Why we’re heading towards a bloodbath and four strategies to avoid it

Being the new kid on the block means that e-commerce ventures in Southeast Asia have the luxury to learn from others’ mistakes, from mature e-commerce markets such as the US and China.

It’s been over 20 years since Amazon (1994) and eBay (1995) were founded. Jack Ma started Alibaba in his Hangzhou apartment in 1999, right before the Internet 1.0 bubble burst. A lot has happened in global e-commerce since then, including the slow but steady march of Amazon, the quick rise and fall of daily deals and flash sale sites, and Alibaba’s blockbuster IPO in 2015. What’s next? This historical review creates the two frameworks, the E-Commerce Lifecycle and E-Commerce 1.0/2.0, to help predict the future opportunity of e-commerce in Southeast Asia.

1. The Ecommerce Lifecycle – How e-commerce models evolve over time

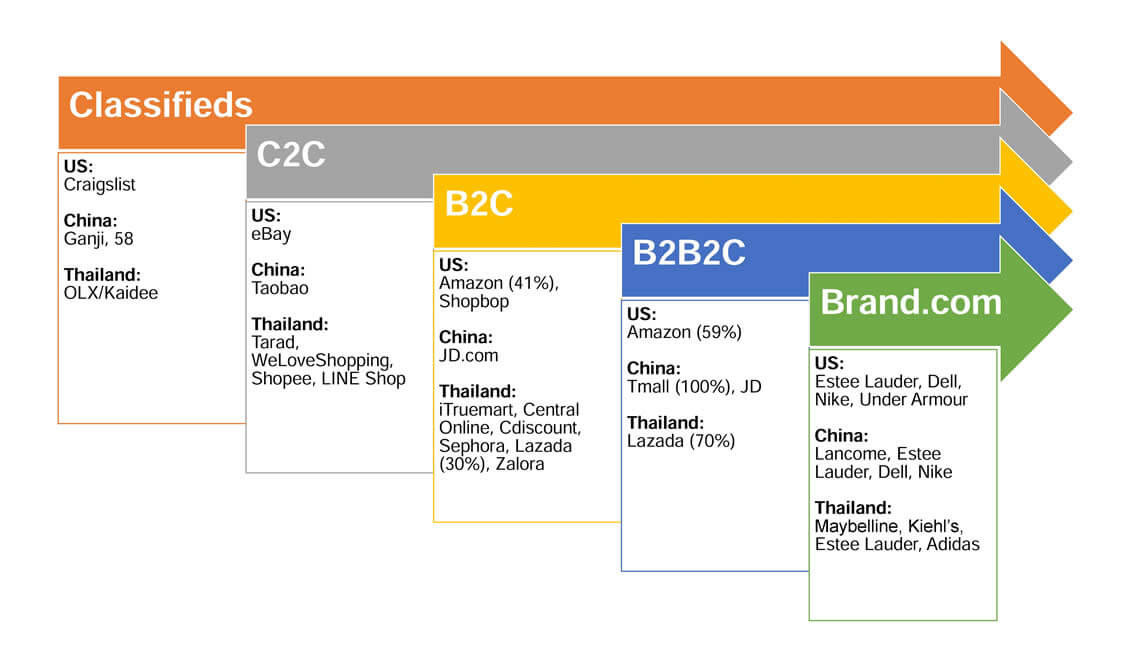

There is a distinct pattern that has emerged from the more mature e-commerce markets’ evolution that offers a degree of prescience for e-commerce in Southeast Asia. This follows the trajectory of Classifieds and C2C to B2C to eventually Brand.com. The US went from Craigslist, eBay and Amazon to brand sites such as Nike, J.Crew and Gap. China went from Taobao, Tmall and JD to the many standalone and marketplace brand sites, like Estée Lauder, Burberry and Coach.

Today’s Southeast Asia is following a similar pattern but at a much faster pace due to “1 to n,” horizontal progress and the resulting leapfrogging behaviour. In our region, we have Classifieds (OLX), C2C (Tarad, Tokopedia, Shopee), B2C (Lazada, Zalora, MatahariMall) and Brand.com (L’Oreal, Estée Lauder, Adidas) all happening at once within a very short time frame.

Figure 1: E-commerce Lifecycle Model

Also Read: Flipkart-owned fashion e-commerce major Myntra acquires Rocket Internet-backed Jabong

LIMITATIONS TO THE MODEL

Local nuances give rise to unique e-commerce business models

eBay could only have been invented in the US because of its auction-driven model in a consumerist culture characterised by excess goods and plenty of hobbyists (think baseball cards and Pez dispensers). eBay didn’t work in China for many reasons, one being the auction model was not appealing to Chinese users who preferred to buy first-hand goods and to negotiate person-to-person via chat.

Tmall’s B2B2C model originated in China because of the bazaar-like, hustle and bustle shopping environments that many Chinese were used to in their offline world.

HOW SOUTHEAST ASIA E-COMMERCE IS DIFFERENT

Southeast Asia is a hybrid between the US and China

Lazada, the dominant e-commerce platform in Southeast Asia, is both an Amazon and a Tmall. Founded in 2011 by Rocket Internet as the “Amazon of Southeast Asia”, Lazada today gets 70 per cent of its GMV from third-party, marketplace transactions, with the remaining 30 per cent generated through “traditional” Amazon-style direct retail. Post-Alibaba acquisition, it’s likely that Lazada will follow the Tmall model and move towards a 100 per cent marketplace with all the model’s inherent scaling benefits.

Compare this to Amazon, which traditionally used to be 100 per cent direct retail but has been moving towards a marketplace model. Today, Amazon gets 59 per cent of its GMV from B2B2C.

Also Read: E-commerce bubble in India: Has it burst yet?

B2C, B2B2C and Brand.com all happening at the same time

In China, brands progressed from selling via Tmall as a stepping stone towards operating their own brand.com site. A case in point is Uniqlo, which started selling through a Tmall flagship store and then later added their own brand.com webstore.

In Southeast Asia, we see brands doing both at the same time, selling via Lazada as well as their brand.com stores, in addition through distributing through e-tailors like Central Online and MAP. This is driven by technology making it much easier to sell through different channels but also necessitated by the high degree of fragmentation in the e-commerce market. Consolidation is expected to happen soon.

Southeast Asia is mobile-first, C2C ecommerce is jumping straight into mobile marketplaces

Whereas in mature e-commerce markets desktop C2C still plays a pivotal role, in Southeast Asia the leapfrogging towards mobile is disrupting traditional, desktop-first marketplaces. Mobile-only C2C marketplaces such as Carousell and Garena-backed Shopee are making aggressive moves against their older desktop counterparts such as Tarad in Thailand and Tokopedia in Indonesia. With an estimated 85 per cent and 79 per cent of online shopping outside of the major metro areas in Thailand and Indonesia happening on mobile, it’s not surprising that companies such as Facebook are also betting on mobile C2C. The ad giant recently launching mobile payments in Thailand where an estimated 50 per cent of C2C transactions are happening on social networks.

Also Read: Indian e-commerce Unicorn ShopClues acquires Momoe to boost its payment network for merchants

2. E-commerce 1.0 to E-commerce 2.0: Four strategies to avoid the imminent e-commerce bloodbath in Southeast Asia

Southeast Asia is the next e-commerce gold rush. For this very reason, it’s also quickly becoming the next e-commerce bloodbath. We’ve already seen many casualties, especially in the B2C space of selling third-party brands. As we previously predicted, Rocket Internet’s Zalora had to sell their Thailand and Vietnam businesses for chump change to local retailer Central Group. This same year, Cdiscount Thailand, part of French retail conglomerate Groupe Casino, was sold for EUR28 million to TCC, a local Thai company that also owns the popular Chang beer brand.

E-commerce 1.0: Selling other people’s stuff to the masses at low margins

E-commerce guru Andy Dunn adopted a strategy that allowed his business to stand a fighting chance in the Amazon bloodbath of the US.

“If you’re selling other people’s brands, you are competing not via a local group of competitors but with everyone. In this type of market, you might imagine having one large national winner. You might imagine that winner is ruthless about scale and cost, and is run by a visionary leader who with an extreme long-term focus. Such a company might not make real money for a long time — but when it does — it will be incredibly powerful.”

With Alibaba coming into the region through the US$1 billion Lazada acquisition, it increasingly looks like ‘Alizada’ is becoming the big threat for other retailers in the market, both in the pure-play and omni-channel space. Expect the bloodbath to intensify and more consolidation to happen over the next few years.

Today, none of the B2C/E-commerce 1.0 players in ASEAN have dominant market share yet.

Granted, Lazada has a headstart with an alleged 20 per cent market share (2014) but this number pales in comparison with Amazon’s 60 per cent in the US, Tmall’s 50.6 per cent, and JD’s 51.9 per cent (direct retail B2C market) in China.

Also Read: Figures don’t lie: Here’s why e-commerce is key to retail innovation

Figure 1: E-commerce lifecycle model

Over the next five to six years, Southeast Asia B2C will go through further consolidation to end up in a one to two players game.

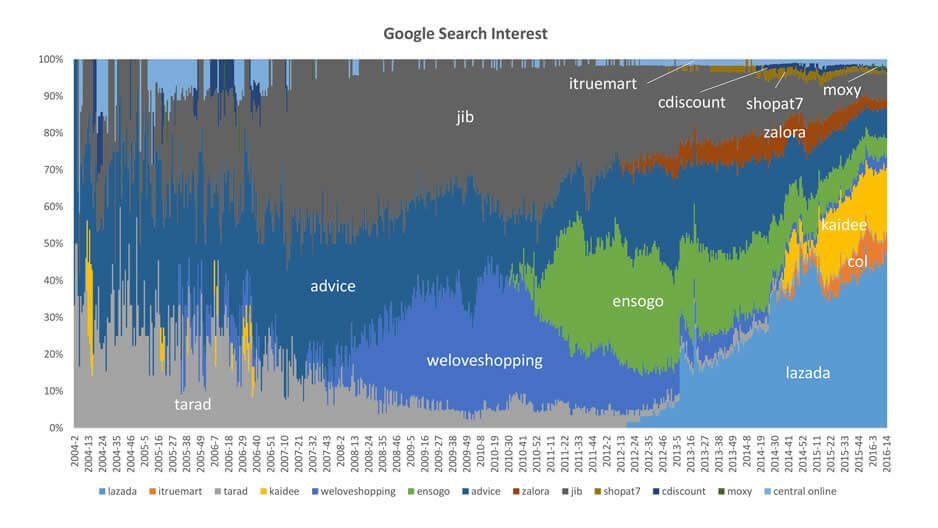

There is no better way to visualise the ongoing consolidation in E-commerce 1.0 than with ‘search interest’ data from Google Trends. The graph for Thailand shows the rise and fall of desktop C2C and daily deals, the fragmentation in B2C, and the rapid ascension of Lazada.

Figure 3: Google search interest showing ongoing consolidation in E-commerce 1.0

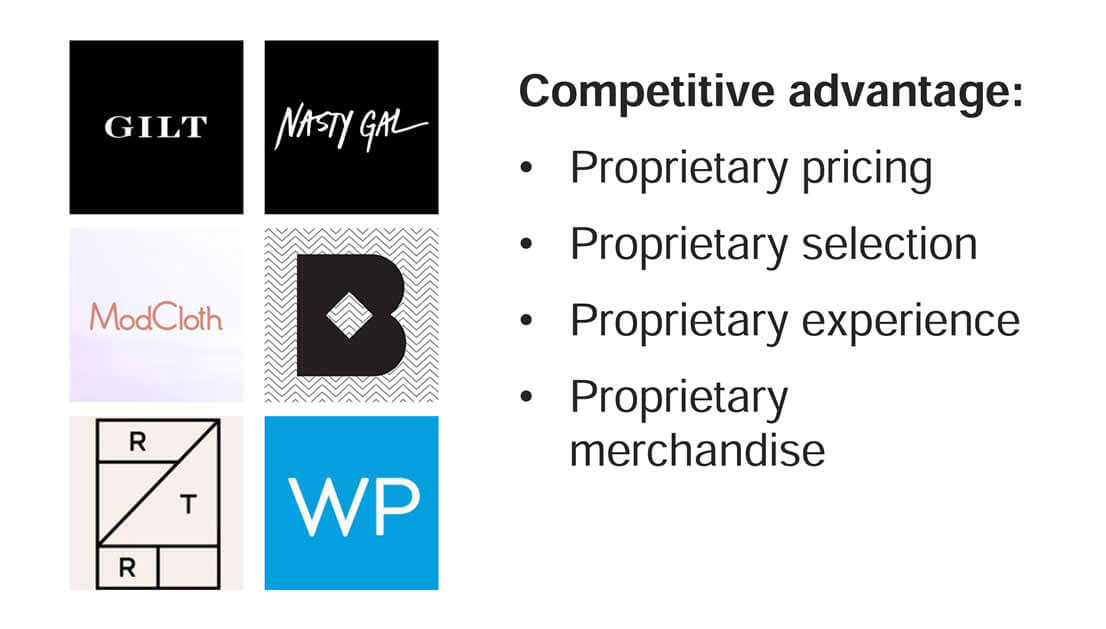

This is where things start to get interesting. Whereas E-commerce 1.0 is a game of brute force and strength, E-commerce 2.0 exploits 1.0 loopholes in many creative ways in order to avoid the zero-sum game against the likes of ‘Alizada’.

“This next generation of e-commerce companies is as much about what you exclude as what you include. It is a paradox that excluding some things takes more time than including everything. The new models are fundamentally — whether the merchandise is proprietary or not — about merchandising.” — Andy Dunn on E-commerce 2.0

Figure 4: Ecommerce 2.0 – Four strategies for avoiding the bloodbath

Also Read: Is it appropriate for Indonesian govt to launch e-commerce site Inamall with Alibaba Group?

Gilt, the posterchild of E-commerce 2.0, rose from the ashes of the 2008 financial crisis with a unique business model that offered high-end luxury goods at a fraction of their original price through time-sensitive flash sales. One of New York City’s first unicorns at a point in time, Gilt later struggled as the economy recovered and brands no longer needed a distribution channel for clearance stock.

While Gilt played the pricing angle, others such as Birchbox and Rent the Runway innovated on the product side by offering a unique shopping experience. Birchbox started the monthly beauty subscription commerce craze and inspired countless “Birchbox for X” clones. Rent the Runway is basically fashion on-demand by providing users rental access to high-end, designer fashion.

E-commerce 2.0 in Southeast Asia: A glimpse of hope for aspiring e-commerce entrepreneurs?

With the E-commerce 1.0 bloodbath in Southeast Asia still ongoing as we speak, a few entrepreneurs have realised that it’s futile to compete against the Lazada’s and MatahariMall’s of the region without deep pockets or any other strategic moat. Instead, they are focusing on emerging opportunities in E-commerce 2.0 by positioning themselves in a unique way.

Also Read: 6 tips to survive the cutthroat world of e-commerce

Proprietary Merchandise

Pomelo Fashion

Founded by the ex-Thailand Lazada founding team, Pomelo Fashion is one of the first E-commerce 2.0 companies in Southeast Asia. Rather than selling other brands’ products with low margins, Pomelo Fashion has taken a M2C/D2C (Manufacture/Direct-to-Consumer) approach, focusing on building its own fashion brand and vertically integrating its supply chain, going as far as manufacturing its own clothing and apparel.

Glazziq and Franc Nobel

Inspired by Warby Parker’s success in the US, Glazziq and Franc Nobel are applying the proprietary merchandise model in the eyewear space in Thailand and Indonesia, respectively. Glazziq adds a local spin by positioning itself as prescription eyewear for Asians.

Sale Stock

In Indonesia, another startup has taken a cue from the Facebook and Instagram seller playbook, and scaled it ten times. Sale Stock, a fast-fashion startup based in Jakarta has taken a similar path to Pomelo Fashion, with vertical integration of design, manufacturing, and supply chain.

Proprietary Selection

Motif Official

Motif Official is a fashion retailer based in Bangkok focusing on proprietary merchandise and selection. Their ‘Motif Official’ label is designed and manufactured in-house. For their ‘Motif Select’ range, they select and curate minimalist brands from across the world. Motif’s e-commerce strategy eerily resembles that of Nasty Gal in the US, where founder Sophia Amoruso started the business in 2006 by curating vintage clothing sourced from second hand stores.

“We are an online concept store specializing in women’s apparels and accessories; from our own in-house label ‘Motif Official’ to our ‘Motif Select’ range, where we curate the best pieces from brands all around the world to your everyday wardrobe. We believe in the concept of minimalism, with attention to details, shapes and silhouettes.”

Motif proves that you can still compete with the big retailers by focusing on a niche and dominating a category through curation. Many of the premium brands on Motif would never sell on Lazada, let alone Zalora.

Following pure play e-commerce companies in the US such as Warby Parker and Birchbox who went offline to augment their brand, Motif also operates physical stores in Central World and Siam Discovery in the heart of Bangkok.

Figure 5: E-commerce 2.0, Global vs SEA Comparison and Opportunities

Also Read: 5 Game of Thrones characters that are using your e-commerce app

The future of e-commerce in Southeast Asia

Applying either the E-commerce Lifecycle or E-commerce 1.0/2.0 framework makes it easy to see where e-commerce in Southeast Asia is headed.

The B2C war will continue to wage for the next four to five years until some run out of money and throw in the towel. In China, this process took almost a decade with Tmall going from zero per cent to 50.6 per cent market share from 2008-2014. In the direct retail B2C space, JD went from 15 per cent to 51.9 per cent. In the same period, previous leaders such as Dangdang (16.2 per cent) and Amazon China (15.4 per cent) faded into irrelevance with four per cent and 3.5 per cent market share remaining as of 2014.

During this time, we will also see more startups and venture capital going into the E-commerce 2.0 space. E-commerce 2.0 isn’t new to Southeast Asia— many have tried to bring the Birchbox model into the region but failed due to the immature market. However, the next few years may be a fertile time as evidenced from the traction that companies such as Pomelo Fashion, Sale Stock, and Motif are getting.

Does this mean we can go ahead and copy something like Gilt into Southeast Asia? It really depends. A model like Gilt needs access to old inventory of premium brands which in markets such as Thailand and Indonesia are controlled by one to two distributors such as Central and MAP. This is the same issue that caused the downfall of Zalora in the same markets. Any E-commerce 2.0 model launched in Southeast Asia will need to be customised for the local market.

E-commerce in Southeast Asia is still relatively young, with only one per cent of total retail GMV being generated online compared to 7.1 per cent and 15.9 per cent in the US and China. However, the region is already widely being touted as the next frontier of e-commerce opportunity, or the next e-commerce gold rush and recent research predicting the market to grow 32 per cent year-on-year to reach US$88 billion by 2025 (6.4 per cent penetration), up from today’s US$5.5 billion (0.8 per cent penetration). As shown in our analysis, there are plenty of opportunities in e-commerce for those with deep pockets as well as those who adopt unique and local strategies.

“Don’t always go through the tiny little door that everyone is trying to rush through … maybe go around the corner and go through the vast gate that no one’s taking.” — Peter Thiel

—

The post was first published on ecommerceIQ.asia.

Share your feedback to @ecomIQ and @sheji_acommerce

The post The evolution of e-commerce business models in Southeast Asia appeared first on e27.