Also, Temasek plans to acquire Israeli cybersecurity firm Sygnia, and Foodpanda India buys food-tech Holachef

Temasek plans to buy cybersecurity firm from Israel Sygnia [Reuters]

Sygnia, the cybersecurity tech, and services provider from Israel confirmed that Temasek will acquire the company with an undisclosed amount of investment. The amount, according to a source, is reportedly around US$250 million, as stated in Reuters.

After the acquisition, the company that has offices in both Tel Aviv and New York will collaborate with Singapore’s VC firm’s portfolios while maintaining its operational independence.

As a cybersecurity company, Sygnia provides users with cyber resilience and help them defeat attacks within their networks. It was launched by Israel’s Team8 that specializes in cybersecurity in 2015 and up until now has only received one-time funding worth US$4.3 million by Team8.

The current head of the company is founder and CEO of Sygnia, Shachar Levy, will keep the position along with Nadav Zafrir, former commander of Israel’s intelligence unit 8200 and CEO of Team8 as the sitting chairman.

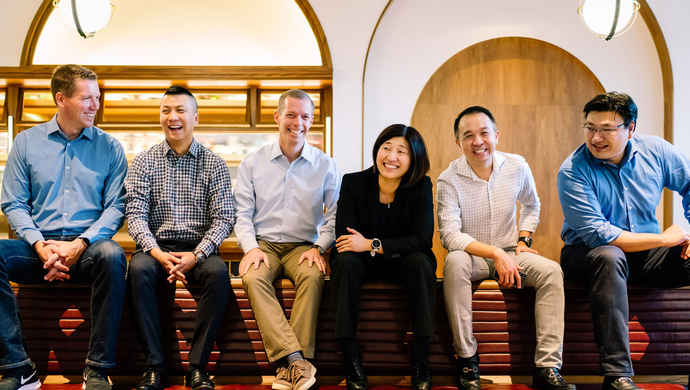

Alibaba’s initial investor GGV Capital raised US$1.9 billion to support more startups in U.S. and China [Bloomberg]

Known as one of the firsts of Alibaba’s investors, GGV Capital has made news for raising $1.88 billion in funding for technology startups in the U.S., China, and emerging markets. The amount is the largest the company has raised so far, and it will be distributed for companies at different stages, including US$460 million for early-stage startups and US$1.36 billion for later-stage companies.

Among the company’s most notable investments were Slack Technologies Inc., Chinese ride-hailing company Didi Chuxing, Airbnb Inc., and Square Inc. and Zendesk Inc., both have been publicly traded.

In total, the company has made investments to over 300 companies since its start of operation in 2000, in which 51 of them are valued at more than $1 billion.

Also Read: Online freelancing platform Fastwork raises US$4.8M led by Gobi Partners

GGV has partners in the U.S. and China, that allows it to spot opportunities other investors may have missed. The fund has also been investing more in emerging markets, including Southeast Asia and Latin America.

Foodpanda India acquires food-tech startup Holachef [Deal Street Asia]

Ola-owned online food ordering and delivery startup Foodpanda India has bought Holachef, a recently shut-down food-tech startup based in Mumbai for an undisclosed amount. With this arrangement, Foodpanda will take over Holachef’s employees and kitchen equipment and the founders will join the leadership team at Foodpanda.

Holachef will be Ola’s second acquisition within a year, which bought Foodpanda from Germany’s Delivery Hero in December last year.

Foodpanda will foray into cloud kitchens that currently are accessible to the claimed 150 million customers with its acquisitions, while also plan to launch its own food brand across categories. “We aim to build India’s largest cloud kitchen network that will be a major step in further elevating the food experience for our customers,” said Pranay Jivrajka, chief executive at Foodpanda.

Founded in 2014, Holachef delivers home-cooked food to customers and was based in Mumbai and Pune.

Uber is looking at US$120 billion company value upon proposing its IPO [Wall Street Journal]

Ride-hailing startup Uber is said to be valued at US$120 billion once it goes public next year, as shown in the proposals made by U.S. banks bidding to run the offering.

The amount of the valuation is about $50 billion more than the company’s most recent valuation, and it’s bound to be one of the biggest listings ever.

Also Read: Zalora ropes in Gunjan Soni from Myntra as its new CEO

Rumours have been swirling since late September that Goldman Sachs and Morgan Stanley were in pole position to secure top roles in Uber IPO, with both companies delivered the valuation proposals to Uber last month.

Uber’s rival Lyft is also gearing up towards its IPO expected in 2019.

Southeast Asia digital credit management service AsiaCollect acquires CREDITSEVA® for India’s expansion [Press Release]

As a part of its strategy to expand to India, digital credit management service AsiaCollect has acquired credit lifecycle management CREDITSEVA®. It is in line with AsiaCollect’s goal to help banks and non-bank consumer lenders in Asian emerging markets manage their non-performing loan (NPL) portfolios and unburden their debtors through digitisation.

Using CREDITSEVA®’s artificial intelligence (AI) technology-driven, customer-oriented debt collections approach and psychometric analysis, AsiaCollect will further strengthen its position as an integrated CMS

provider, its ability to improve recovery rates for lenders, and strong presence in the Southeast Asian market.

Following the acquisition, CREDITSEVA®’s team will operate in India under the AsiaCollect brand and jointly offer AsiaCollect’s integrated suite of digital CMS, including CMS Outsourcing and Advisory, NPL Purchasing, and Software-As-A-Service (SaaS).

AsiaCollect’s expansion to India is timely as it is estimated that unsecured consumer NPLs have risen 27 percent from 2014 until now, and is expected to continue to grow. India currently holds over US$150 billion in unsecured consumer NPLs.

POWERED Accelerator’s 6 women-led startups to get US$10K seed funding [press release]

POWERED Accelerator, an entrepreneurship programme in India focusing on women-led businesses in the energy value chain, has announced a seed funding of US$10,000 for 6 of the shortlisted startups from its first cohort of 10 startups.

The six women led startups selected for the seed fund are: Cellerite Systems, Loans4SME, HoneyComb Inventions, Kumudini Enterprises, Upcycler’s Lab, and Taru Naturals.

POWERED is a joint initiative of Shell Foundation (a UK based charity) the UK Government’s Department for International Development (DFID), Government of India’s Department for Science and Technology (DST); and managed by Zone Startups India.

The accelerator recently showcased its first cohort of women-led startups and their innovative technology solutions to an audience of investors, corporates, multilaterals, government representatives, and CSR heads at the India Habitat Centre.

–

Image Credit: GGV Capital

The post Today’s top tech news, October 17: Alibaba’s early backer GGV Capital just raised US$1.9B appeared first on e27.