The CoinDesk report on the state of Bitcoin and blockchain industry also revealed that the Chinese government’s crackdown on Bitcoin leaves no negative impact on its prospect

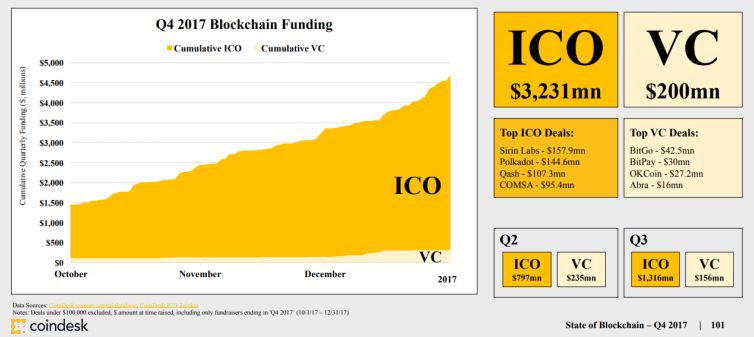

The number of funds raised through ICOs in the last quarter of 2017 had reached US$3.23 billion, with venture capital (VC) amounting to US$200 million, according to a report on the state of Bitcoin and blockchain industry by CoinDesk.

The report also noted several record-breaking deals in Q4 2017, such as Sirin Labs’ US$158 million ICO, which falls into the third biggest of all-time. As a comparison, the biggest VC deal made by a blockchain company in the same period was a US$42.5 million funding round raised by BitGo.

However, it also revealed that ICOs are “less spectacular” when raised in Ethereum; with companies raising 56 per cent more in Ethereum as compared to 146 per cent more in US Dollar.

Apart from ICO, the report also highlighted the bright prospect of forks. While ICOs were able to reach record-breaking number in Q4 2017, it is important to note that Token Generating Events (TGEs) had been dominated by forks with US$44.3 billion.

By December 31, 2017, the market cap for Bitcoin Cash was US$40.13 billion and US$4.19 billion for Bitcoin Gold.

“Forks and airdrops come with a built-in user base (generally bitcoin HODLers) and were much more significant to the overall market cap in cryptocurrencies,” explained CoinDesk in a press statement accompanying the report.

Also Read: Today’s tech news, Feb 09: Indonesian bitcoin PoS firm Pundi X eyes India entry

“The Bitcoin cash fork was the first to surprise the industry with the interest it generated, catching several exchanges flat-footed when users demanded their inherited property,” they added.

Government and regulation

The Chinese government recent crackdown on ICOs and Bitcoin exchanges had led the public to fear for the prospect of the cryptocurrency, but the report noted otherwise.

“Any look at trade volumes and markets pre-2017 would have led the reader to believe that Bitcoin and cryptocurrencies would suffer from this loss. But even with all Chinese exchanges closing on the final day of Q3, Bitcoin promptly went on its greatest bull run ever,” CoinDesk explained.

“In short, it seemed no one cared that China was out. Rather, it was an opportunity for new players,” they concluded, naming South Korea as an important cryptocurrency trading hub in Q3 and Q4 2017.

Generally, in Asia, the trend is for governments to issue more regulations from cryptocurrency.

While countries such as Indonesia has been reaffirming the illegal status of cryptocurrency as a payment method, Japan has approved four new cryptocurrency exchanges in the same year.

India and Malaysia are the countries that are seeking to regulate cryptocurrency in 2018, together with South Korea.

Who bought Bitcoins?

The report also noted how the cryptocurrency market has “significantly” diversified. While Bitcoin’s value represented over 90 per cent of the cryptocurrency market in January 2017, the launch of the ERC-20 smart contract has allowed Ethereum to gain traction.

Also Read: Bitcoin is tanking because it will never replace cold hard cash

“Demand for Ether (generally needed to participate in many ICOs) grew, and so did the ability to finance and create new blockchains. This chipped away at bitcoin’s dominance in the market until Q3, when Bitcoin reversed the downtrend,” it explained.

Eighty-six per cent of more than 3,000 respondents in the survey stated that they owned over three unique digital assets, with 89 per cent of them being unaccredited investors.

It is also interesting to note that 82 per cent of respondents claimed that they did not go into debt to purchase crytocurrency; 52 per cent of those who did already paid it back.

“The important and historic takeaway is that if Bitcoin is indeed a bubble, it is the rare kind that has inflated with little leverage or borrowed money,” the report said.

—

Image Credit: Johannes Plenio on Unsplash

The post Total funding raised by ICOs hit US$3.23B in Q4 2017, exceeding VC by 16+ times: Report appeared first on e27.