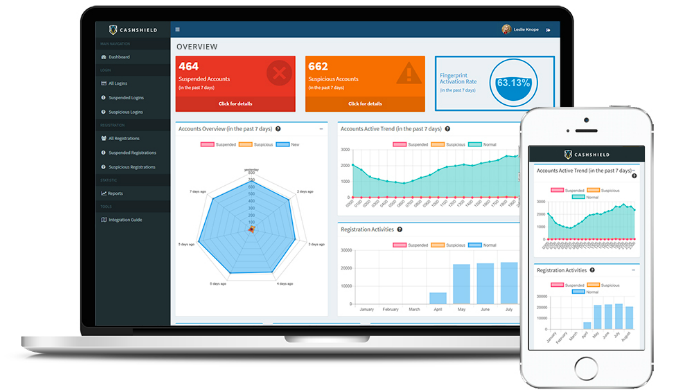

Combining AI and high-frequency trading techniques, CashShield secures transactions and consumer accounts from cybercriminals without the need for human intervention

Singapore-based online fraud management solutions company CashShield has raised US$20 million in Series B funding, led by Temasek and GGV Capital.

Tony Fadell, an early investor and Principal at Future Shape; Wavemaker Partners; and Tao Zhang also joined the round, which brings CashShield’s total financing to date to US$25.5 million.

The funding will be used to strengthen CashShield’s technology with an aim to provide comprehensive fraud screening abilities for businesses, financial institutions and government organisations.

Combining Artificial Intelligence (AI) and high-frequency trading techniques, CashShield secures transactions and consumer accounts from cybercriminals, without the need for human intervention.

With the rise of hacking and data breaches, the value of online accounts have skyrocketed, and can be sold on the dark web for 60 times more than a credit card number. The firm’s technology protects consumers’ data in a way that it can’t be used once stolen.

Also Read: Young but growing, Cambodia startup ecosystem is ready to step up

CshShield has clients in e-commerce, digital goods, telecommunications and online travel across more than 190 countries. The firm has global operations in the US, Europe, China and Southeast Asia.

“The ability to use first-rate technology to solve fraud woes creatively has unlocked tremendous value for enterprises, allowing CashShield to be profitable since the beginning,” said Justin Lie, CEO and Founder of CashShield.

Last September, CashShield raised US$5.5 million in a Series A round led by GGV Capital.

“CashShield secures more than US$5 billion worth of transactions per year and over 10 million user accounts. It has an army of AI sentries guarding businesses and protecting their customer information. There’s nothing else like it on the market,” said Fadell, an early investor and Principal at Future Shape.

GGV Capital is a VC firm founded in 2000 with the idea to have one team investing in both the US and China. With US$3.8 billion under management across eight funds, the GGV portfolio includes Airbnb, Alibaba, AlienVault, BitSight, Ctrip, Didi Chuxing, Domo, Grab, HashiCorp, Houzz, Nimble Storage, Opendoor, Pactera, Pandora Media, Peloton, Percolate, Slack, Square, Synack, Wish, Youku Tudou, YY, Zendesk, and 51credit.

The post Temasek, Alibaba backer join AI-powered fraud management firm CashShield’s US$20M Series B round appeared first on e27.