soCash is also planning to raise a Pre-Series A round in the next six months

Singapore-based fintech startup soCash has received a government grant of undisclosed sum from Singapore’s central bank, Monetary Authority of Singapore (MAS).

The Financial Sector Technology & Innovation (FSTI) Scheme – Proof Of Concepts (POC) grant aims to help Singapore-based financial institutions or technology providers work on the early stage development of their products.

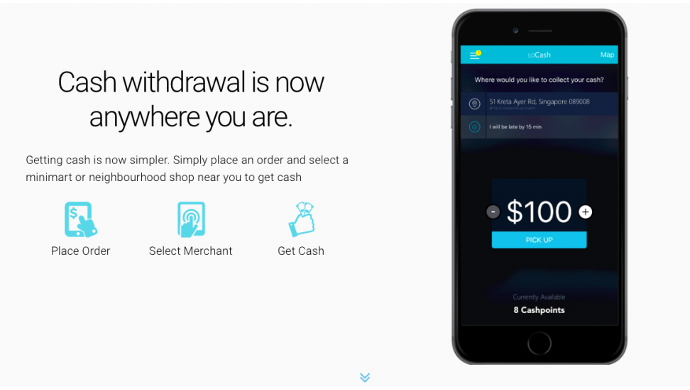

Founded by co-founder and CEO Hari Sivan, soCash’s unique value proposition is that it turns offline retail outlets into cash withdrawal points — and without the need for the customer to spend money first (unlike supermarket stores in Australia).

“Our business model avoids the need to buy anything before getting your cash, which most supermarkets force you to do. And in soCash, the transaction happens on bank’s mobile app, so it is safer than using the card & pin,” Sivan tells e27.

This also reduces the need to establish expensive ATM networks, which sometimes charge exorbitant fees for cash withdrawals.

“When the next billion people in Asia Pacific start their consumption journey, it will be cash driven. Banks are finding it very expensive to expand their ATMs. There is no way the current cash logistics will be able to cope up with that demand,” he adds.

Also Read: As India moves to demonetise large bills, is the country shifting toward a cashless economy?

For merchants, soCash allows them to streamline the management of their daily cash flows.

Most shops prefer payments in cash over cards because there are no added fees or charges (merchant discount rate), so at the end of the day, shops that accumulate a lot of cash transactions would have to physically deposit them into banks.

By allowing soCash to move this volume of cash via customers’ cash withdrawals, merchants can automatically debit or credit the day’s earnings into their bank.

So in a nutshell, the customer gets cash without going to an ATM, and the merchant gets money credited into their account without going to the bank.

“Banks pay us because we are significantly cheaper than an ATM transaction and we bring liquidity back into their balance sheet. Cash sitting in ATMs is treated as capital outside their balance sheet,” says Sivan.

soCash has plans to turn museums into cashpoints. It also aims to raise a Pre-Series A round in the next six months.

In July this year, soCash raised US$296,000 in seed funding from a group of undisclosed angel investors.

—

Image Credit: soCash

The post Startup that lets customers withdraw cash at stores gets grant from Singapore’s central bank appeared first on e27.