Data seems to suggest that long-term performance of a company is more dependent on the motivations of executives as opposed to their education level

The Harvard Business Review (“HBR”) publishes a list of top 100 CEOs in the world every year. In judging the quality of CEOs around the world, HBR focuses on the “results they produce over their entire tenure” based on objective data. The Review analyses various metrics like long-term shareholder return and environmental, social and governance (ESG) performance to arrive at the best performing CEOs in the world.

Our readers in Asia might wonder, how many of them are Asians? What do they do and what are their backgrounds? We have the answer for you.

Ten out of a hundred CEOs in the ranking are Asians

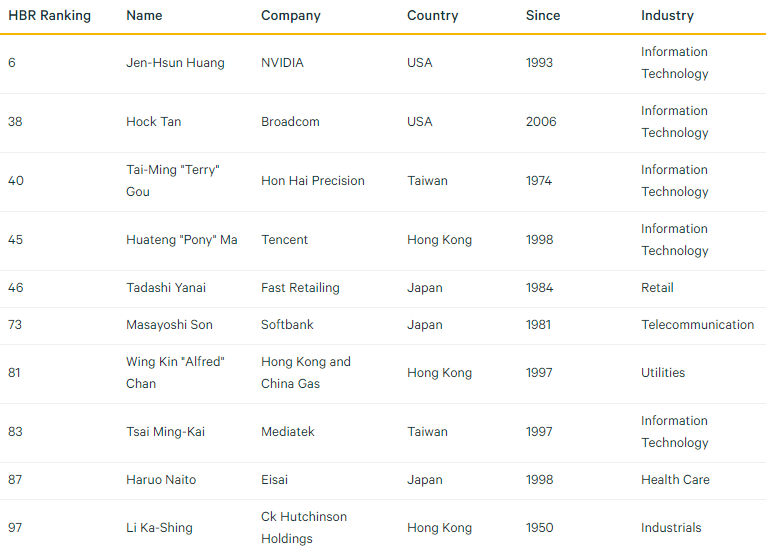

Of the 100 CEOs that were ranked by HBR, 10 are Asians, though only eight are actually working at a Asian companies. The highest ranked is Jen-Hsun Huang of NVIDIA, the famous graphic chipmaker based in the US. Among executives located in Asia, Terry Gou of Hon Hai Precision was at the top, ranked at #40. He has been with the company since 1974, and his tenure of 42 years was second only to Li Ka-Shing who founded his company CK Hutchinson in 1950 shortly after the world war.

While 10 may not sound like it’s a lot, readers should note that there were only seven Asian executives in the same ranking by HBR in 2015, of which only six were in Asian companies. As Asia continues to be the engine of global economic growth, it seems that an increasing number of companies and executives are gaining influence and recognition in the global business world.

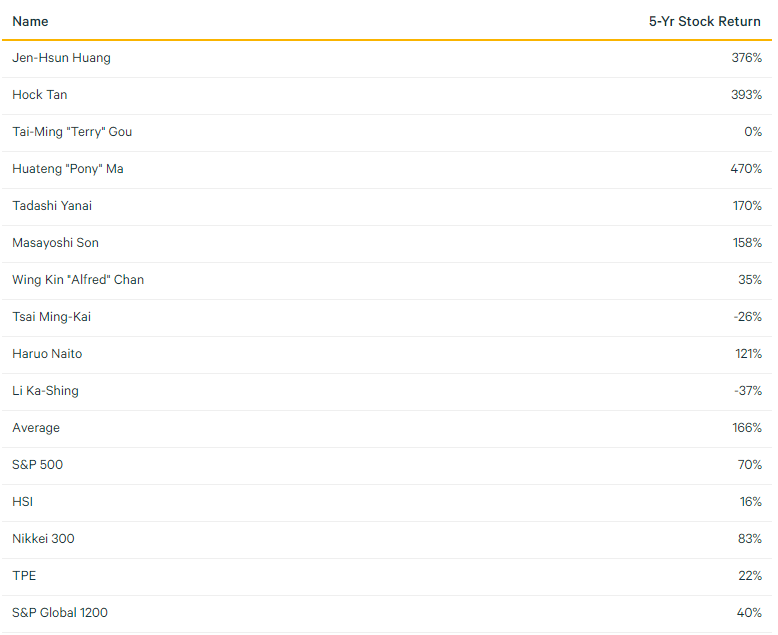

True to HBR’s commitment to “objective metrics,” these CEOs have generated amazing shareholder returns over the years. For instance, NVIDIA stock has returned 376 per cent in the last five years excluding dividends, while Tencent has returned 470 per cent. On average, these ten executives have returned 166 per cent over the last five years excluding dividends, as opposed to 70 per cent by S&P 500 and 83 per cent by Nikkei 300.

Lastly, it’s worth noting that all of these CEOs came from the US, Taiwan, Hong Kong and Japan. There was no executive representation from countries like South Korea, China, or other Southeast Asian nations.

This may be because of various factors like corporate governance of maturity of the markets. For instance, Korean companies have long traded at discount to peers because of corporate structures that allow chaebols to do anything they want with their companies. Similarly, many of the large companies in China are state owned enterprises that don’t always take shareholder friendly actions.

Seven technology executives

It’s interesting to note that seven of the ten executives in this series were involved in some form of technology-driven sector. The exceptions included Fast Retailing, Hong Kong and China Gas Company, and Eisai. Although Softbank and CK Hutchinson Holdings are not necessarily ‘tech’ companies, they are both well known for their savvy investments in various tech startups like Facebook and Alibaba.

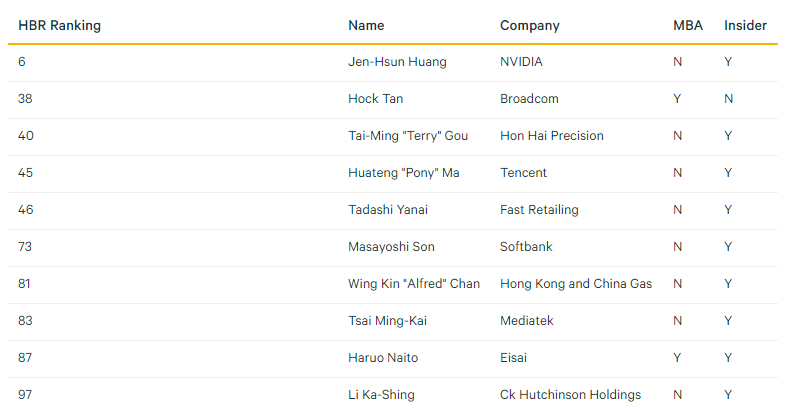

Two MBA’s, nine insiders

Among the top 100 executives selected by HBR, only 24 had an MBA and 84 were insiders. This is even more accentuated for Asian CEOs, of whom only two have an MBA degree and nine were insiders.

Apparently, an MBA is not quite enough to get you the top job in companies and help you perform well. There is a logical explanation for the apparent disconnect between the perceived value of an MBA degree and its lack of evidence among the top executives in the world. Given that best CEOs tend to be insiders who own meaningful amount of their companies’ stocks and hence have aligned interest with shareholders, they simply are more motivated to make the long-term decisions instead of chasing after short-term gains.

On the other hand, an MBA degree does not seem to help you much in becoming a great business leader, especially if your interests are not aligned with long-term opportunities. Investors and professionals both should take such a lesson to heart. Data seems to suggest that long-term performance of a company is more dependent on the motivations of executives as opposed to their education level.

When investing in companies, it is crucial to recognise the important roles played by their executives. CEOs’ decisions have a lasting impact, because they decide how much capital to deploy into which projects.

While some projects can have decent returns, others can create an enormous amount of value for shareholders (or destroy the company). For instance, just imagine what Apple might be today if Steve Jobs was not there to invest in iPods and iPhones, and how Microsoft has changed since Satya Nadella has taken over the company.

The CEOs listed above definitely has the track record to show that they’ve created more value than the average executive over a long period of time.

—-

This article originally appeared on ValuePenguin.

The views expressed here are of the author’s, and e27 may not necessarily subscribe to them. e27 invites members from Asia’s tech industry and startup community to share their honest opinions and expert knowledge with our readers. If you are interested in sharing your point of view, submit your post here.

The post The world’s best Asian CEOs are all in tech appeared first on e27.