In case you missed it, here are some lessons shared and learnt at e27 Academy

Earlier this week, I gave a talk at e27 Academy in Batam, Indonesia, about how we can unlock the visionary within and consistently build world changing products. Radical Product Thinking means devising improvable systems (“products”) to achieve your desired impact on the world.

The change you are working to bring to the world isn’t necessarily through a high tech product. It could be through the work of your non-profit, the research you’re conducting, through freelance services you’re offering, or even by remodelling the kitchen for your family.

Anything could be your product if it’s your mechanism to bring change.

Consequently, you can apply product tools (Vision, Strategy, Roadmap, Execution and Measurement) to any product you’re building, to create change more effectively.

e27 Academy brought together a diverse group of over 150 entrepreneurs and innovators representing more than 16 countries, and a range of verticals, from social enterprise to tax software, from modular furniture to supply chain logistics. This diverse group of people had one thing in common: They are all working to bring a change to the world by solving a problem that inspires them.

Here are some of the questions that came up at e27 Academy that have also been asked on other occasions by entrepreneurs I’ve met around the world:

1. We’re fundraising — how do we demonstrate traction for our product?

The startup world teaches us that “traction” means showing growth in popular metrics such as registered users, ARR (Annual Recurring Revenue) and LTV (Lifetime Value) of a customer. Pirate metrics might be exactly the right kind of metrics for you to track, but they come packaged with certain assumptions about your business which may or may not be accurate.

The activity of “growth hacking”, a term coined in 2010, means making growth your “true north” and scrutinizing everything “by its potential impact on scalable growth”. But growth alone is not the right metric for success. Your product should be measured by whether it’s helping you create the change you desire in this world.

Trying to simply improve on metrics, whether or not they align with your vision and strategy, leads to a product disease we call “hypermetricemia”. The biggest symptom? Making many small changes to the product and iterating to optimize metrics, but not necessarily getting any closer to your vision. A data-driven approach to building your product is great — but only if you’re measuring the right things. “Data-driven” is often taken to mean that the business and product are driven by the metrics.

Instead, derive the right metrics to measure traction for your business by starting with a clear Vision, building a Strategy based on that vision, a Roadmap based on the Strategy and then a hypothesis-driven Execution and Measurement plan. Here’s a link that explains how you can arrive at the right metrics for your business.

Educate your team and investors. Don’t fall prey to setting your measurement strategy based on how investors or popular metrics might define “traction”.

Think of measurement as burning down each of the risks in your business so you can prove to yourself that there is a market and that your approach at addressing this market is working. Educate your team and investors on why the metrics you selected are the best indicators of traction for your company.

Also read: We need to tap more into culture in determining our product strategy

2. Working on my new product will help me reach my end goal. But what if I have a cash-cow today that I need to maintain and support if I want to survive? What do I prioritize?

As a startup, your resources are limited and you have to make decisions on how to spend these resources in reaching your vision while balancing day-to-day needs. It helps to visualize your prioritization. This approach for prioritization requires defining two concepts for your team:

- Vision: What’s the end-goal for the team? You can define the “source-code” for your vision using this approach that will then be “compiled” into a more polished form for specific media and audiences.

- Sustainability. What’s the biggest existential threat to your product? Typically, for startups, running out of money is the biggest threat, but this may not be the biggest threat for your startup — use this approach to evaluate yours.

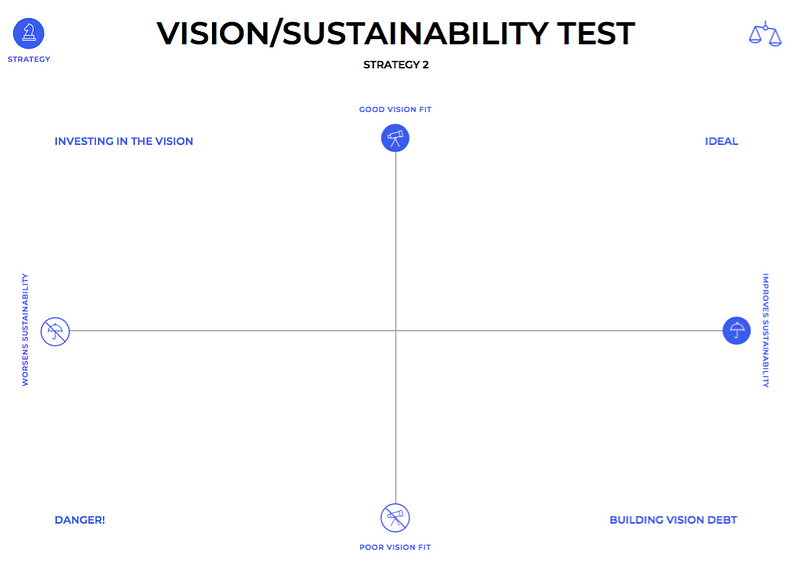

With those defined, you can use the following rubric to evaluate opportunities and features on how they contribute towards achieving the vision vs. helping the product survive. Here is an example on how an organization, The Avenue Concept, used this approach for prioritization.

To summarize the quadrants in the rubric:

- Ideal: Opportunities in the top right quadrant are those that most closely match your vision and reduce existential risk — if there are features that are genuinely needed on the cash-cow and your new product, they fall in this quadrant.

- Vision Investment: Items in the top left corner are a good vision fit, but might raise your risk exposure in the near term. These can be worthwhile to pursue, but not if you’re already in a precarious situation. Take on as many of these as your situation allows.

- Vision Debt: Items in the bottom right corner are ones that reduce your risk exposure, but are a poor fit for your vision; pursuing them results in “vision debt”. Incurring vision debt can help keep you alive during tough times, but ultimately will derail your efforts if too much is allowed to accumulate. Use vision debt wisely to fund investing in the vision.

- Avoid it: Items in the bottom left are both a poor vision fit and expose you to additional risk.

The approach is simple but powerful and has proven immensely useful to companies when I’ve introduced this in workshops — these companies use it at all levels, from product teams to boardrooms. You’ll find that this approach helps you get more buy-in from your team because it communicates not just the priorities but also the rationale for priorities. Further, it gives your team the tools to evaluate opportunities so that they can make decisions aligned with your collective goals, even when you’re not present.

Also read: Craft your mission-vision not just for yourself, but also your detractors and competitors

3.1 My product addresses the needs of 2 different customer segments. Am I Strategically Swelling (or bloating) my product if it serves more than 1 customer segment?

When you are addressing 2 different customer segments, you are most likely creating two different products (or bloating one). It may look like they have the same needs, but as you start building your product, the differences start to emerge. For example, if you’re building robotics for the beverage industry and for general merchandise, at a high level the problem might sound the same. These robots have to pack cases on top of each other. But as you delve into testing your product you discover that the weight of these products has implications — in the beverage industry you can stack cases of Pepsi on top of one another, but in general merchandise the robots would destroy stock if they were to stack heavy goods like canned beans on top of aluminium foil.

This is also true for B2C. When I founded my startup, Likelii, to build Netflix for wine, we could have targeted amateur wine drinkers or the experts — after all, both customer segments were looking for wine recommendations. But the needs of the two groups are very different: Wine is subjective, and the wine expert would always have a strong opinion on the accuracy of a recommendation. But an amateur wine drinker finds wine intimidating and is open to suggestions rather than scrutinizing them. So our focus was on the amateur wine drinker.

As a startup it’s very difficult to target 2 customer segments and to sustain parallel development efforts. This is why the Vision worksheet only gives you one slot for identifying your target customer segment. Choosing the right customer segment for your business is a hard but rewarding endeavour. Here’s a post about how you can start to identify Real Pain Points for your customers. By having only one product vision for your product and thinking strategically about your target segment, you can avoid Strategic Swelling.

3.2 My product is a marketplace — I have 2 customer segments, buyers and sellers. Shouldn’t I have 2 visions for my product?

Even if you have this marketplace problem, your product vision must be to serve a specific customer segment. But to serve that customer segment, you may need to also make other groups happy. For example, let’s say that buyers are your chosen customer segment. In a marketplace buyers won’t be happy if there are no merchants selling on that platform. So you’ll need to also do enough to encourage merchants to be there. By keeping your primary focus on one, you can establish trust with that group. Amazon has buyers and sellers on its site, but it’s very clear that their vision focuses on the consumer.

You may occasionally need to trade-off which of the two sides of the marketplace you need to please — use the Vision vs. Sustainability approach to make these trade-offs when needed.

In the interest of keeping this post short (relatively), in our next post we’ll cover more questions we hear from entrepreneurs globally. In the meanwhile, share your questions and feedback below!

—-

A shoutout to the e27 team for putting together an impeccable event at e27 Academy and bringing these inspiring founders and innovators together: special thanks to Mohan Belani, Jiaway Koh, Shernice Lum, Jared Meng and Ash Philomin.

Product is a way of thinking. Radical Product is a movement that’s applying the best insights and techniques of product thinking throughout life and work. You can use the free and open source Radical Product Toolkit if you’d like a step-by-step guide to help you start applying Radical Product thinking today.

—-

This article originally appeared on Medium and was first republished on e27 on December 6, 2018

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Join our e27 Telegram group here, or our e27 contributor Facebook page here.

The post Top questions asked by entrepreneurs around the world, part 1 appeared first on e27.