Seedly co-Founder Kenneth Lou shares his thoughts on starting up Seedly

Founded in early 2016, Singapore-based Seedly is one of the fast-growing fintech startups. It was recently selected as part of Top 9 DBS Hotspot programme and has received investments from East Ventures and NUS Enterprise.

The Seedly app gives you overview balances, monthly cash flow and categorises all of your expenses automatically at a click of a button by syncing up to five banks.

It mainly targets the Singaporean millennials aged between 18 to 40 years old who want to keep track of their finances, where their accounts and balances are without spending too much time in putting together an Excel sheet.

Seedly was founded by Kenneth Lou, 24 and Chew Tee Ming, 26. Kenneth had worked on two startups before, but both failed to scale. A straight-A student through secondary school and a JC and NUS Scholar, he won the SMBA Young Entrepreneur of the year and Philip Yeo Innovations fellow in 2015.

L-R: Chew Tee Ming, Kenneth Lou

Tee Ming has been a programmer since he was 17 and studied at Temasek Poly and NUS (Computer Science major). He worked in corporate at KPMG before becoming one of the first back-end developers at Shopback prior to heading to Silicon Valley to work at Pixlee, a user-generated content marketing startup.

The two met in Silicon Valley, where Kenneth’s decision to stay at Tee Ming’s has led to them sharing and working on different ideas, and eventually Seedly was born. Tee Ming won a hackathon in Silicon Valley for the first version of Seedly while Kenneth raised their first grant round of S$10,000 (US$7,440) with NUS Enterprise in Singapore.

When Tee Ming came back to Singapore in January 2016, the two went to incorporate their startup and started validating the idea. Soon after, they raised their first undisclosed pre-seed round with Willson Cauca of East Ventures.

Also Read: BofAML, HSBC and IDA Singapore join forces to build blockchain trade finance app

The duo then joined the DBS Innovation HOTSPOT programme and progressed to the top nine startups out of over 290 applicants. Together, they have a potent mix of experience in startups, moving from ideas to the execution of mobile products.

e27 asked Kenneth Lou some questions over email about the frustration and consumer pain that led to founding Seedly, how the mobile app will benefit the ecosystem, and the problems the team plans to solve. The edited transcript is below:

What kind of frustration and pain point drove you to establish Seedly?

Personally, being part of this group of young millennials entering the workforce really helped. We surveyed our friends and families who have also recently started working, and we found that managing expenses and budgeting have been a mess, which, in their view, were burdensome and complex to deal with. Existing solutions like Excel sheets and manual tracking applications are time-consuming.

So we thought about how we could improve this issue, and sought to build something simple, accurate and secure – and Seedly was born.

The best part is that we are solving our own problems, and we use the app every day to track our monthly budgets and spending patterns over the months.

What are the problems that you were hoping to solve?

- Messy, complicated and time-consuming budgets (phase 1)

- Overspending every month (phase 1)

- Not knowing which financial products such as loans and cards are applicable to users (phase 2)

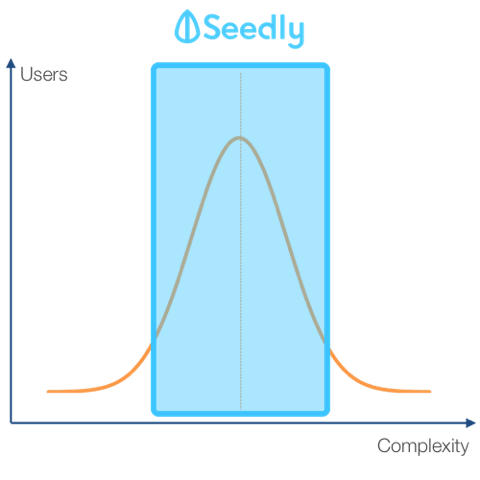

As seen in the diagram, we built Seedly for the middle 50 per cent of the population who are concerned about managing their expenses and savings but are not super detailed about it. They are not a lazy crowd who get buried in debt over time. We aim to help this group maximise their wealth over time, so we grow with our audiences as the product develops.

In what ways do you think Seedly will benefit the startup ecosystem?

We have been pushing things forward in a number of ways.

Seedly would mostly benefit the PFM (personal finance management) space in fintech. The banks are noticing this and amid the huge financial and economic downturn that we are experiencing right now, we will see good innovations emerging from banks and startups.

The idea is to create more success stories in the NUS Overseas Colleges (NOC) startup scene, and different generations have had different case studies.

For example, Mohan Belani and Thaddeus Koh were part of the first batches of NOC who started e27, and then it was Darius Cheung with 99.co, and subsequently Royston Tay and his co-founder with Zopim, along with the others.

Also Read: Mark your calendar: Apple Co-founder Steve Wozniak to speak in Singapore next week

It’s great to be part of a community of really driven people who carry the torch forward to continue to push boundaries and work hard towards creating meaningful companies.

We are a young bunch of change makers trying to push things forward and solve really hard problems – dealing with security and bank transactions to improve the lives of Singaporeans. On a personal level, I have been giving talks at young entrepreneur symposiums to inspire others to build a startup as well.

The time is now, and I strongly believe that in the next 50 years, it’ll be the age of innovation and entrepreneurship for Singapore. If we do not enter this phase, we will only lose out greatly to our neighbouring countries where skills are so much cheaper and affordable. We need to build on the knowledge workforce.

What are the challenges in building a fintech startup such as yours?

1) Regulations

Monetary Authority of Singapore (MAS) and the banks fall strictly within boundaries set by MAS with regard to precautions etc.

Since we are not dishing out financial advice or managing payments or stored values, we are less regulated. But for things like customer privacy, it’s of paramount importance that many fintech startups need to really be aware of.

2) Customer perception and concerns

To ask users to input credentials to allow us to help them pull data from their bank statements automatically is an uphill task. Inevitably we faced some resistance and drop-offs due to this.

The same thing happens to any fintech startup, for example Mint or Yodlee, which is an API provider that pulls data remotely from bank statements.

Also Read: OCBC Bank set to disrupt wealth management and customer service with these 3 startups

We need to reiterate the security of our system and have security audits to ensure that we are well protected against any breach.

3) Points 1 & 2 add up to time to market and strategy implications

With security and regulations being of utmost importance, we cannot simply launch any other day and think that everything would work. We are constantly solving problems and ensuring that the system becomes more secure over time and to build customer trust from the ground up.

It’s not like an e-commerce startup where a Minimum Viable Product (MVP) can be developed in a week and launched the following week. It’ll take us more time, especially with additional costs for security audits and other things factored in.

What is next for Seedly?

Right now we are hyper-focused on our early adopter segment, of which we have a good user base to begin with, and we have been ramping it up on marketing while we hire more in-house engineers to build the product further.

The goal will always be in line with our mission to make personal finance simpler, more accurate and secure.

we hope that users can continue to give us feedback and share their thoughts on how we can improve their experience to make it less fearful and less complex (to manage finances) on a daily basis.

We will be partnering with local banks to help simplify the experience even further to build on what they have done as well.

The post This fintech startup wants to make personal finance management a breeze to millennials appeared first on e27.