Here’s why the KFit founder thinks there should be a stronger partnership between China and Southeast Asia

KFit Group Founder Joel Neoh

Along with the globalization drive of Chinese companies, China is having a greater influence on the rest of the world as a marketplace, a foreign investor, and more importantly, a source of innovation. Southeast Asia (SEA), a densely populated region that’s expected to foster the next unicorn, is among the areas that are feeling these impacts.

Thanks to geographical adjacency and cultural similarities, SEA has become the first stop for Chinese companies when expanding abroad with an increasing number of Chinese firms like Huawei, Alibaba and Xiaomi are taking their foothold in the region. But what, if anything, will SEA startups gain from this boom?

Also Read: With an aim to become a full-fledged O2O platform, KFit Group acquires Groupon Malaysia

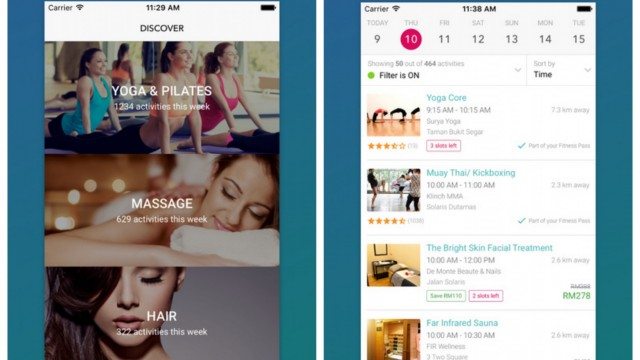

TechNode got a chance to speak with Joel Neoh, CEO of KFit and former head of Groupon Asia-Pacific, to hear from the other side of the story. Malaysia-based KFit is a gym pass and O2O commerce platform that offers subscribers cheap health options and other offline services like salon and spas. As a hit startup in the region, KFit has marked a series of milestones this year. After securing a US$12 million series A round this February, the company acquired Groupon Malaysia and Groupon Indonesia earlier this year.

Screenshots of KFit App

What does China mean for SEA startups?

China is significant because it has really laid the groundwork for startups in SEA. As frontrunners in online-to-offline (O2O) commerce over the past decade, Chinese startups have evolved into ‘tech giants’ in the world’s largest developing market. They’ve proven that there is a massive growth opportunity in countries with fast-developing infrastructure and rising middle-class income levels.

It’s encouraging to see a lot of similarities between China and SEA. Our current landscape is very similar to China’s of five to ten years ago. For this reason, we expect China to play two key roles for SEA startups: as a provider of strategic capital and as a knowledge-sharing partner.

I see a huge opportunity for China to partner with us as we develop the SEA commerce ecosystem through popularising high-frequency use cases, such as restaurant payments on online platforms, and other means. We are currently exploring collaborations that will help us capitalise on fast-improving infrastructure and growing mobile penetration across the region to serve SEA’s vast population.

The O2O model is in full swing in China. KFit launched Fave earlier this summer to pioneer the O2O trend in SEA. What were the obstacles you faced in localising this model for local market?

Benefitting businesses and consumers alike, our O2O platform is already proving its worth in SEA. It successfully generates increased sales for offline businesses (such as restaurants, spas, movie theatres, gyms, and so on), while also offering great savings and convenience to consumers. To date, we have sold over 5 million online vouchers for offline businesses in Indonesia, Malaysia, and Singapore.

For us, the key aspect to localising this model is to have a deep understanding of the language, culture, consumer habits, and regulation in each country we want to serve. There is no shortcut to this knowledge; we invest a significant amount of time and energy in each of our markets. We work with teams of local experts who understand local merchant requirements and who know local consumers and how best to appeal to them.

What tech trends coming from China do you think would have the potential to grow in the Southeast Asia market?

I think there’s huge potential for the ‘consumer internet’ and everything related to it. By this I mean businesses that offer services, products, or content to capitalise on the growing consumer class and the growth of internet and mobile adoption. There are also promising opportunities for large companies to support digital commerce through better and more convenient payment solutions.

Also Read: After the deal: How one-year-old KFit managed to acquire O2O behemoth Groupon’s Malaysian business

As we continue to build our O2O platform in SEA, we see a big opportunity for local services. Even more than transportation or physical goods e-commerce, this sector holds great promise due to how frequently people use local services. At this point, the market is still pretty fragmented and no single player dominates. However, the rapid development of the mobile wallet in SEA will further expedite the adoption and development of O2O local services. This is creating a gap in the market that we hope to close.

As the economy in China slows down, India, being backed by developments of SEA, is expected to overtake China as the next innovation hotspot. How are your views on this?

Like China, both India and SEA have a huge consumer base and growing technology adoption. With a combined population of almost 2 billion people, India and SEA have to be a significant piece of any technology giant’s globalisation plan.

India, in particular, has greatly benefited from an influx of global investors. The market is currently the ‘sweet spot’ for China’s BAT companies: the ‘big three’ of Baidu, Alibaba and Tencent. All three are very active in India, with Alibaba investing in Paytm and Snapdeal, Tencent’s Hike and Practo, and Baidu-backed Ctrip investing in India’s largest online travel agency MakeMyTrip.

SEA is currently at an earlier stage of the cycle. For example, in 2015, total investment in Indian startups was US$9 billion, compared to US$1.6 billion for SEA startups. So while SEA is quite far behind India in terms of funding today, we foresee that SEA will be the next region to hit an upcycle.

Google, Amazon, and Microsoft for the US; Baidu, Alibaba, and Tencent for China. What about the tech giants in Southeast Asia? How does the dominance of internet giants impact the local entrepreneurial environment?

The tech giants of the US and China have led the tech world to where we are today. For example, China’s BAT have together played a crucial role in educating the market and spearheading growth in the tech industry over the past decade. Local startups benefit from the ecosystem that these ‘big three’ have built.

In SEA, the more well-funded startups like Lazada, Gojek, and Grab are burning cash and investing time and effort into educating the market about e-commerce and mobile payment. Many startups and growing platforms, like Fave, will benefit from the efforts of these trailblazers to popularize online payment. SEA is still an open market at this point, with a few companies with the potential to grow into the SEA equivalent of one of China’s BAT companies. That’s something we at Fave are aspiring to.

Most disruptive startups attract customers by providing more convenient or cheaper services. The early explosive growth is usually reliant on highly-subsidized models – that’s the case for China’s Didi Chuxing and several others. When the company stops providing subsidies or discounts, they risk losing customers. KFit has just discontinued the offer for unlimited classes for more sustainable profits. How do you balance this?

The core value proposition of our O2O platform is convenient savings for customers and increased sales for businesses. This was our underlying aim when we started, back in April 2015, helping consumers save money and get fit while also supporting gyms and fitness studios to increase sales and gain customers. After signing up more than 65 per cent of all gyms and studios in our key cities in SEA, we are now expanding the same value proposition across new verticals, such as dining, health and beauty, and entertainment. The acquisition of Groupon Malaysia and Groupon Indonesia allows us to integrate millions of customers and thousands of merchants into Fave, achieving greater scale of impact.

Also Read: KFit emerges as survivor of the fittest; absorbs Passport Asia

In terms of the high-subsidy business model, we must remember that the subsidy is strongly correlated to competition; it’s a factor when competitors are backed by funders with deep pockets. And this is not yet happening in O2O local services in SEA — especially as our largest competitor, Groupon, is now part of our business. As the early market leader in this space, we’re now prioritising growth in order to establish our position and ensure we dominate the market in terms of users and supply. In the platform business, there is no room for more than two players and so the fight for market position is intense. Once you become a dominant player, you can set sensible prices and increase profits.

Any tips for Chinese startups that are aiming to expand into the Southeast Asian market?

My best advice for anyone aiming to grow in SEA is to find or invest in a local partner. If you’re already considering a local partner to help you avoid the pitfalls of doing business in our diverse region, try to partner with an individual or company with a strong entrepreneurial spirit. You need someone who can be very nimble and react quickly in order to win in this market. In general, I’d say the SEA startup scene is ‘fast eat slow’ rather than ‘big eat small.’

There is a rise in the number of Chinese entrepreneurs born in the 1980s to 1990s. As a part of this generation, what are your views on the rise of young entrepreneurs globally?

I believe there is rebirth of renaissance thinking among Chinese entrepreneurs of this generation; they believe that they can win globally as well as locally. Better education and global exposure over the past 10 to 20 years, coupled with passion, hard work, and strong ethics have increased the confidence of Chinese entrepreneurs, encouraging them to compete with the rest of the world and build winning global companies.

—

The article What does China mean for Southeast Asian startups? Q&A with KFit Founder Joel Neoh was first published on TechNode.

The post What does China mean for Southeast Asian startups? Q&A with KFit Founder Joel Neoh appeared first on e27.