The mobile commerce landscape in South East Asia has been growing, and how. From a desirable add-on, mobile commerce has now become the key to success in these economies. It’s not hard to figure out why.

As of July 2019, a whopping 416 million people in South East Asia had access to the internet and internet penetration now stands at 63 per cent. This number continues to grow quickly as well the number of internet users has increased by 10 per cent in just the last year. Just as interestingly, mobile subscriptions are at a whopping 853 million, which means there are 1.29 mobile subscriptions for every person living in the region.

So far, most of the commentary around e-commerce and mobile commerce has been focused on the rapid pace of mobile penetration and mobile commerce. Eg: from July 2018 to June 2019, the number of people who made online purchases grew by a whopping 17 per cent. Then there are the mobile commerce numbers themselves — three countries in South East Asia (Indonesia, Thailand, and the Philippines) are in the top five countries in the world when it comes to the number of mobile commerce users. In Indonesia, for instance, almost 80 per cent of internet users aged 16-64 reported buying something via a mobile device in the last month.

Changing times

But the mobile commerce story of South East Asia is changing. It’s no longer about getting more and more people to download your app by offering huge discounts and offers. As the market matures, consumers are choosier and they are no longer enticed by just discounts. Brands are being forced to shift their focus toward customer experience, engagement, and loyalty. The new growth metrics these days are Monthly Active Users (MAU), retention rates, repeat transactions and CLTV (Customer Lifetime Value).

At MoEngage, we’ve witnessed this shift first-hand. Brands such as Tokopedia, Bukalapak, Traveloka and more send billions of push notifications, SMS, emails and other communications through MoEngage to millions of their end-users. So, we looked into data from our platform to understand how the focus has shifted towards retention, engagement, and loyalty.

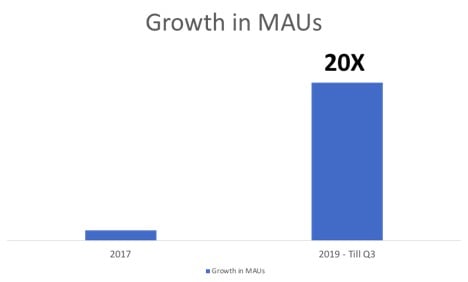

Monthly Active Users (MAUs) is the number of users who opened/ revisited the app in the last 30 days. This metric helps us filter out users who are not using the app actively and is one of the key indicators of higher engagement and retention. In just the last 2 years, we have seen a 20X increase in Monthly Active Users (MAU) highlighting how e-commerce brands are successful in getting more and more people to use their app every month.

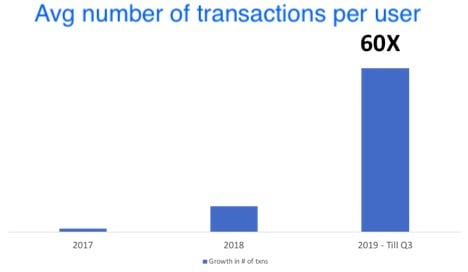

As an e-commerce company, it’s obviously not enough to get people to use your app. App usage also needs to translate into transactions. Between 2017 and 2019, the average number of transactions per user has jumped 60x. Thus validating that e-commerce companies are focusing more on customer retention to drive repeat purchases.

What’s also clear is that these numbers aren’t accidental — they are the results of a well planned strategic shift towards building customer retention and loyalty. One of the key drivers of a good retention strategy is a well-designed cross-channel communication plan across email, push notifications, SMS, in-app messages, website pop-ups and more.

In summary, it’s an extremely exciting time for mobile commerce in South East Asia. On the one hand, in certain countries in South East Asia, digital penetration is rapidly improving and a whole first generation of mobile users are coming into the market. At the same time, in several other countries, mobile commerce customers are maturing, forcing brands to have a sharper focus on retaining customers and delivering long-term value. The combination of both these factors operating simultaneously makes South East Asia one of the economies to really look out for.

—

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Join our e27 Telegram group, or follow our e27 Facebook page

Image credit: Pixabay

The post The changing focus of mobile commerce in Southeast Asia appeared first on e27.