In most jurisdictions, it is easier to buy a bank than to obtain a new license

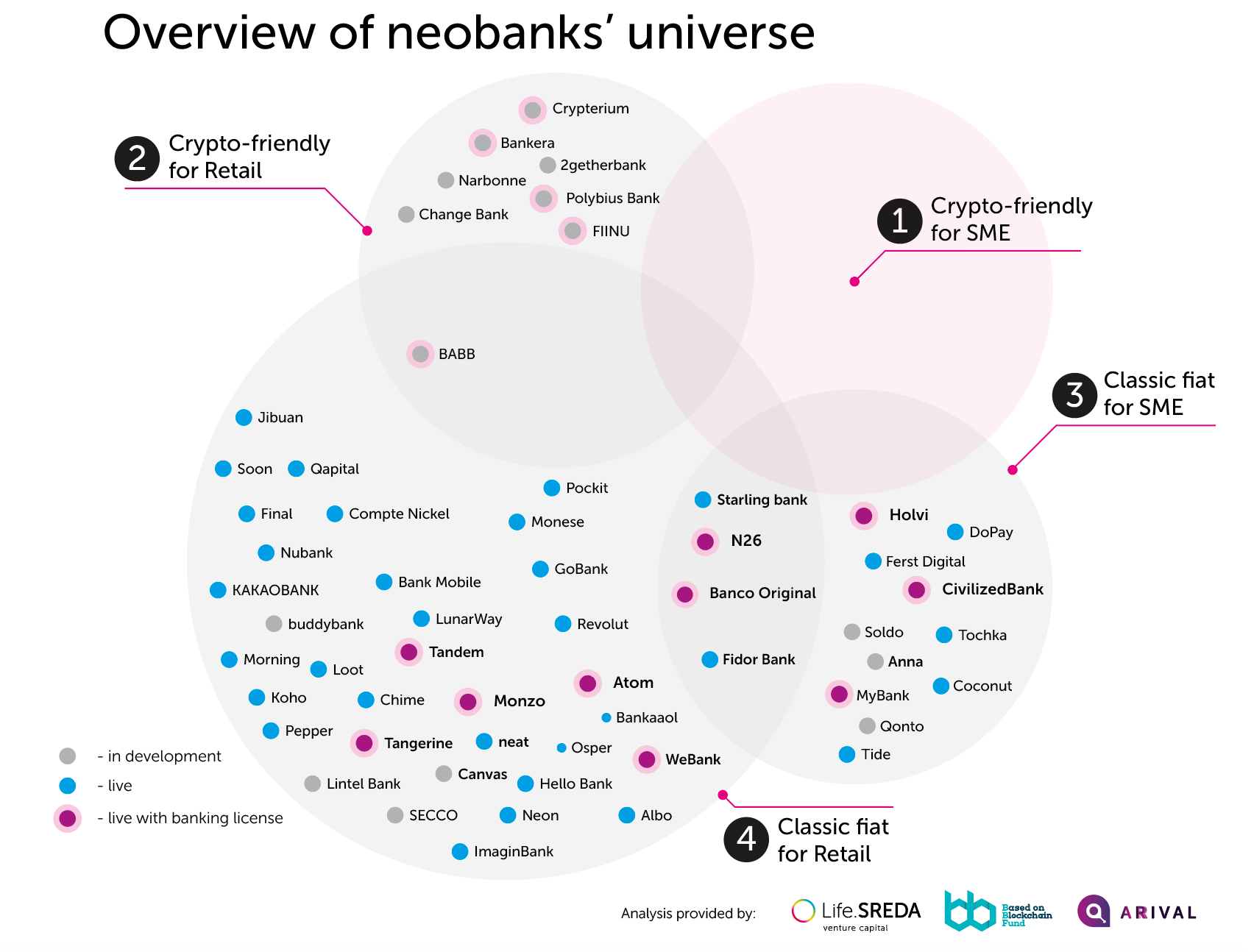

There are 8 newborn crypto-friendly neobanks like Polybius and Change. Two have already held ICOs, and six are in the process. They have already raised more than US$45 million in crypto, and are going to raise about US$150 million in aggregate. This is about half of the investment attracted in 2016 by “traditional” fintech neobanks like N26 and Tandem, which are higher in number and at a later growth stage!

None has gone live — at best, they have implemented a registration module for the future neobank (digital KYC). But even these solutions in the field of blockchain-based digital KYC, judging by the information available, have not been accredited by the central banks or data protection authorities. Meaning that these startups just have it.

All are going to serve retail customers — no one is focussing on small and medium business. Whereas in the context of major problems with traditional banks and the existing (not in the future but current) needs for crypto-friendly neobanks, it is the SMEs that are now the most mature target audience: About 500 startups that have already held ICOs (raising over $3 billion which they can’t freely use), crypto-exchanges themselves, crypto-payment startups, and other community members. Moreover, these SMEs are now bringing greater number of retail customers (their employees, partners and customers) than those predicted in the future by new crypto-friendly neobanks.

They are all being established by those who have launched startups before (in some cases fintech startups, but not Class A names), but not banking startups (lacking the experience of communicating with the regulator), neobanks/challenger banks.

For example, one of the startups had successfully raised money through the ICO, but when they have applied for a license, they have discovered that the regulator was not ready to accept fiat in the bank’s capital after the conversion of the crypto raised from the ICO. Considering that almost all of them are going to apply for their own licenses, but none of them have ever done it before, the question arises: there is no doubt that they know how to make cool applications, but do they have enough experience to launch and run a regulated bank?

One crypto-friendly bank has made a pretty strange move claiming: We accept crypto to establish a crypto-friendly bank, but “in the beginning we will not work with crypto, in order to obtain a license first.” It sounds like “we are opening a gay-friendly bar, but we won’t serve gays for the time being, and, just to be on the safe side, we will participate in gay-bashing because the society requires such behavior.” Am I wrong?

Also read: Singapore’s community-led crypto-fintech startup Change raises US$17.5M via tokens sale

They all reincarnate “card + app to manage your account” – exactly what has been done a long time ago by the previous and current generations of “traditional” fintech neobanks. That is, instead of taking into account their best practices and adding blockchain/crypto component, they are really reinventing the wheel. “I want to give rise to a new style of versus but I would like to start with reinvention of the English language”. If you are a blockchain expert who is well aware of the current needs of the crypto world, shouldn’t you add your knowledge and functionality (and licenses) to existing neobanks, actively building partnerships with them rather than cannibalise the immature market?

There is no doubt that we need crypto-friendly banks, because traditional banks hate the crypto (everywhere: South Korea, Singapore, UK, US, etc.). We need separate banks with their licenses that are not dependent on current players and are focussed only on crypto-currencies and ICO-backed startups. The banks that will completely change and focus all business processes and technologies on this type of customers. The banks that are constantly communicating with regulators of different countries — explaining what they do and how, how they work with clients, what types of risk appear and how it can be solved, developing new technologies for this.

In most jurisdictions, it’s easier to buy a bank than to obtain a new license as most regulators are determined to reduce the number of bank licenses in the market. Interestingly, all current projects are designed to receive licenses in Europe or the UK, i.e., to work with the euro or the pound as a currency, whereas according to statistics, most of the payments after the crypto conversion are converted into the US dollar at the first, second or third step.

In addition, the American regulator constantly sets the “mood in the market” with its views on cryptocurrencies and ICO. Therefore, the question arises: Why does one run away from the problem, instead of coming to its source? There are many small banks in the US – worth from $5 to $50 million – available for purchase. I am looking for a bank in the US to buy – to be focussed only on this type of startups and this type of “source of funds”, – to help these (and all next) crypto-friendly neobanks to scale to the US market.

For sure, we need more than one such a bank. We need them in different jurisdictions, not only in the US or Europe as soon as the customers are located in different countries that have different regulation — which each time is optimal only for solving a number of issues of a certain range of clients — and have their own currencies (and customers want and should freely operate all major currencies).

The bank’s business should be cleared from all non-core businesses and focused only on the blockchain/crypto/ICO with all technologies, processes, business logic focused exclusively on a new class of assets and customers. They should also build an open dialogue with the regulator instead of playing dumb and talking about traditional business in meetings while making innovations under the table.

They should declare that we do this and nothing else, we understand this, we are fully responsible for everything that we do and with whom we do it, we are in a constant dialogue/educating you, we disclose everything in detail and when we see something incomprehensible or a failure — we search how we can solve it at the level of technologies and processes.

Also read: Top 50 fintech influencers in Singapore

Why are these eight banks going to obtain eight licenses in two countries? Eight licenses in eight countries – cool, but licenses + backends won’t give you a competitive advantage. You can rent them to other players. It’s important and difficult to do it for the first time. But it’s silly to do it for 3, 4, 5, 10 times. People need new services, not new licenses. It is necessary to understand beforehand that this is not a struggle for one and only universal bank in the world (and you will never become one), but simply for the first practical full-fledged example/standard (not monopoly) to which people/banks will connect.

Currently, everyone understands that this kind of bank should have an open-architecture — a set of open APIs integrated into its own BaaS-platform. It will allow to:

- Quickly launch products and partner with third-party developers for the customers’ sake;

- Effectively integrate in one network your banks and any other banks (both traditional and neobanks that have raised or are raising ICO rounds in order to get their own banking license in their own countries), which want to join the community of crypto-friendly banks

- Land any other fintech, blockchain, crypto-startups

- Create, in fact, the first fintech-bank in the world allowing them to launch faster and cheaper as well as to scale to other countries.

There is no need to reinvent all fintech services once again – too many people have been doing this for the past five years! You simply need to help them to move to new rails, integrate them among themselves on the basis of your open architecture and business processes tailored for a new type of customers.

Also read: Fintech to cause decline in Asian banks

One of the key APIs should be blockchain-based digital KYC. It allows very fast complete legal verification (of both individuals and businesses) for any financial service performed online from any country. There will be no need to register and verify again in all other partner services. For partner startups it will reduce time and costs for development of their registration and compliance processes.

In the future, based on these digital passports, as you accumulate data about your behavior in other services (only if you want to share this data! and only with those you choose!), you will receive your online score, which will make it easier for you to get loans from existing lending fintech startups and emerging blockchain startups.

As mentioned before, a big shortcoming of existing projects (not yet launched but planning the launch) is their focus on retail customers instead of small and medium business.

Whereas there about 500 customers (which have raised over US$3 billion through ICO) on the market. This type of customers is very homogeneous, fast-growing, and absolutely no one is ready to serve them now.

In the second approximation, there are other very clear clients with similar problems: crypto-exchanges, exchangers, wallets, money transfer services, etc.

The “Blue Ocean” are, of course, the representatives of the GIG-economy: freelancers, independent contractors, makers and doers. They should work with SMEs first (and not second or third) as they are the driver of the new economy. While retailers — their employees, partners and customers — will come after them.

—-

Editor’s note: e27 publishes relevant guest contributions from the community. Share your honest opinions and expert knowledge by submitting your content here.

Featured Image Copyright: damedeeso / 123RF Stock Photo

The post With 8 crypto-friendly neobank startups, is the bubble generation on its way to launching the first bubble bank? appeared first on e27.