SmartCoin aggregates thousands of data points on a customer’s smartphone, including financial transactions, device usage and app behaviour to build a customised credit score

(L to R) Jayant Upadhyay, Rohit Garg, Vinay Kumar SIngh and Amit Chandel

Bangalore-based fintech startup SmartCoin Financials, which provides a data-driven micro lending app under the same brand, has secured an undisclosed sum in investment led by Mumbai-based Unicorn India Ventures. A clutch of other unnamed angel investors have also joined this round of financing, which will be used for scaling operations.

SmartCoin was started in 2016 by IIT/IIM alumni Rohit Garg, Amit Chandel, Vinay Kumar Singh and Jayant Upadhyay. It is a mobile app-based lending platform focused on the vast underserved middle/lower-income segments in India. The app is capable of assessing the risk profile of a prospective borrower in real time, using data science and machine learning algorithms.

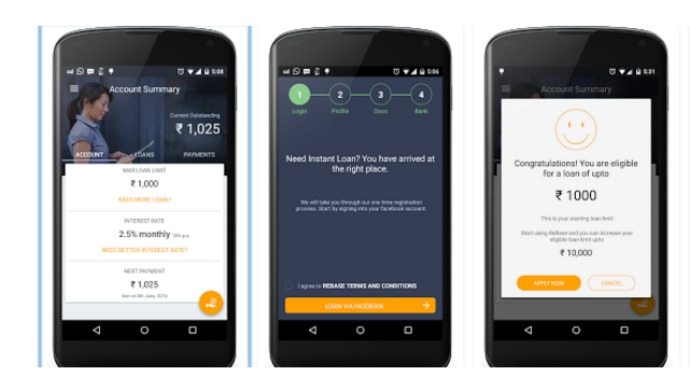

Its proprietary credit underwriting engine aggregates thousands of data points on a customer’s smartphone, including financial transactions, device usage and app behaviour to build a customised credit score. A customer is instantly offered personalised loan products on the basis of his risk and capacity, and the money is transferred digitally to the bank account.

Also read: IndiaLends that aims to provide quick access to cheaper loan products raises US$4M Series A

All that a customer needs is a bank account, Aadhaar card (India’s unique identity number) and social media presence. The entire process, from app download to loan approval, takes less than five minutes, claims the startup.

Since its launch at the end of 2016, SmartCoin claims to disbursed more than 3,000 loans and is growing over 50 per cent month on month. It plans to disburse 50,000 loans by the end of next financial year. The company is partnering with leading non-banking financial corporations (NBFCs) and microfinance companies, which are looking to leverage their technology to expand customer base.

Rohit Garg, Co-founder and CEO, SmartCoin, said: “Traditional underwriting methods are largely reliant on credit histories, and thus unable to serve people with limited credit data. As a result, there is a huge underserved segment spanning not just the corporate workforce, but also the emerging aspirational class working in semi-white collar and blue-collar jobs. We believe credit should be accessible to everyone, and the process should be as simple as online shopping or cab booking.”

“Long-term partnerships with NBFCs are beneficial to everyone in the ecosystem. These borrowers, traditionally underserved by the financial institutions owing to thin-file or no-file data, are generating a lot of digital data as a result of deepening smartphone penetration. Our data-driven technology can score them more accurately reducing the risk of underwriting and opening newer growth avenues for NBFCs,” he added.

“The idea behind SmartCoin is new age. The technology has been designed keeping the end customer at the heart of it, thus ensuring convenience in filling in their information and offering them a loan product suited to their needs. The concept of app based micro lending has proven successful in several other emerging markets and we see a huge potential in such a business model for India,” says Archana Priyadarshini, Venture Partner at Unicorn India Ventures. She will also be joining the board of SmartCoin and will be working closely with the team to scale up their business.

“The idea behind SmartCoin is new age. The technology has been designed keeping the end customer at the heart of it, thus ensuring convenience in filling in their information and offering them a loan product suited to their needs. The concept of app based micro lending has proven successful in several other emerging markets and we see a huge potential in such a business model for India,” says Archana Priyadarshini, Venture Partner at Unicorn India Ventures. She will also be joining the board of SmartCoin and will be working closely with the team to scale up their business.

Last December, IndiaLends.com, a credit underwriting and analytics startup for unsecured lending, raised US$4 million in Series A funding from American Express Ventures, with participation from existing investors DSG Consumer Partners, Chinese investment firm Cyber Carrier VC and AdvantEdge Partners.

—

Register for your Echelon Asia Summit access pass now! Enjoy additional 10% discount on Echelon Asia Summit Startup, Investor and Corporate passes just for being our favourite e27 reader: e27.co/echelon/asia/register/?code=EMPOWER10

The post SmartCoin is capable of assessing risk profile of a prospective borrower in real time, gets funding appeared first on e27.