The number of Chinese tech IPOs is expected to rise in the near future in Hong Kong and the US

The article Taiwan’s crypto scene is booming, but still needs a clearer regulatory framework to thrive by Nicole Jao originally appeared on TechNode, the leading English authority on technology in China.

China’s tech IPO craze is reaching a fever pitch. On July 12, the executives of a whopping eight Chinese companies that went public on the same day were forced to share their time of glory at the Hong Kong Stock Exchange due to a bell shortage. Compared with their foreign counterparts, this is even a bigger compromise for Chinese execs given their love for stage props. The US is seeing something similar: three Chinese tech firms including Pinduoduo went public in the US on July 26.

China’s IPO wave

Ever since last year, an increasing number of Chinese tech companies can be seen joining the IPO craze. A PwC China report shows that 23 Chinese companies, including China Reading, raised a total ofUS$4.65 billion in H2 2017, making the country the largest global tech community in terms of the number and total value of IPOs. The tendency continues this year with a roster of big-name companies such as Xiaomi, iQiyi and Pinduoduo, and unicorns from various verticals such as Liepin, Inke, Baby Tree and 51 Credit Card.

Image Credit: Tiger Securities

As a part of this trend, Chinese companies are turning to stock markets in Hong Kong and the US over the mainland market, marking the fifth overseas listing rush.

In 2000, internet tycoons like Sohu, NetEase, and Sina forged their way into the US stock market. With respectable performance that bucked disappointing IPO offerings in the US market, the three news portals soon gained the attention of global investors. The term “China Concepts Stock” was popularised to refer to Chinese companies—or in a more narrow sense, Chinese tech companies listed abroad.

Chinese tech firms’ love for the overseas stock markets has gone through hot and cold periods since then depending on the tech trends of the time. Baidu and Ctrip went public in the US and Tencent in Hong Kong between 2003 and 2005, a period when China witnessed some of its tech powerhouses establishing their dominance. As the market grew, so did the number of unicorns from various verticals. Companies who listed from 2010 to 2012 include Youku (video streaming), YY (video streaming), and Qihoo (online security).

Also Read: This Philippine-based startup is going head-to-head with Eatigo; raises US$2.3M via IPO

The blockbuster IPOs of Alibaba and JD made 2014 a year of e-commerce. Social is another theme of the year with the IPOs of Weibo and Momo, currently two of the country’s largest social networking platforms.

Appetites for overseas listing started to cool off at the beginning of 2015. Since then, nearly thirty US-listed tech stocks initiated privatization plans in search for a domestic re-listing, with big names among them such as Qihoo 360, Momo, Perfect World and Shanda Games. But the enthusiasm for privatisation soon wore off as the government suspended the launch of both a register-based regulation system and the Strategic Emerging Board, a market dedicated for science and technology innovation enterprises. The two moves were expected to facilitate IPO of tech firms.

Overseas listing started to warm up again at the end of 2017. Similar to previous trends, the current IPOs reflect the keywords in China’s tech world – the “new economy” and consumption upgrading. China’s “new economy”, also known as the digital economy, totaled RMB26 trillion (US$4.28 trillion), representing around 32 per cent of the national GDP in 2017.

“Each IPO wave consisted of companies with mixed qualities. Some companies went public for the funding they needed for long-term and sustainable development, but some are just following the trend to cash out,” according to Wang Shan, an analyst at online brokerage service Tiger Securities.

Destination decisions

Chinese tech companies seeking to go public have a few options to choose from – China, Hong Kong and the US.

Most Chinese tech firms are under the VIE (variable interest entity), a structure that’s adopted by many tech startups to lure foreign investment. For them, this rules out the option of a local listing since China’s stock market only receives companies that are registered in the country. Of course, they still can go for a local IPO by removing the VIE structure, but the process is often costly and time-consuming.

What’s more, the threshold for domestic listing is high. For example, Chinese mainboards require listed companies to record sustained profitability, a condition most internet companies can’t meet in the first few years of operation.

Also Read: E-sports video streaming site Douyu planning a US IPO

In addition, China’s merit-based IPO regulation system is subject to strict rationing and control, with protracted periods before actually getting listed. This is a huge concern for tech firms, which would prefer quicker funding to adapt to the changing market. China’s market is also subjected to tight government regulation. The state has suspended IPO process nine times in history with suspension time varying from three to 14 months.

The Hong Kong Stock Exchange is a popular listing destination for Chinese tech startups thanks to similar culture, geographical adjacency, and a mature system. Thanks to a registration-based system, the listing time is shortened to around three months. But its market size is relatively small compared with the mainland and the US: only 1/30 of New York Exchange and 1/4 of NASDAQ, resulting in lower fundraising capacity and valuation. Over the past decade, traditional financing companies have been dominating Hong Kong, while internet and technology companies account for only three per cent of its total size. The figure for Nasdaq and New York is 60 per cent and 47 per cent, respectively.

Chinese tech firms’ enthusiasm for Hong Kong rallied as the Hong Kong Stock Exchange shifted to a dual-class shares mechanism in April 2018, which allowed tech firms to have share classes with different voting rights. The absence of this system is one of the major reasons that barred the likes of Alibaba Group Holding Ltd. from considering the former British colony. Missing out on Alibaba was a big loss to Hong Kong market, not only because of the sheer size of the company but also because it would have made Hong Kong a more attractive destination for tech companies that might follow. Five years later, businesses are finally able to apply for listing under the dual-class share regime.

The US has the most mature stock market in the world, but for Chinese companies, it’s difficult to explain their product and business model to investors who have a different culture, and therefore make it hard to get the valuation they expected. The market has a higher entering requirement for Chinese tech firms in terms of language, information disclosure, investor relationship, and costs.

Big boy pipeline

Since Alibaba, not many China tech companies have made it to IPO but now, many are ready to take the leap.

A string of tech tycoons has raised an average of four to five rounds of financings by now. Companies like Xiaomi and Meituan have been basically backed by nearly every prominent private equity and it’s difficult for them to get funding in the primary market at their hefty valuations. An IPO could be the only channel for them for further funding. The massive IPO wave has, in turn, sparked rumors about the long-anticipated IPO of Ant Finance, Didi, and ByteDance.

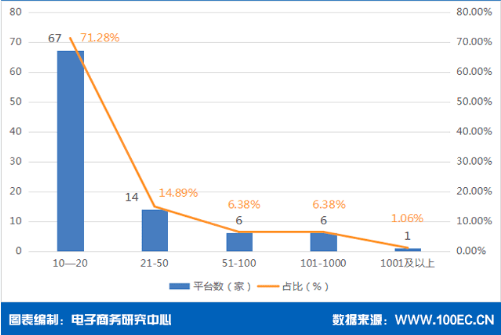

Number of Chin’s unicorns by scale

China’s tech boom has been fostering a lengthening list of IPO candidates including super big titles as well as vertical unicorns. Three are 94 unicorns in China’s e-commerce-related industry with a combined valuation of US$479.92 billion, according to a report from the E-commerce Research Center. Ant Financial tops the list with a US$150 billion valuation, followed by Didi Chuxing (US$56 billion), Meituan Dianping (US$30 billion), JD Finance (US$20 billion), Cainiao (US$20 billion), Lufax (US$18.5 billion).

The market morale is still high. More companies will flock to the Hong Kong market after August, followed by an IPO peak around September to November, Charles Li, executive director of the Hong Kong Stock Exchange, told local media.

CITIC Vice President of Large and Medium Corporation Simon Tseung echoed Li’s prediction. He told TechNode that the IPO craze is going to continue in the near future for both Hong Kong and the US in line with the rise Chinese tech unicorns.

—

The article Taiwan’s crypto scene is booming, but still needs a clearer regulatory framework to thrive first appeared on TechNode.

The post What China’s history of overseas tech IPOs says about the current wave appeared first on e27.