In this blog post, we explore various practical use-cases of blockchain in the energy space

We are focused on solving issues at the power generation, distribution and retail level of the entire energy supply chain.

While many recognise that blockchain could be immensely disruptive, we delve into what we think is plausible in the short to medium term. Our team at Electrify hopes to build solutions around these issues to solve the various pain points that we face today in the energy industry, namely counter-party risk, grid stability, trade and settlement of distributed production, stakeholder accountability.

Real time settlement between producers and consumers

The beauty about trading energy on the blockchain is that all processes can be connected to a smart contract and data can be distributed to all involved parties. As power is being generated and transmitted to the consumer, the blockchain permanently records the source and amount of power. Power is then delivered instantaneously to the consumer when he/she switches on the lights.

At the end of each pre-defined time block, the smart contract can be used to transfer payments from the consumer to the producer automatically. With real-time or almost real-time settlement, smart contracts can be used to ensure payment on delivery of power, reducing counter-party risk for both parties. Producers can be certain that energy supplied will be paid for, and consumers can be assured that they do not pre-pay and face supply issues down the road.

“Prosumers” not only consume commodities but also dispose of generation capacity in the form of solar systems, small-scale wind turbines or CHP plans. Blockchain technology strengthens the market role of individual consumers and producers. It enables prosumers to buy and sell energy directly — manually or via automation — with a high degree of autonomy. — PW

Real time settlement can apply to traditional retail supply contracts, utility-to-utility trading contracts, and even peer-to-peer (P2P) supply contracts. P2P contracts between distributed generation sources has been gaining momentum in developed grids as more people opt to generate power using renewable sources. Oftentimes, surplus power can only be sold to the grid operator at a less-than-ideal price, disadvantaging the producer. Electrify’s P2P framework (Synergy) seeks to bring solutions for P2P trading across a national grid, allowing existing producers to extract more value out of their solar panels, or incentivising more households to install solar panels to sell to their neighbours.

Most of the current OTC trade lifecycle has been digitalised in which settlements is still an exception — RWE

Reducing credit risk and transactional fees

Credit risk in the energy business is a major pain point, mainly because the margins in most levels of the energy supply chain are thin. A single default event can wipe out many months or years of profits for energy providers.

(With blockchain) Marketplaces will consolidate, and accessibility will explode, significantly compressing margins at the transactional level. — Deloitte

Smart contracts and digital payments help mitigate this issue. Options available to the energy provider:

- Ensure that the consumer has sufficient funds in their wallet before supplying the energy

- Assess a consumer’s past payment behaviour to decide whether or not to onboard the consumer

- (Other more innovative solutions are emerging, check out toastycoin.com)

Blockchain and smart contracts allow producers and consumers to transact in a manner that is not dependent on a central intermediary. Smart contracts can be written in a way that is as neutral as possible, ensuring that the consumer’s rights are fairly protected. Having a contract executed by code also means that the right amount is paid for the goods/services delivered, in this case, energy supply.

Low transaction fees via a blockchain allows producers to collect payments more frequently (perhaps one transaction per day or even per hour). In general, reducing the time between supply and payment for energy reduces credit risk faced by energy suppliers, allowing them to better control their default levels, bringing system-wide cost benefits.

Also read: The economics of blockchain and crypto assets

We look forward to the development of platforms such as Plasma which allow multiple “Plasma Blockchain(s)” to be linked to the main Ethereum “Root Chain”. The intention of Plasma is to reduce transaction costs and increase speeds significantly, all while ensuring a similar level of security as executing on the Ethereum public chain.

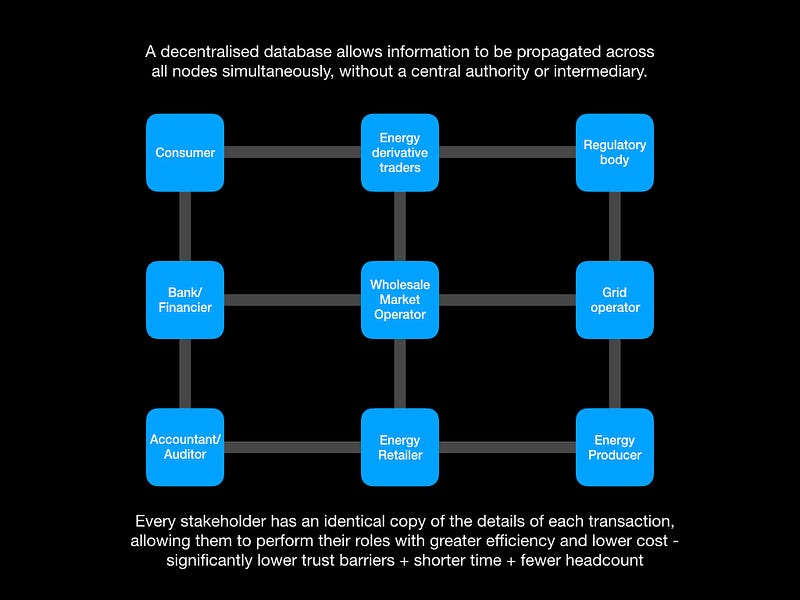

Distributed Assurance (via DLT)

Complex infrastructure such as a power grid consists of an entire web of stakeholders, from project financiers to regulators to end consumers. Each of them has an interest to know what transactions are going on at various tiers of the value chain. Tracking data on the blockchain means that there is no one party consolidating and distributing the data, all stakeholders have a peace of mind that the data is legitimate and real-time data is fully accessible to them.

A few examples:

- Consumer — With the increasing level of awareness of low-carbon energy sources, consumers buying power through the main power grid still wouldn’t know if the clean energy they are buying is truly green, since they may be paying a premium for it. Having a robust energy ecosystem built on a blockchain will allow producers to register and log the energy quantities generated from each source type: clean vs dirty generation. Each unit of energy can be tagged to its source. Consumers can be assured that the source of energy is authenticated and immutable.

- Bank/Financier — Upon financing a wind power project, the lender will need to assess and monitor the cashflow of the wind project to ensure that actual revenues are consistent with projected revenues. DLT allows the financier to have an identical copy of the transaction ledger (possibly in real time). Having access to information allows them to quickly address any potential cashflow issue. A trust-less system means that the financier will incur less cost in verification, data authentication and in managing risk. Conversely, this also applies to cases where an existing wind power project requires refinancing. DLT ensures that data cannot be manipulated, giving financier assurance that a project’s power generation and actual cashflow is legitimate. Lower operational costs and risk> lower interest rates > more renewable projects become commercially viable.

- Grid operator — with small-scale energy transactions logged on the blockchain, grid operators are given visibility of the aggregated supply of power from distributed sources (solar panels, micro wind turbines) in near real time. Distributed generation data gives the grid operator more certainty in forecasting power demand and in deciding how much power is required by conventional power generators in the next power trading period (next 30-min block for instance). The removal or reduction of uncertainty means that the grid operator does not require excessive amount of generation reserve capacity, thereby reducing unnecessary cost to the grid and all consumers.

Reducing human intervention and manual execution (via smart contracts)

Smart contracts are software programmes which are stored in a blockchain. They can automatically execute a code when called, allowing actions to be executed or transactions to occur based on certain external conditions.

A few examples of energy contracts are Utility-to-Utility power trading, Retailer-to-Consumer supply, of even Peer-to-Peer trading of distributed energy lots. The complexity of these contracts range widely. A simple retailer contract, in plain english, could be: If a consumer consumes X kWh, he/she will be charged $P/kWh and billed D days after the end of each calendar month. Some contracts involve more complexity, such as time-varying energy price or energy prices that are dependent on other external factors such as the price of crude oil and/or foreign exchange rates.

Smart contracts can be written to include these logic sequences, with connections to external data feeds such as price, volume tiers or weather, allowing energy contracts to be executed automatically. Since contracts are executed by code, rather than humans+excel sheets, they have the potential to significantly reduce operational cost and reduce probability of error. Because of it’s inherent flexibility, smart contracts also have the potential to replace expensive ERP/CRM systems to generate energy invoices, bill the customer, receive payments and generate management reports.

Smart contracts are effectively programmes which are loaded into, and sit alongside traditional transactions within a blockchain, that can automatically execute pre‑definable code when called (for example, automatically executing the terms of a contract when trigger events occur). Think of a digital confirmation containing embedded IF.. THEN statements that could automatically be executed if certain price or volume conditions are met. — Deloitte

While smart contracts and oracles are still at a nascent stage of development today, we see huge potential in how smart contracts could be structured (full functional stack versus partially dependent on external software) to gradually fit into existing business process. This is a crucial step to widespread adoption.

Demand response

Demand response allows consumers to reduce their power consumption when the electrical grid is undersupplied in order to reduce overall system demand. This is most applicable in cities with lower power reliability, experiencing frequent blackouts or brownouts.

http://www.goodenergy.com/Energy-Efficiency/demand-response

http://www.goodenergy.com/Energy-Efficiency/demand-response

In most countries, demand response allows participants to receive revenues from the energy market operator by pledging to reduce their energy usage. In certain countries, where the existing metering infrastructure is not developed or robust enough to provide real-time monitoring of load reduction, consumers are required to record their voluntary power reduction and submit them to the authorities. This presents a trust issue. Imagine a situation where a consumer claims to have reduced his/her energy usage in order to receive a financial incentive, but did not actually do so. The entire system will be disadvantaged by these bad actors.

Also read: Fintech can be a tool in advancing energy inclusion and rural electrification

A distributed ledger that is updated in real time across all stakeholders is one solution to this problem. With blockchain (and appropriate use of tamper-proof hardware), authorities can ensure that consumers report their participation details to the market operator in a manner that is transparent and immutable. The ledger can be used in ensuring that all activities are legitimate between the participant and the energy market operators, allowing system-wide benefits both financially and socially.

Conclusion

Blockchain applications in a mature power grid have been limited. Many solutions that have been created are currently limited to micro-grids or for the renewable energy industry (tracking of generation source, logging of carbon credits or RECs). Solutions for P2P trading across a developed power grid remains a challenge due to settlement issues. Payments and default risks are also common issues, even in developed economies.

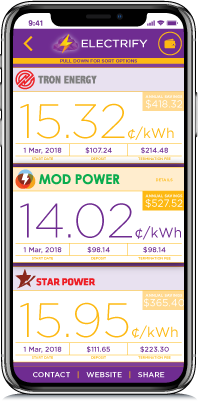

At Electrify, we see opportunity in this space and have developed solutions to solve these problems through blockchain technology. In the next few years, we expect countries across Asia to deregulate their electricity markets, bringing autonomy and the power of choice to small independent energy producers and consumers. We aim to build an platform to foster the maturity of this ecosystem, bringing choice and price benefits to consumers.

—-

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Featured Image Copyright: josefkubes / 123RF Stock Photo

The post Thinking out of the block, here are practical applications of blockchain in the realm of energy appeared first on e27.