Huawei, Xiaomi, Vivo, and Oppo are not the most popular Chinese smartphone brands in the continent

The article The Chinese smartphone maker you’ve never heard of is dominating the African market by Elliot Zaagman originally appeared on TechNode, the leading English authority on technology in China.

When thinking of Chinese phone brands, what names come to mind? If you’re like most people I speak to, you’re probably thinking about Huawei, Xiaomi, or possibly Vivo or Oppo. But what about TECNO?

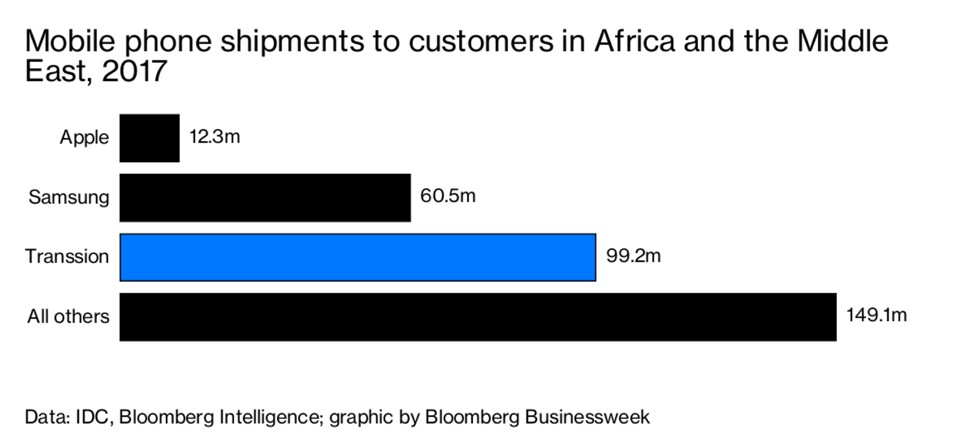

Even in China, where the phone maker’s parent company, TRANSSION Holdings, is based, TECNO is hardly a household name. It has never even cracked the top ten in China’s smartphone market, and has not focused heavily on developed markets. However, if you live in Africa, the brand is just about unavoidable. In fact, TECNO, its sister brand itel and other TRANSSION devices make up nearly half phones that are sold on the continent, according to company representatives.

TRANSSION is just one of many Chinese technology firms who have made inroads into Africa in recent years, and with the increasing focus that China is devoting to the region, the firms there now may simply be the first wave of Chinese tech pioneers on a continent that may be poised for same kind of dynamic economic growth that China itself experienced in the 1990’s and 2000’s.

Founded in 2006, the themes of TRANSSION’s origin story are similar to those of many hardware firms in their hometown of Shenzhen who have gone on to have global success. Rather than attempting to fight their way into the overcrowded consumer markets of the developed world, they saw opportunity in the less-glamourous markets of the “global south.” By 2010, TECNO ranked among the top three brands in the African mobile phone market. In September 2011, they opened a manufacturing facility in Ethiopia. They have remained a dominant force in Africa’s mobile phone market since.

Also Read: Russia is now the new frontier for Chinese smartphone makers

Getting there first and localising

When speaking with those in and around the company about their recipe for success in Africa, the terms “hard-working” and “street smart” were frequently mentioned.

“First, I’d say we got into the market at the right time,” explained one TRANSSION employee who has worked for the company in three different African countries. “We also focussed on building up brand equity in these markets over the long-term, not just make money quickly. And finally, we localise to meet the needs of our African users.”

It is worth noting that TRANSSION’s localisation contrasts with the commonly-held stereotype of Chinese companies in Africa. In a November 2017 an op-ed in Chinese newspaper The Global Times by Huang Hongxiang and Huang Ye of the Nairobi-based firm China House wrote a scathing critique of how their home country’s firms often fail to adequately build goodwill with local populations on the ground in Africa.

“The Chinese always say China-Africa is win-win cooperation and we are brothers. I don’t know whether it is win-win, and who are the ‘brothers’ they talk about, maybe our government officials?” asked one African reporter who was interviewed for the piece.

This failure to engage and benefit the general public, whether real or perceived, can undermine the message of shared development that China and its companies are attempting to send in Africa.

“Joint Ventures and localisation were crucial for China’s growth. That’s the model African countries are looking to get from Chinese companies too – where they can get maximum knowledge transfer, local jobs, and tax from the foreign investment,” illustrated Hannah Ryder, CEO of Development Reimagined, a Beijing-based consultancy focused on China-Africa development issues.

It is the fact that their approach contrasts so dramatically with the stereotype of Chinese firms in Africa that makes TRANSSION’s success in Africa so remarkable. Their approach to localisation has been quite holistic.

“In our case, acting locally entails creating products that are fully localised and based on in-depth market insights;” explained Group VP Arif Chowdhury in an email for this piece, “It also means actively building strong relationships with local distribution partners, with whom we then build and grow brands together; it also means hiring a great number of local employees to drive local employment. In other words, we get fully involved in local mobile business as well as economic and community development. In addition, we are also running numerous CSR programmes, which contribute to our good reputation as a responsible business actor in the communities we operate in.”

One strategy they used was to build strong long-term relationships with local vendors who could offer a greater depth of understanding regarding the local cultures and market demands.

Also Read: Enjoy being slow: Why Chinese tech companies are embracing a slower culture

“We are also sharing experiences with partners such as local suppliers, to drive more development,” said Chowdhury. “In our early days, TRANSSION worked closely with Mwale, a Nairobi local advertiser. As TRANSSION took off, so did Mwale’s advertising business, quickly becoming one of Kenya’s top 10 advertising companies and later expanding to other African countries.”

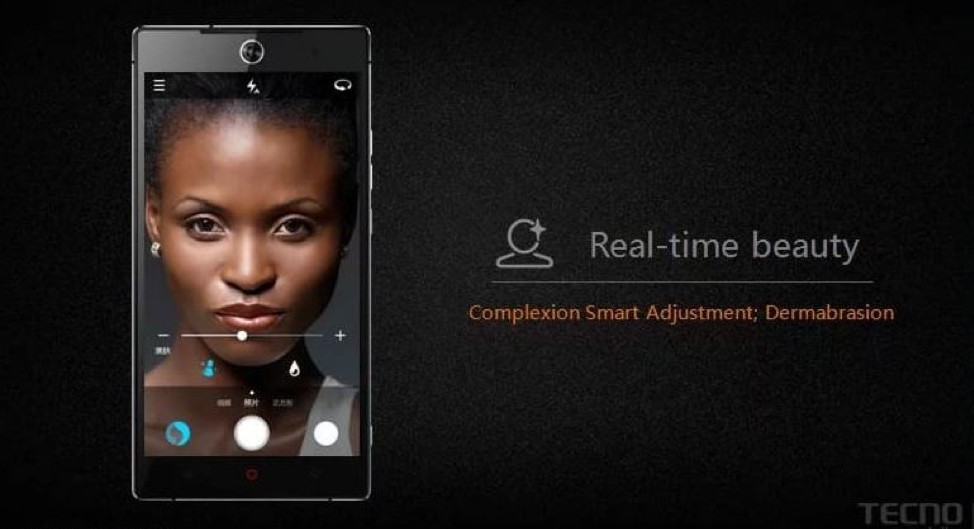

TRANSSION has applied their localisation focus to product design as well. They’ve tailoredtheir devices for Africans’ needs by focusing on internet connectivity, allowing for dual sims, and by featuring louder speakers for phone calls and music. As African markets can suffer from inconsistent power supplies, they focused on longer battery life. They’ve also designed a camera specifically for African facial features and skin tones.

Their low price-points (TECNO phones can run from US$50-100) and ubiquity on the continent meant that for many Africans, TRANSSION was the company that made smartphone ownership a reality.

Many TRANSSION devices are designed specifically for the African market

Managing instability

Despite their success on the continent, the sustainability of their good fortune is hardly a given in African markets, where political and economic uncertainty can often be par for the course. The company’s plans for a 280,000-square-foot factory in Ethiopia were put on hold recently after the surprise resignation of Prime Minister Hailemariam Desalegn destabilized the country’s ruling regime and prompted its government to declare a state of emergency. Ethiopia’s tumultuous political environment could put the company’s future at risk.

However, for TRANSSION, managing such risk seems to be a chance they’re willing to take to maintain a foothold in the continent’s high-potential markets. When asked about the risk that such instability poses, Chowdhury emphasized a long-term outlook, saying:

“Africa has been a focus market for us for the past 10 years. As we look towards the future, Africa will certainly remain our priority market. We hope that in this case, through our efforts, the new factory will not only provide local consumers with high-quality products but also contribute to the development of the local community. We will let you know as soon as we have further updates.”

For the many Chinese companies using TRANSSION’s case as a model for African localization, they will certainly be watching closely.

—

The article The Chinese smartphone maker you’ve never heard of is dominating the African market first appeared on TechNode.

Image Credit: rawpixel on Unsplash

Come to the Echelon Asia Summit 2018, which will be held at the Singapore Expo from the 28th to the 29th of June. Click here to get your tickets now. Enter the promo code e27-ROCKS to redeem a free pass! It is limited to only 30 passes and expires on the 20th of June, so hurry now!

The post The Chinese smartphone maker you’ve never heard of is dominating the African market appeared first on e27.