Alibaba, with its financial arm Ant Financial, is already the largest shareholders of Ele.me

The article What does Alibaba’s takeover of Ele.me mean? This is what China is saying was written by Masha Borak for TechNode.

This week has been brimming with rumours on Alibaba’s takeover of food delivery platform Ele.me. Media reports stated that Alibaba plans to purchase food delivery platform Ele.me for US$9.5 billion. Both Alibaba and Ele.me have declined to comment on the rumours but we know one thing: something is definitely cooking between the pair.

Beijing Hualian Department Store, a shareholder in Hong Kong-based Rajax which owns and operates Ele.me, announced today that Rajax is indeed talking to Alibaba about increasing its stake in Ele.me. However, the deal is still not settled:

“Key issues like price, timing, volume and the method of any equity transfer are still under discussion,” Hualian told Reuters.

So why is Alibaba’s potential takeover of Ele.me so important? Alibaba together with its financial arm Ant Financial are already the largest shareholders of the company with a 32.94 per cent stake. Rumours about the acquisition have been circulating in Chinese media for quite some time. Ele.me’s CEO Zhang Xuhao went online on Monday to tell everyone to “cool off.”

Screenshot from WeChat Moments

“I hope all my friends and relatives could calm down a bit! Every year we have this news, it seems that strength is not enough, we need to continue working hard,” Zhang said somewhat cryptically on his WeChat Moments.

What Zhang was referring to is the rumour that struck headlines in December last year that stated that Alibaba will takeover Ele.me because it did not meet its VAM, an agreement that allows investors to claim their money back if the company they invested in fails to deliver. Both companies have denied the claim but speculation on the future of Alibaba and Ele.me continue to abound.

Also Read: Baidu Waimai said to merge with Ele.me

Many of these speculations refer to the future role of Koubei, Alibaba’s own delivery service. Some are guessing that Ele.me will merge with Koubei and be placed under Alibaba Group CEO Daniel Zhang (Zhang Yong). Ele.me already has formal access to Koubei and is integrated into Alipay’s app.

Others think that different combinations are possible. Last year, during Alibaba’s and Ant Financial’s US$1 billion investment into Ele.me (the second in a row), Alibaba said that Koubei and Ele.me would divide their areas of work. Koubei will focus on restaurants, Ele.me will focus on delivery to homes. Koubei has already completed a layout of an unmanned restaurant in Hangzhou and at the same time, it’s trying to create a new market through the semi-finished dishes, according to aTencent Deep Web report.

An obvious benefit of Alibaba’s potential purchase is Ele.me delivery system called Hummingbird (蜂鸟) which, according to latest data, filled 4.5 million orders daily in 1200 small- and medium-sized cities. The main goal for Alibaba is to solve the human efficiency problem through data. This army of delivery personnel may become an important component in Alibaba’s “new retail” plan.

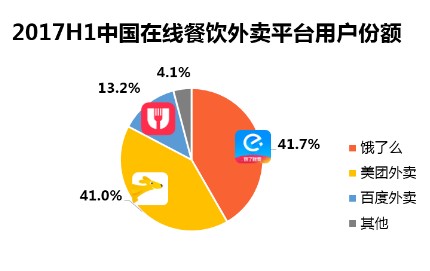

One thing we do know is that if the Alibaba and Ele.me deal goes through, it will further cement the duopoly between Alibaba and Tencent in the food delivery business. Tencent is backing O2O (online to offline) platform Meituan-Dianping which covers a wide variety of services, from food delivery to hotel booking to group buying. iiMedia figures published in the first half of 2017 show that Ele.me held 41.7 per cent of the food delivery market, while Meituan-Dianping had 41 per cent and 13.2 per cent belonged to Baidu’s takeaway service Baidu Waimai. Baidu officially walked out of the race in August last year by selling Baidu Waimai to rival Ele.me.

Screenshot from iiMedia.

Also Read: Ele.me CEO: Only two food delivery platforms will be left in China

According to business analyst Doug Young, with the food delivery market neatly split up between the two tech giants, we are likely to see a cooling period in this area. However, this does not meant that the battle is over.

One of the reasons why Alibaba and Tencent chose to get into food-delivery startups is to further boost their payment services, Alipay and WeChat Pay. But food delivery is just one piece of the puzzle in propping up mobile payment usage. From booking hotels, flights, and movie tickets, to “new retail” ventures, the O2O market in China is brimming with opportunities. There are many areas which are experiencing similar proxy battles between Alibaba and Tencent. In short, the fun is not over.

—

The article What does Alibaba’s takeover of Ele.me mean? This is what China is saying first appeared in TechNode.

The post What does Alibaba’s takeover of Ele.me mean? This is what China is saying appeared first on e27.