from China, US, Europe and Southeast Asia are looking for promising technologies and strategic investments. Golden Gate Ventures expects 250 M&A transactions per year in 2020 – a 500per cent increase from 2015.

Also Read: Managing the many moving parts during acquisitions and exits

But what does it mean for a startup and its founders to sell the company? Stories about 100 million dollar acquisitions, deals closed in the airport-lounge and signed contracts belong to myths spread across entrepreneurs. But M&A is not magic. It is a result of great preparation and in most cases a well executed process on the buyer and seller side.

Selling a business is not easy, and it needs a lot of effort. In most cases, it is more complex that raising funds for your company, although the steps are very similar. It is a one-time chance and should be prepared and executed at its best! A process which lasts between four to nine months requires a highly concentrated and well steered collaboration between sellers, buyers, advisors, former investors, and other parties. During this time and even before, the sellers/founders have to focus on both – the operational business and the sale process – and this requires extra effort by founders and often key employees.

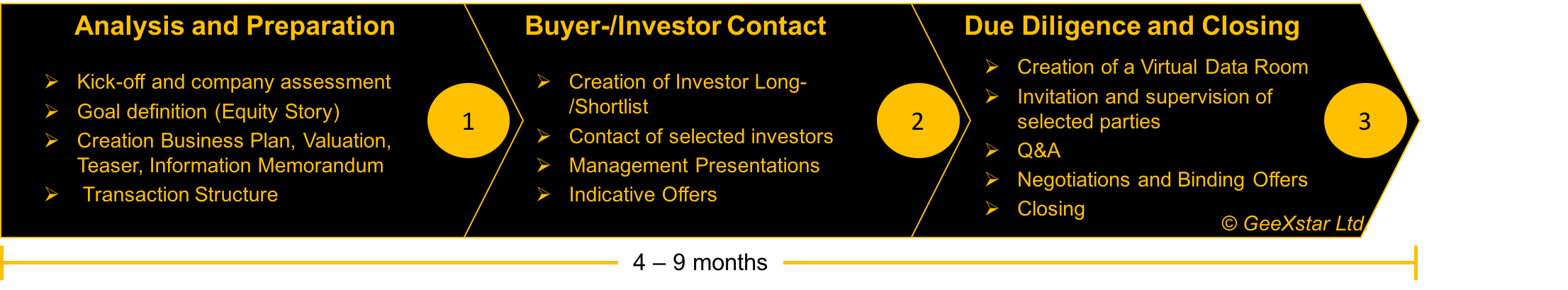

Let’s have a look how a sell-process is structured and how M&A investment bankers can help to streamline the process, relieve the management from additional work and close the deal successfully. While reading the following process description keep in mind that there are lots of variations on this process but this is a fairly typical example.

Image 1: Example Sell-side M&A process

Great preparation is the key to success

The analysis and preparation phase is time consuming and has the aim to prepare the company for the sale. An in-depth analysis and detailed preparation increases the probability of a positive reaction from potential buyers. This is very similar work to a Due Diligence, which we will describe later.

The investment bankers start with the history and analyse the company’s development, vision, products and services, market and competition, team and management, financials, marketing, KPI’s, and technology aspects. A good advisor also helps you to adjust and reposition aspects which could pop up and threaten the sale or bring up arguments for price reductions, before the buyer approach starts.

Also Read: How to pull-off that magic phrase: M&A

Following the first analysis, the sellers and advisors define a strategy plan, i.e. determine the goals of the transaction, such as deal structure (share deal vs. asset deal), process type (auction process vs. negotiated sale), price expectations, preferred buyer field. But selling a company is different from case to case. If you are not the next Google, a great “equity story” gains in importance, increasing your attractiveness for potential buyers. There are different strategies which make an equity story successful, the positioning can vary, depending on the buyer.

But how do you show what you have to offer? Well, bankers call it Teaser and Information Memorandum (IM). The Teaser is the appetiser. It is used to generate a first interest: It includes basic information about your business, the planned transaction, market and competition, as well as other information.

Buyer approach

The bankers compile a long-list with a potential buyer field and after you agree on buyers you would like to approach, the short-listed buyers will be approached. As selling a business is a very sensitive task and in case of an unsuccessful process it is very likely that you will still remain active in this market, it is very crucial not to spread the information across the market, especially not to your customers, competitors or employees. Why? Rumours circulate very fast.

It is very obvious that, for example, employees who hear about the sell process start getting scared about their jobs. It is not always a positive sign when a company is being sold, so either you inform your employees early in a proper way or keep it confidential. Same for competitors and clients. In many cases it makes sense to approach selected parties, or do a step-by-step approach, starting with the most desired buyer.

The buyer approach should be done indirectly, as far as you do not know your buyer very well. The one time opportunity is too important to approach buyers without a profound knowledge. Furthermore the advisors’ intermediate role positions him as the “good guy” or “bad guy”. As described above, the process can take up to nine months, and during this period divergent views are expressed. After a successful exit, the sellers remain within the company, at least for a certain period – and it makes much more fun to work with somebody whom you like and vice versa. The advisor leaves after the sale, being a bad or good guy.

After generating a first interest, and signing a non-disclosure agreement (NDA), the IM is distributed to selected parties. The IM includes more information about your business. Depending on the size and complexity of your business, it can contain between 30 and 150 pages of information.

Also Read: Preparing for a merger or acquisition? Here is what you can not afford to ignore

Remember that each process is tailor-made, but following the IM the next logical step is to answer related questions and clarify open issues, so that the buyer will be able to submit an indicative offer based on the information he has received and first discussions with the management.

In some cases, a roadshow with management presentations can make sense, i.e. on-site presentations by the management for the buyers. Selected bidders are invited to participate in further due diligence after the investment banker and seller have reviewed the bids and decide which party will be invited into the VDR (virtual data room).

Due diligence and negotiations

In today’s world, it is not required to be present in a physical data room – especially not when we are talking about tech companies. A virtual data room, which can be set up in dropbox or more sophisticated environment such as Merrill Data site, is accessible 24 hours a day, 7 days a week. The banker and seller can continuously track the activity, limit the access to sensitive documents, manage the rights of several viewers, even restrict the documents to being printed. Specialised providers offer really great tools, but this comes at a price. If you want to go basic, a dropbox data room is easy to setup, although we would not recommend it as you often can draw analytical conclusions how interested the bidder really is and protect your sensitive data.

A data room’s intention is to make your business as transparent as possible to the buyers. Past, present and future prospects are made available to the data room invitees. Financial reports, contracts, agreements, insurance policies, legal documents, strategic papers, technology descriptions, KPI’s, are just some parts of the VDR which we mention here exemplarily.

Different levels of access and a smart management allows to held sensitive data back until final stages of negotiations. Remember, at this stage buyers can still stop the process and gain data which could harm your business. There are certain protection mechanisms, such as break-up fees, but still, paying a relative reasonable fee vs. gaining competitors’ information can be more lucrative in the long-term. Smart advisors will manage the data room and provide the right information at the right time to the parties.

Also Read: Pro bono: Practical legal advice about startup fundraising from lawyer Yingyu Wang

Following the viewing period, the bidders will come up with questions. In many cases, specialised advisors will join the buyer, e.g. tax advisors, market specialists, product experts, lawyers, HR specialists, and each of them will come up with questions. That’s what they are paid for, and therefore easily 500+ questions can be submitted before the buyer will be ready to submit a binding offer. This is a lot of work, considering that you have to run your daily operations while managing the sell process.

After a positive DD outcome, management meetings and clarifying all questions, the buyer should submit his binding offer, also called Share Purchase Agreement (SPA). It’s almost done. After reviewing the bids and agreeing about the conditions, the contracts can be signed and withe the transfer of the money to your account the deal can be closed. The last steps are also very crucial ones. All deal members had spent many months of hard work and each party will try to optmize the SPA to his best, the risk for a deal braker is still very high: Founders who had a dream that it does not make sense to sell the company, the night before the signing, or buyers who decided to acquire a competitor are not just myths.

Conclusion

The secret of a successful exit or fundraising process is a great preparation and of course a great company. Creating and communicating a great investment case, an understandable and plausible business plan, smart negotiations and realistic price expectations increase the probability to successfully find a buyer for your startup.

Selling your company is the culmination of many years of hard work, sacrifice, sweat and is one transformative moment in the founders’ lives. Without being guided throughout the process, the risk of making costly mistakes and missing the one time opportunity is very high. Buyers are mostly skilled at acquisitions and work with deal devoted teams. If you do not have any M&A experience in your team, you should definitely think about external support.

—-

The views expressed here are of the author’s, and e27 may not necessarily subscribe to them. e27 invites members from Asia’s tech industry and startup community to share their honest opinions and expert knowledge with our readers. If you are interested in sharing your point of view, submit your post here.

Featured Image Copyright: rawpixel / 123RF Stock Photo

The post Selling your startup: Architecting a successful acquisition appeared first on e27.