Despite challenges, direct corporate and CVC investment is expected to account for 35 per cent or more of total global VC dollars invested by 2025

Traditional venture capital firms (VCs) have dubbed corporate venture capital (CVCs) as “lumbering giants” for moving slowly and driving up asset prices, and unfortunately, there were instances where the critic is justified. However, despite the criticism direct corporate and CVC investment is expected to account for 35 per cent or more of total global VC dollars invested by 2025, rising from the current level of around 28 per cent.

Telstra Ventures Managing Director Mark Sherman explained it in a Telstra Ventures report he co-wrote with Albert Bielinko.

“Technology disruption, global competition, and corporates seeking access to new revenue streams, products and customers are driving the increase of CVC in both percentage and absolute dollar terms,” he said in a press statement accompanying the report.

Called Strategic Growth Investing: The Next Evolution of Corporate Venture Capital, the report discusses the role of CVC in the VC sector and explore the reasons why corporations succeed and fail in this space.

Also Read: A Singapore private university is investing US$35.1M to develop entrepreneurs

It began by highlighting how investing in a tech startup through CVC has been seen as a more favourable way to innovation, compared to investing in a corporations’ own R&D department. CVC investments are able to give corporations access to innovative technology, with the ability to overcome the limits of existing channels, products, customers, processes and business models.

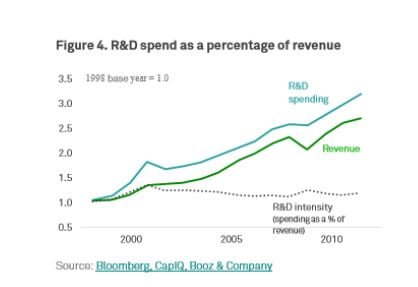

“Consequently, despite the importance of new technology to so many businesses, corporate R&D investment is actually flat as a percentage of company revenues,” the report stated, adding that corporations have been trying to mimic the operating approach of startups in their in-house innovation.

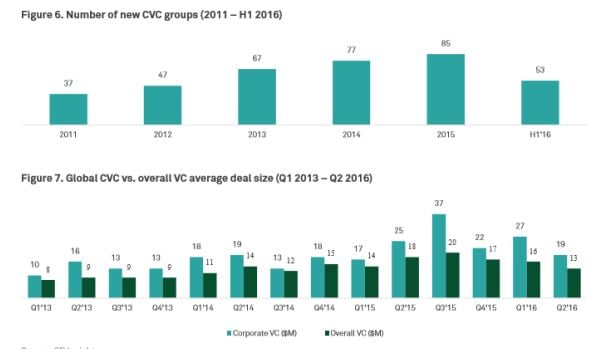

Since 2010, more than 366 new CVC groups have been formed with the number of active quarterly global CVCs has more than doubled since 2012. CVCs also tend to participate in bigger investments than traditional VC deals, with the average CVC deal in Q2 2016 reaching US$19 million, compared to US$13 million overall.

Also Read: Alibaba invests in Irish cinema analytics startup showtime analytics

How Asia is catching up

Rapid changes in the tech industry did not only affect the different sectors that are trending each year; more importantly, it also affect the regions where CVC money is coming down to next.

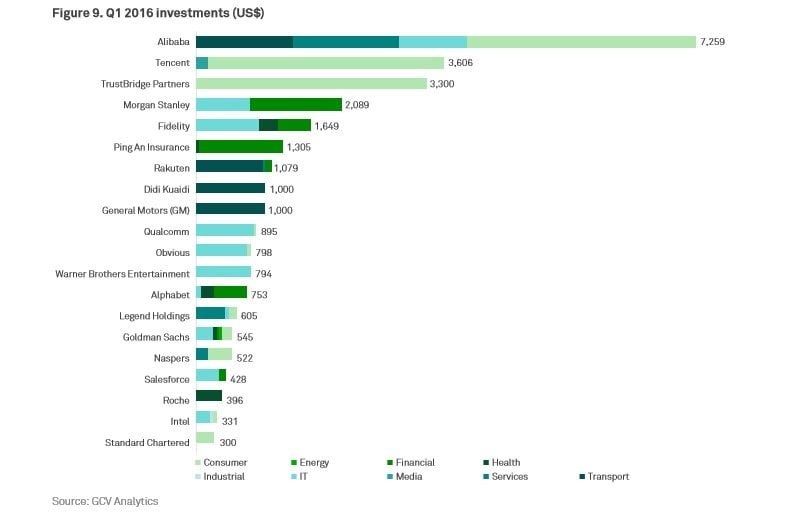

Though Silicon Valley remains the “spiritual home” with many VC fundings and significant exits coming from the area, in the early 2016, China-based internet and e-commerce giants were the largest investors as seen in the graphic below.

The report also mentioned that between 2011 and the third quarter of 2016, Asia increased its share from 13 per cent of dollars invested in venture-backed companies to 28 per cent. In the West, Europe rose from 10 per cent to 11 per cent while the US fell from 76 per cent to 61 per cent, indicating that the focus has begun to shift.

Giving value

What are the factors that startups are looking for in an investor? According to the report, entrepreneurs make their decision based largely on the value-add the investor provides, which can be broken down to four factors: Revenue growth opportunities; people and connections; board governance; and strategic insights.

Also Read: Ruvento raises new seed fund for hardware startups in Singapore, China, and the US

The main difference between VCs and CVCs lies in the type of value-add that they provide. The report revealed that CVCs often provide rapid access to revenue through large customer bases, channels and complementary products, while VCs add most value in board governance and connections.

But CVCs may have a hard time maximising their true potentials due to these reasons:

1. Inconsistent presence in global market

“Funding may depend on the ongoing financial health of the corporate parent. As a consequence, many companies have wavered in or out of the market, with damaging consequences,” said the report.

2. Slow decision-making process

“At times a lack of senior engagement or direct VC experience within CVC arms has drawn out investment decisions, with corporations then losing out on ‘hot’ investments in the face of significant VC competition.”

3. Relationships with entrepreneurs

“Large corporations can lack experience with the needs and dynamics of startups and the broader technology ecosystem.”

4. Insufficient investment size

“Global 2000 corporations may start off making US$0.5M to US$2M VC investments per deal. This often results in little or no value for the emerging company or themselves and can see them being cut out of investments.”

5. Alignment of incentives

“Corporate incentive structures might not reward the long-term development of ventures businesses, creating challenges with retention and incentivising the best investment behaviour amongst the ventures team.”

Also Read: Under Trump, SoftBank will invest half of its US$100B Vision Fund in the US

The solution

So what can CVCs do make a difference? The report introduces a concept that they refer as “Strategic Growth Investing” which characteristics involved:

1. Acting as a catalyst for emerging companies’ growth

2. Providing large corporations with new products, customers, business models and leadership

3. Leveraging customers, market insights and substantial resources to invest in companies that are most likely disrupt their existing businesses

4. Engaging Global 2000 corporations to work with their customers to co-create new ideas, revenues and capabilities

5. Generating senior support for disruptive innovation in Global 2000 corporations

—

Image Credit: bowie15 / 123RF Stock Photo

The post The rise and fall of corporate VCs: What corporations can do to make a difference appeared first on e27.