The key to sustainable startup growth lies in the judicious management of its financials

“90 per cent of startups eventually end in failure” is a statistic that is often cited in tech blogs; but why do they fail? Well, it can be attributed to various factors, of which some are evitable. One of the determinants that can apply across all stages of companies is financial planning and management.

At our startup business growth consultancy firm BlackStorm Consulting, we have continuously been engaged by clients of different stages to provide them with advisory on structuring, restructuring, and scaling of the businesses.

Poor use of funds and unreasonable company valuation are often the main reasons that hindered them from raising funds to move to the next stage of their business lifecycle. We often play the devil’s advocate by highlighting potential red flags to our clients that might hinder their businesses’ growth.

This is to ensure that they are aware of the matters and take actions to circumvent them. Financials should be adequately accounted for and presented in a fair and reasonable manner. With the figures in place, businesses can build credibility to interested parties when it comes to fundraising.

Typically, a business will go through the four phases of a lifecycle chronologically:

Comprehending what phase the business is in can make vast differences in financial planning and operations. We have encountered several owners who did not allocate resources well enough to fuel the growth, causing them to miss out on valuable opportunities. The business journey is always arduous. It will be wise to plan financially to defy the odds and stay in the game.

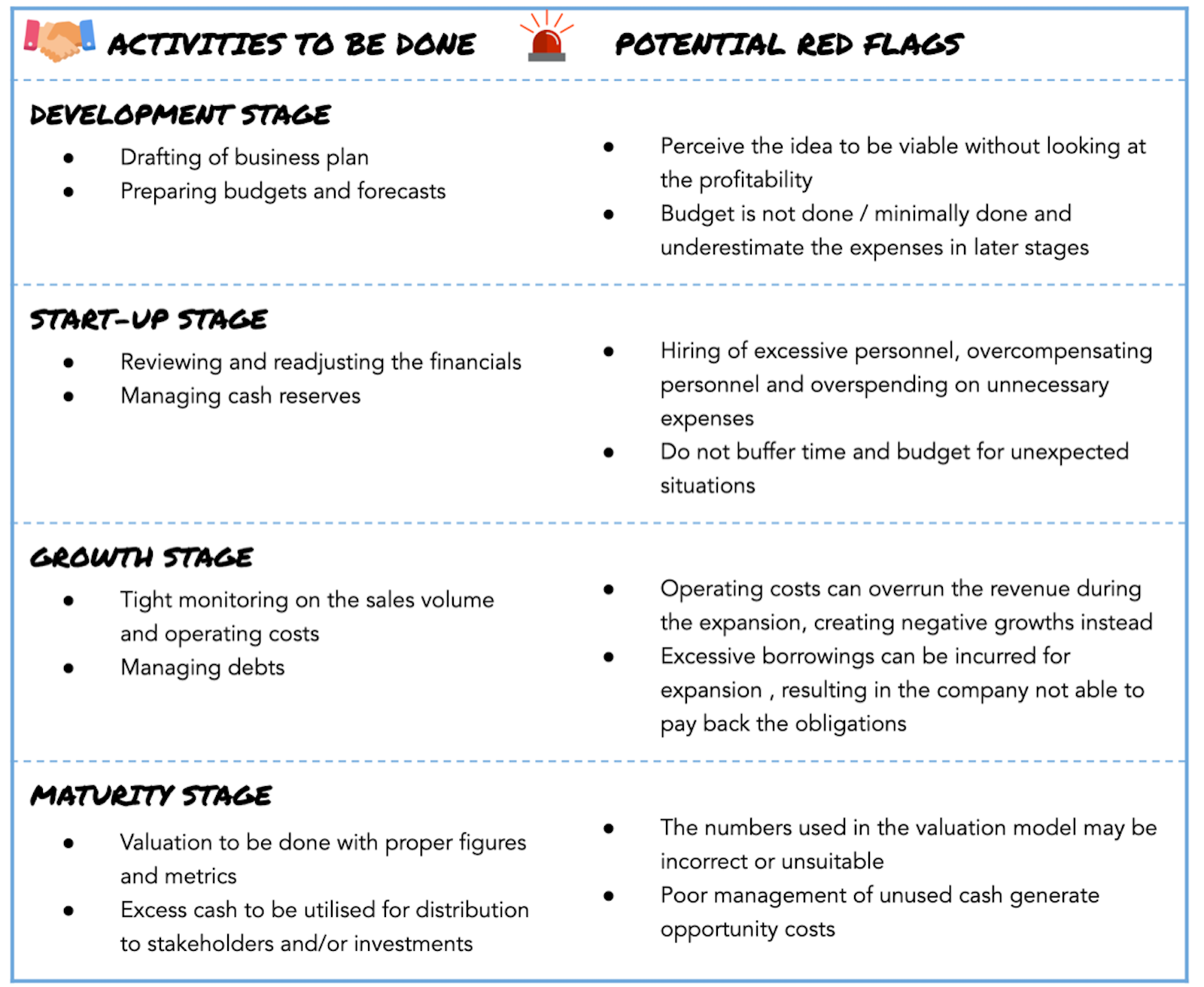

Here are some pointers that may help business owners and managers to consider during each stage of the business in the financial context.

Development stage

It is the beginning of the business lifecycle when the idea will come into existence. The idea will then be put into a trial for business feasibility and be examined whether it will eventually be able to generate profits. If it is of commercial sense, the business owners-to-be can start drafting a business plan, of which the budget will include the related expenses such as setting up of company, office rental, and payroll. It is essential not to disregard the expenses as some of them can be considerably high.

Start-up stage

This is the stage where the business is officially formed and ready to launch the MVP (Minimum Variable Product). The business at this phase will require funding for the operations, gaining market traction and further development. Many times, the actual costs exceed the allocated budget, and some of them are controllable.

Common mistakes made by the startups include hiring too many staff, overcompensating them and overspending on unnecessary expenses. The fast depletion of the fund supply will adversely cause the burn rate to be higher. With minimal sales coming in, the business can suffer significant losses.

Also Read:5 essential traits of a successful entrepreneur

In the face of this, the stakeholders would likely pull out, and the business collapses as a result. At this stage, the business is only as strong as its weakest link as it is at the riskiest and most vulnerable state. Thus, we often educate startups on managing the sales expectation as customers at this stage will be scarce and it requires some time to build up. Therefore, we would suggest startups to maintain their cash reserves that can last for at least six months so that it can survive through them and move on to the next stage.

Growth stage

At this stage, growth can be defined in terms of expansion of the product, capturing more market shares and/or entering more markets.

The business at this stage should be steadily growing new customer bases and generating constant sources of revenue. Presently, the company can be operating at a net loss or maintaining a healthy profit. The recurring revenues can help to pay for the operating expenses, and the net profits can be given out as dividends.

By declaring and paying dividends to the shareholders, it will indicate good health of the company and exude confidence to the stakeholders. However, this action can impact the cash flow, and it is crucial that such an act should be done when the company is not making losses, and cash supply is adequate.

Competition is intense at this stage, but at the same time, many opportunities will be open for the company and it has to act fast. A renowned example will be Airbnb. The company’s co-founder Brian Chesky and his team decided to acquire Accoleo, a German platform that allows students to rent out their flats, extra beds, or couches to other students, in order to fight against a clone competitor. This allowed Airbnb to have a major competitive advantage in the European market. By 2012, bookings had grown ten times, and Airbnb had opened nine international offices over Europe.

Also Read:7 steps to increase the value of your business (before you sell)

The company will fine-tune the processes and products to compete, and decide on venturing out to new markets. Scaling can capture a more extensive base of customers and bring in more revenues. As a result, it will also require expanding the workforce to handle. The company will then need to strike a balance between the high sales volume and increased personnel costs to optimise the rapid growth.

Reversal effect can kick into the business when operating costs overrun the revenue, resulting in negative growth. During this stage, the company may require additional funding to expand. If the company were to choose not to dilute the existing shareholdings, the company will choose to incur debts. As such, liabilities will be escalated, causing a deficit in equity. This can be a big red flag as the company is at risk of bankruptcy if it is not able to make the financial obligations. Therefore, the cash reserves must be planned and managed well before embarking into expansion as the market conditions can change unfavourably at any times.

Companies that choose to expand rapidly without weighing the costs face a decline in their profitability due to the relative rising costs. As companies burn through their cash reserves to scale fast, they may look for external sources of funding such as through debts, issuance of new shares or via newer models of financing such as Security Token Offerings (STOs).

This, however, may bring superfluous stress to the financial positions and may actually have an inverse effect on the companies’ operations as they may be forced to slow down their scaling strategy due to the increased financial obligations.

Maturity stage

After the successful scaling in the business, the company is now at the peak and has matured. The company can be still growing but at a sluggish rate. Based on our experience, the mature companies will then reach the crossroads. The owners will then need to consider further expansions which may require more funding or they choose to exit before the business starts to decline.

If the company is to go for expansion again, it will be back to growth stage. However, most of them will start to find an exit route as the valuation at this point will be reaching its climax. The owners will then use different methodologies to determine the valuation amounts. Some of them may be using estimations, but the common approaches will be DCF (Discounted Cash Flow) Model, Company Comparable Analysis and Precedent Transactions Analysis.

Also Read:5 things I learnt from talking to 50 VCs

It is not surprising to know that even up to this stage, some companies will still be facing net losses and negative cash flows. They are relying on funding sources to sustain the business as they are seen to be of high potential value. However, on the common ground, it is vital for the company to be in a healthy financial position and earning positively to achieve a surpassing valuation figure.

Cash should not be deliberately held on by the company to magnify the valuation figures. Opportunity costs will be created as the surplus cash in the company can be used for distribution to the stakeholders and/or strategic investments to boost the company’s value further.

Correspondingly, when it comes to calculations, figures and metrics can be misused to inflate the valuation,

In case you find this complicated, we have summarised the key ideas into the table below.

All in all, not every business will go through every abovementioned stage. They may not also experience them in chronological order. For instance, some companies may see exponential growth right after the start-up stage, and the founders may decide to cash out right away.

Generally, for most companies, the entrepreneurs will need to anticipate the potential issues ahead and prepare to maximise the success of the businesses, of which financial control will play a significant role. Owners and managers should be aware of their key figures and make the correct financial decisions to drive the businesses towards greater heights in every stage.

—

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

The post The essentials of managing your business financials at 4 stages of its lifecycle appeared first on e27.